Cryptocurrency can be very profitable, but it is also very risky. Prices can go up or down by 10%, 20%, or even 50% in a single day. Many people lose money in crypto not because crypto is bad, but because they do not manage risk properly.

Risk management is not about avoiding losses completely. Losses are part of investing and trading. Risk management is about protecting your money so you can survive long enough to grow it.

1. What Is Risk Management in Crypto?

Risk management means:

Protecting your capital (money)

Limiting losses when trades go wrong

Avoiding emotional decisions

Making sure one bad trade does not destroy your account

In crypto, risk management is more important than strategy. Even the best strategy will fail if risk is not controlled.M

any professional traders say:

“Protect your capital first. Profits come later.”

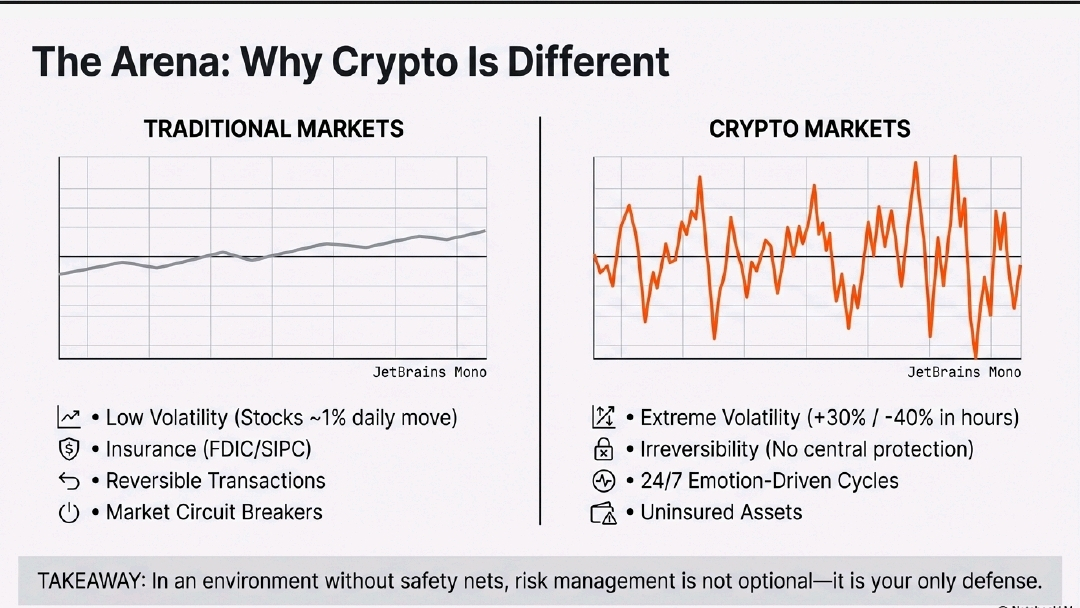

2. Why Crypto Is Riskier Than Traditional Markets

Crypto markets are more dangerous because:

🔹 High Volatility

Bitcoin and altcoins can move very fast. A coin can:

Go up 30% in one day

Drop 40% in a few hours

🔹 No Central Protection

Unlike banks, crypto transactions:

Cannot be reversed

Are not insured in most cases

🔹 Emotional Market

Crypto markets are driven by:

Fear

Greed

News

Social media hype

Because of this, risk management is not optional in crypto it is necessary.

