Let's be honest. Most blockchain projects sound the same these days. Another Layer 1, another promise of "changing finance forever," another token launch that pumps and dumps within weeks. But every once in a while, something actually different shows up. Plasma is one of those rare projects that made me stop scrolling and pay attention—not because of hype, but because it's solving a real problem that affects billions of people.

Think about the last time you sent money internationally. Or tried to pay someone in USDT and got slapped with ridiculous gas fees. Frustrating, right? That's exactly what Plasma is tackling head-on, and honestly, it's about time someone did.

What Makes Plasma Different?

Here's where things get interesting. Plasma isn't trying to be everything to everyone. It's not building the next "Ethereum killer" or promising to replace your entire financial system overnight. Instead, Plasma focuses on one thing and does it exceptionally well: stablecoin payments. Zero-fee USDT transfers. That's the headline, and it's not marketing fluff—it actually works.

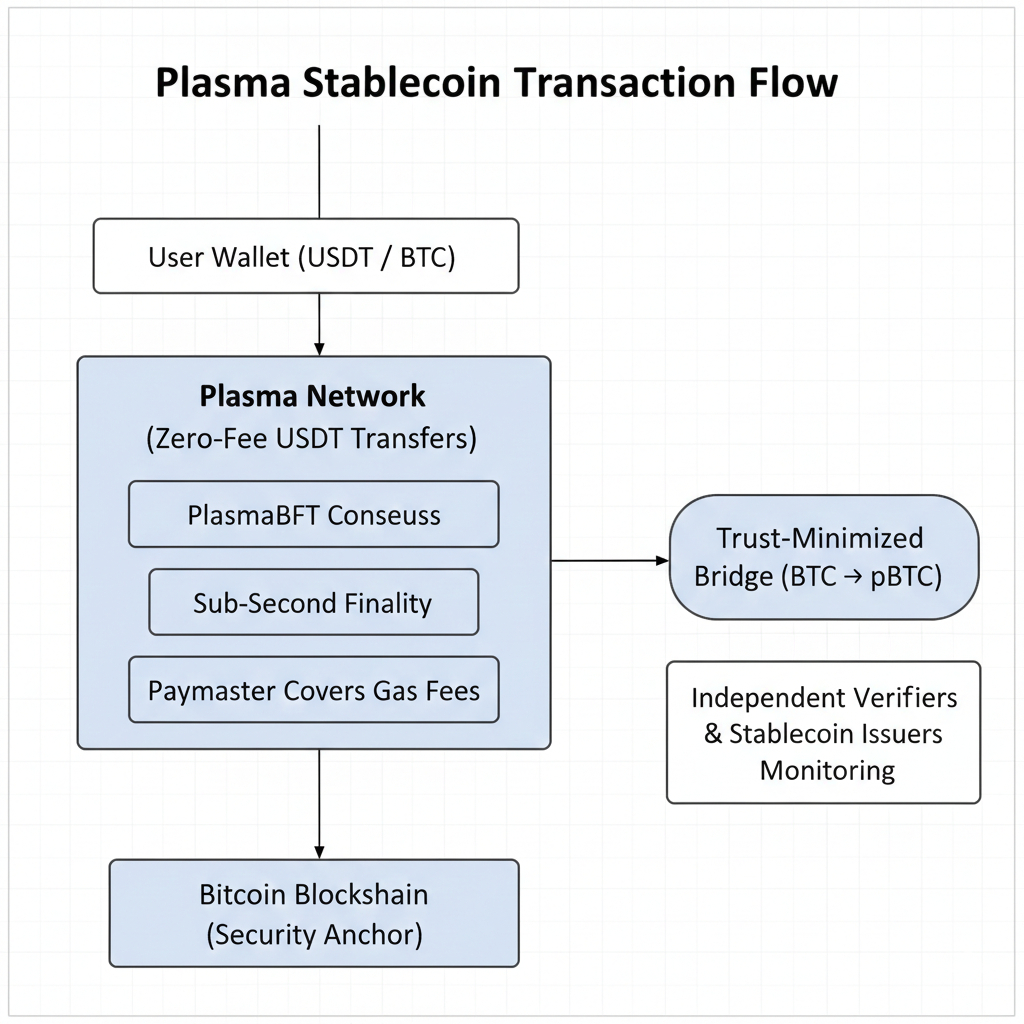

The backbone of Plasma is something called PlasmaBFT, a consensus mechanism that sounds technical but really just means transactions happen fast. Like, really fast. Sub-second finality fast. And unlike other chains that sacrifice security for speed, Plasma anchors itself to Bitcoin's blockchain. Think of it as having a backup plan written in the most secure ledger humanity has ever created.

