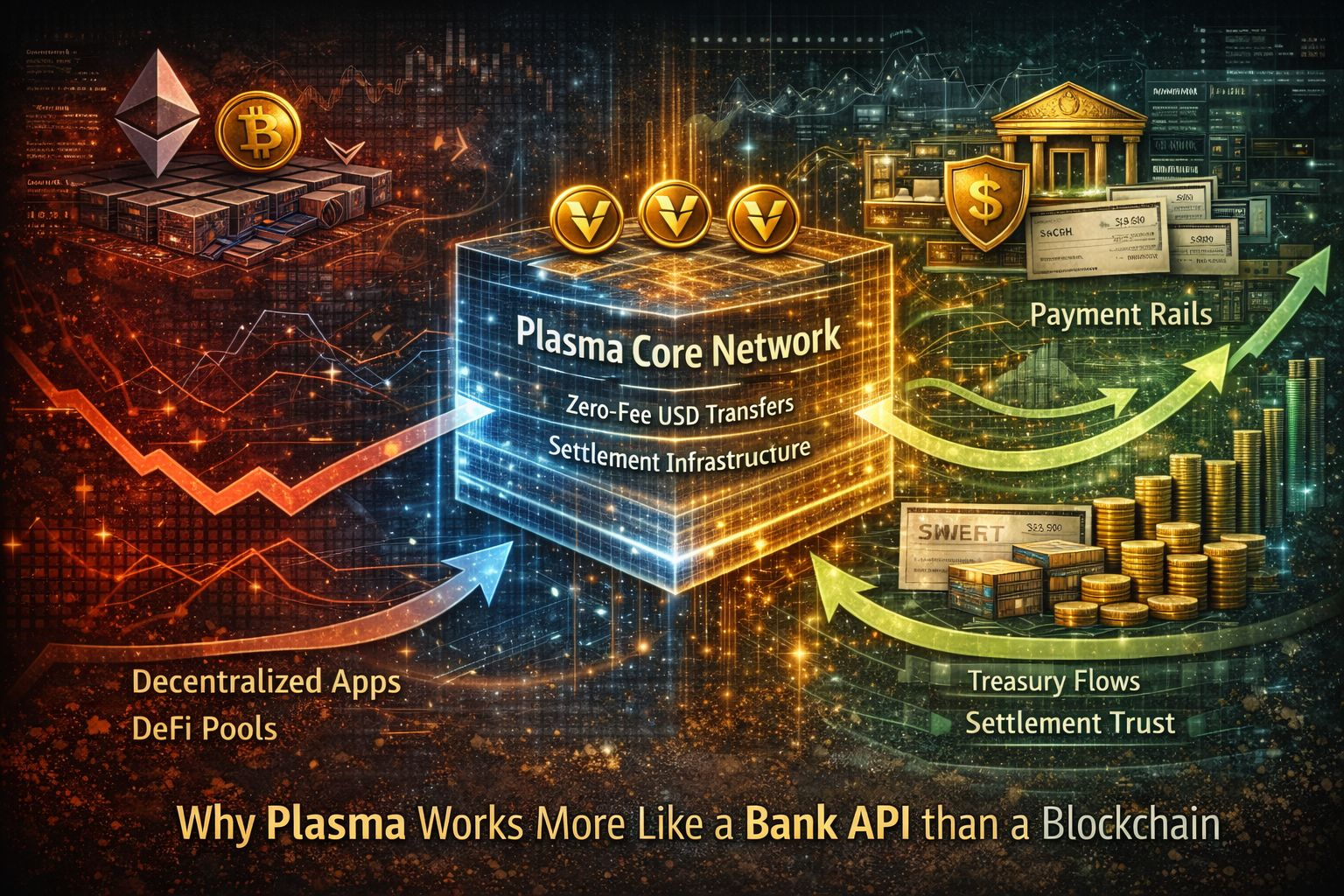

At first glance, Plasma can look like another attempt to squeeze into the space between Ethereum and Bitcoin. That assumption does not survive close inspection. Plasma does not behave like a blockchain trying to attract developers or applications. It behaves like infrastructure designed to replace how money quietly moves today.

Most crypto discussions still focus on throughput and fees. Those metrics matter when chains compete for decentralized applications. Plasma steps outside that contest. Its defining feature — zero-fee USD stablecoin transfers — immediately changes the comparison. Free transfers at scale are not a blockchain norm. They are how banks operate.

The system is built around a simple reality: most financial activity is repetitive and reliability-sensitive. Payroll, treasury operations, and internal settlements do not need flexibility. They need certainty. Existing systems like ACH and SWIFT move massive value but suffer from slow settlement and reconciliation risk. Plasma positions itself where those systems struggle, not where Ethereum excels.

Removing fees forces a deeper structural shift. Instead of charging per transaction, Plasma pushes cost to issuers and infrastructure participants. The incentive is no longer transactional revenue, but control over stable settlement rails. This aligns with a market where stablecoins exceed hundreds of billions in circulation and most volume avoids DeFi entirely.

Plasma further narrows its scope by limiting programmability. Stablecoin-native contracts replace general-purpose logic. This constraint mirrors bank APIs, which expose carefully controlled endpoints to reduce risk. Innovation slows, but reliability improves — a tradeoff financial systems have always accepted.

By anchoring to Bitcoin, Plasma emphasizes settlement trust over composability. Bitcoin’s long record of value transfer matters more to institutions than expressive smart contracts. Plasma does not chase visibility. It optimizes for quiet adoption. In financial infrastructure, invisibility is often the clearest sign of success.

Plasma is easy to misunderstand if viewed through standard crypto lenses. It does not compete on developer mindshare, application diversity, or expressive smart contracts. Its architecture suggests a different goal entirely: becoming a settlement layer that behaves more like a bank API than a blockchain platform.

Zero-fee stablecoin transfers sit at the center of this design. While they resemble common crypto promises, the comparison quickly breaks down. Free transfers at scale are a banking feature, not a decentralized one. Plasma adopts this model because it targets financial flows that prioritize reliability over experimentation.

Most money movement today is operational, not speculative. Payroll runs on schedules. Treasury balances shift predictably. Internal settlements repeat daily. Plasma acknowledges this reality and designs for it, positioning itself as an alternative to systems like ACH and SWIFT that move enormous value but introduce delay and reconciliation complexity.

Eliminating fees requires rethinking incentives. Plasma does not ask users to pay validators directly. Instead, issuers and infrastructure participants absorb cost in exchange for dependable settlement. As stablecoin volumes grow and regulation tightens, owning compliant rails becomes more valuable than charging per transaction.$XPL @Plasma #Plasma