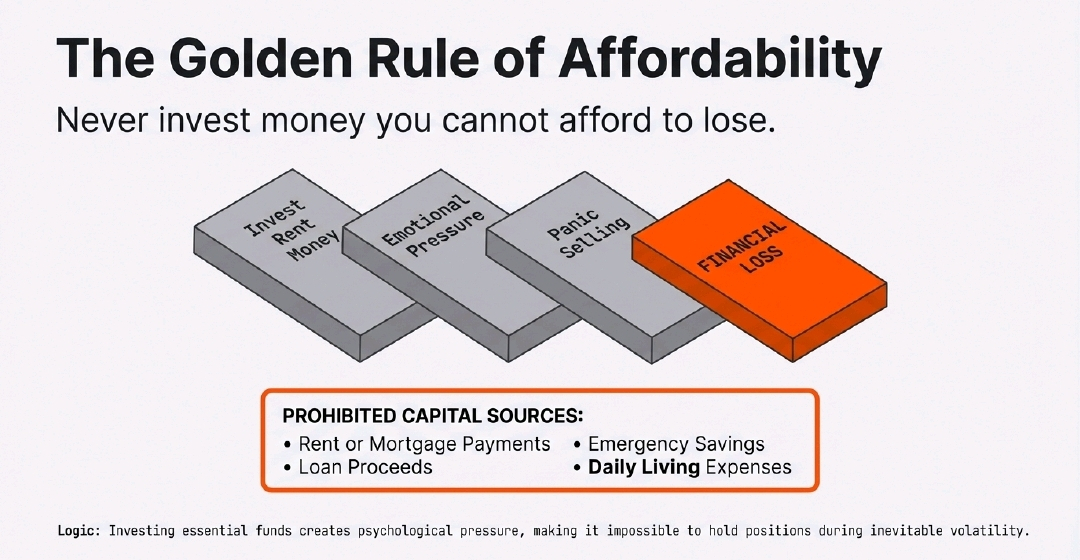

3. The Golden Rule: Never Invest Money You Can’t Afford to Lose

This is the most important rule.

You should never invest:

Rent money

Loan money

Emergency savings

Daily living expenses

Why?

Because emotional pressure leads to:

Panic selling

Bad decisions

Overtrading

Crypto should be treated as high-risk investment, not guaranteed income.

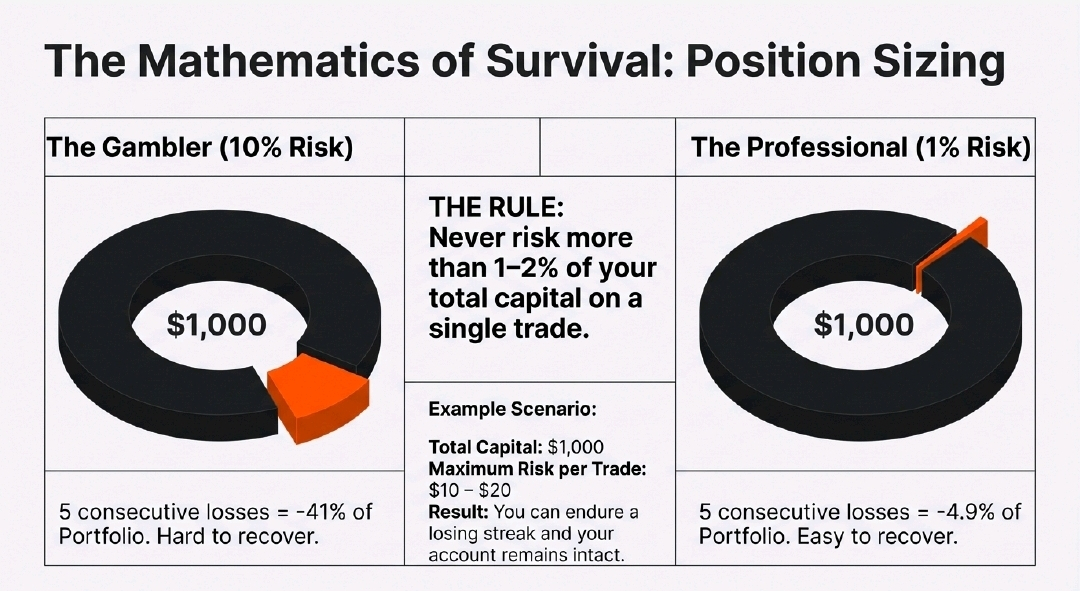

4. Position Sizing: Don’t Put All Your Money in One Trade

Position sizing means how much money you use in one trade.

A Simple Rule:

Never risk more than 1–2% of your total capital on one trade

Example:

If you have $1,000:

Maximum risk per trade = $10 to $20

This way:

This way:

You can lose multiple trades

Your account still survives

Many beginners lose money because they go “all-in” on one coin.

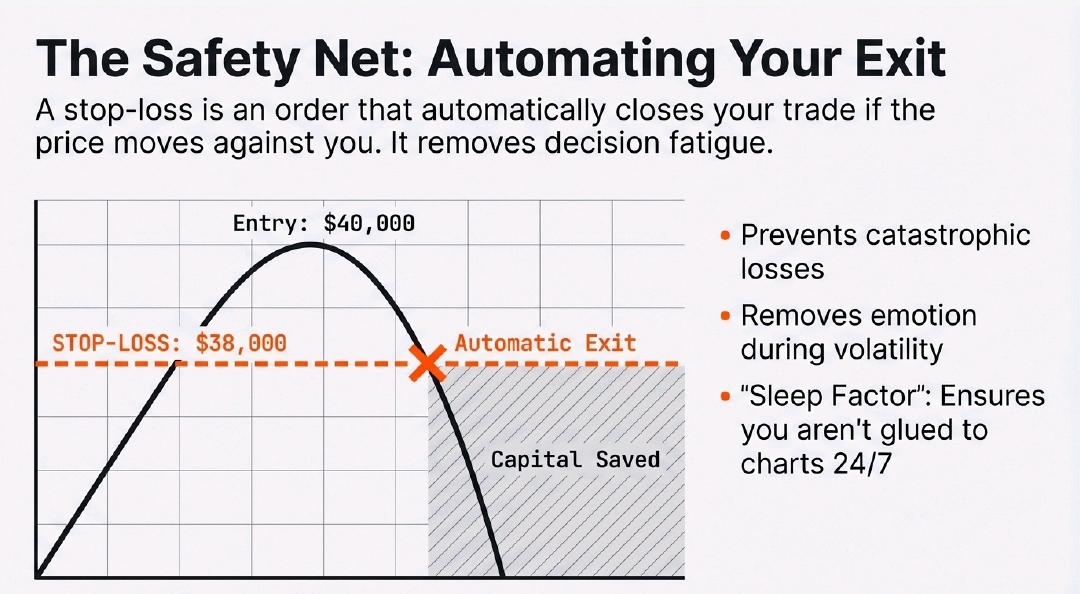

5. Stop-Loss: Your Safety Net

A stop-loss is an order that automatically closes your trade if price goes against you.

Why Stop-Loss Is Important

Protects you from big losses

Removes emotional decision-making

Helps you sleep better

Example:

You buy Bitcoin at $40,000

You set stop-loss at $38,000

If price falls to $38,000:

Trade closes automatically

Loss is controlled

Without stop-loss, a small loss can become a huge one.

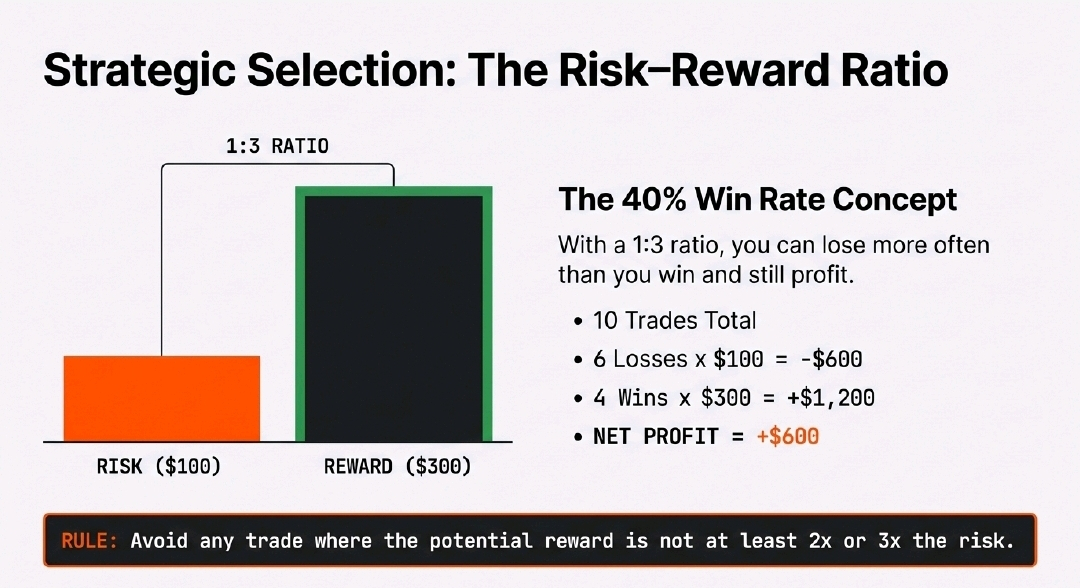

6. Risk–Reward Ratio: Think Before You Trade

Risk reward ratio compares:

How much you can lose

How much you can gain

Good Risk–Reward Example:

Risk: $100

Reward: $300

Ratio: 1:3

This means:

Even if you win only 4 trades out of 10

You can still be profitable

Avoid trades where:

Risk is bigger than reward

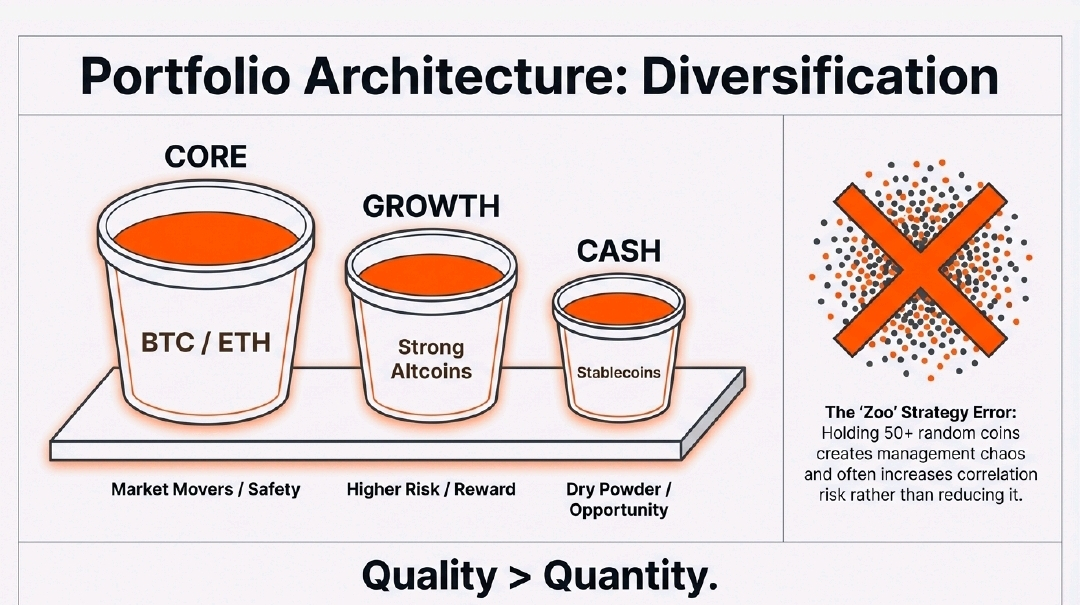

7. Diversification: Don’t Depend on One Coin

Putting all your money in one coin is dangerous.

Smart Diversification Means:

Large coins (BTC, ETH)

Some strong altcoins

Maybe stablecoins for safety

Avoid Over-Diversification

Owning 50 random coins:

Is hard to manage

Often increases risk

Quality is better than quantity.

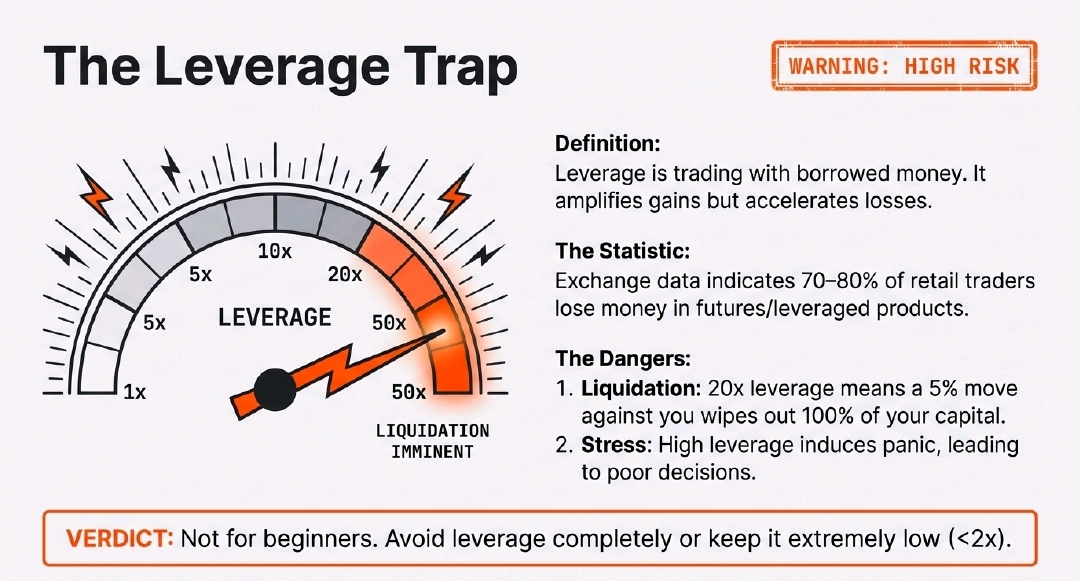

8. Avoid High Leverage (Especially for Beginners)

Leverage allows you to trade with borrowed money.

Example:

10x leverage means $100 controls $1,000

20x leverage can liquidate you in seconds

Data from exchanges shows:

Over 70–80% of retail traders lose money in futures trading

High leverage:

Increases stress

Increases liquidation risk

Is not beginner-friendly

If you are new, avoid leverage or use very low leverage.

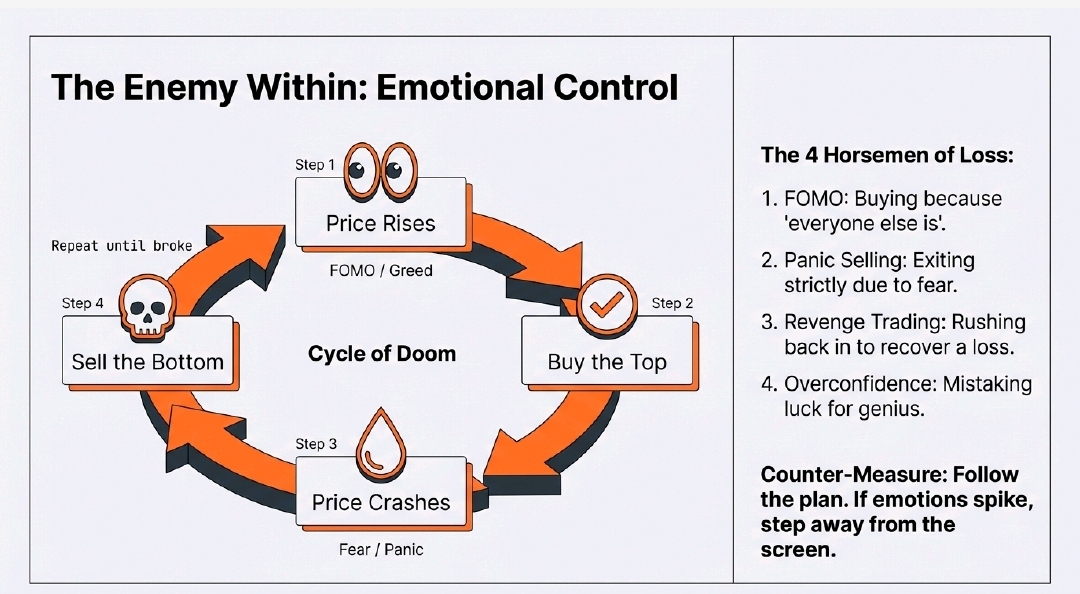

9. Emotional Control: The Hidden Risk

Emotions are one of the biggest reasons people lose money.

Common Emotional Mistakes:

Fear of missing out (FOMO)

Panic selling

Revenge trading

Overconfidence after wins

How to Control Emotions:

Follow a trading plan

Accept losses as part of the game

Take breaks after losses

Good traders manage emotions better than charts.

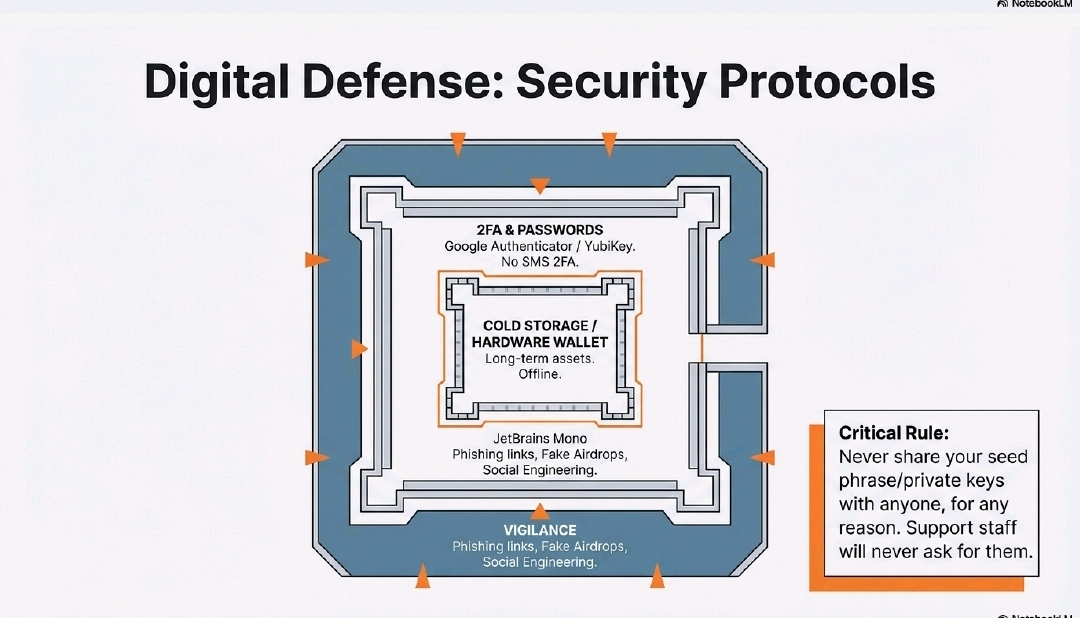

10. Security Risk: Protect Your Crypto from Theft

Risk management is not only about trading it is also about security.

Best Security Practices:

Use hardware wallets for long-term holding

Enable 2FA on exchanges

Never share private keys

Avoid unknown links and fake giveaways

Many people lose crypto not from trading, but from scams and hacks.

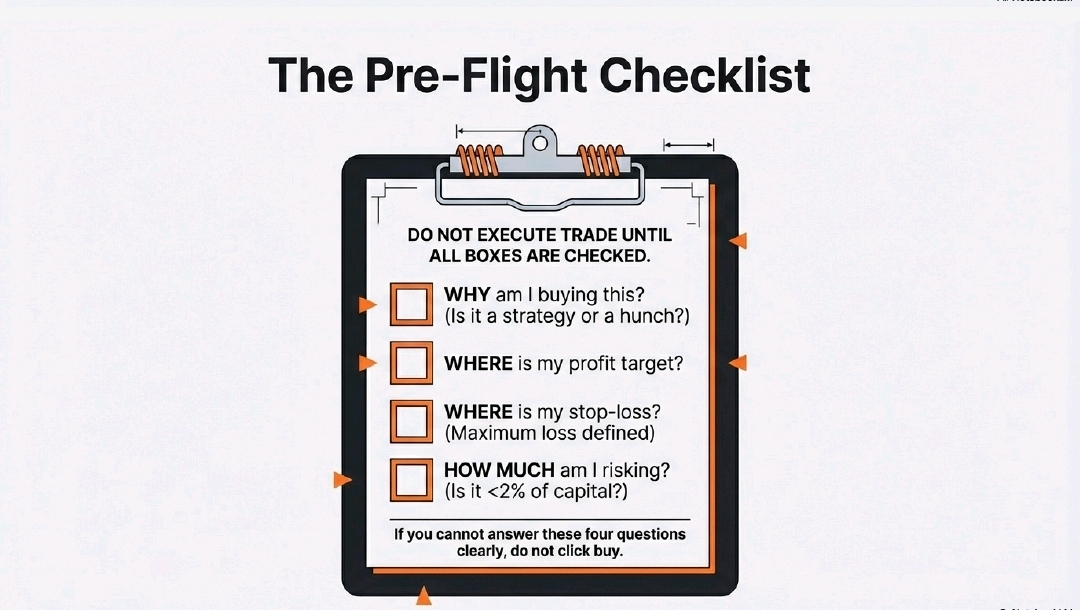

11. Have a Clear Plan (Before You Invest)

Before entering any trade, ask:

Why am I buying this?

Where will I exit in profit?

Where will I exit in loss?

How much am I risking?

If you cannot answer these questions, do not enter the trade.

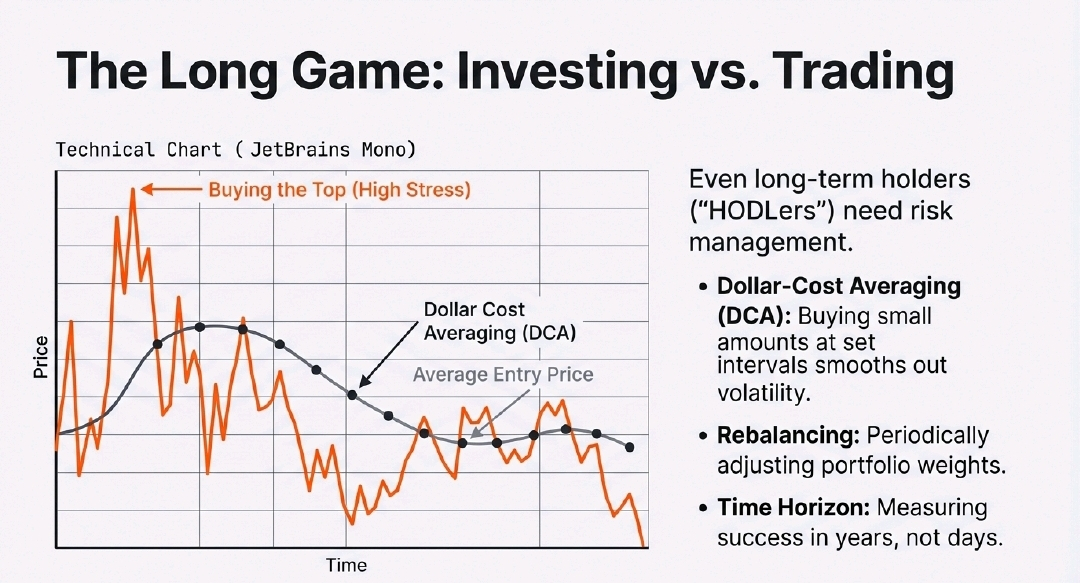

12. Long-Term Investors Also Need Risk Management

Even long-term holders should:

Avoid buying only at market tops

Use dollar-cost averaging (DCA)

Rebalance portfolio sometimes

Keep expectations realistic

Long-term investing reduces stress, but risk still exists.

13. Common Risk Management Mistakes to Avoid

Trading without stop-loss

Overtrading

Copying others blindly

Believing “guaranteed profits”

Ignoring market conditions

If something sounds too good to be true, it usually is.

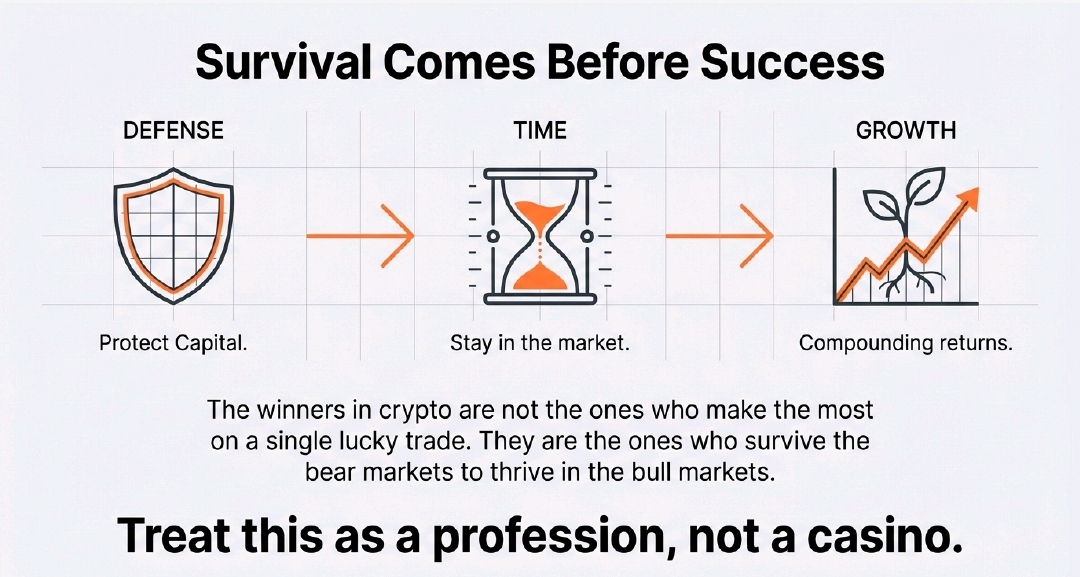

14. Final Thoughts

Crypto is not a get-rich-quick scheme. It is a high-risk, high-reward market. Those who survive long-term are not the smartest or luckiest but the ones who manage risk properly.

If you protect your money:

You stay in the market longer

You learn from mistakes

Profits eventually follow

In crypto, survival comes before success.