What caught my attention was how Plasma integrated with Bitcoin as a sidechain. Most projects talk about Bitcoin integration, but Plasma actually built a trust-minimized bridge. You can move BTC onto Plasma (it becomes pBTC), and independent verifiers—including stablecoin issuers themselves—monitor everything. No centralized custody nonsense. That's genuinely clever.

The XPL Token: More Than Just Gas

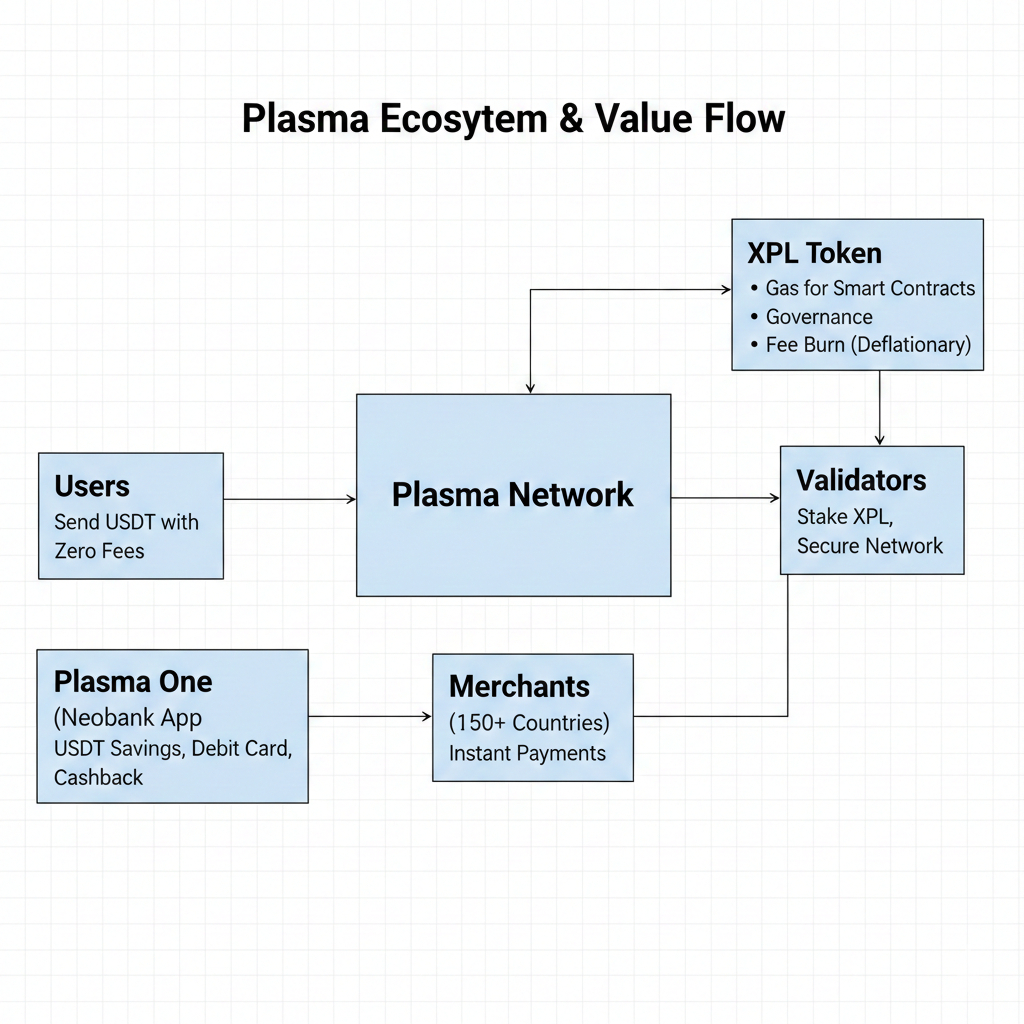

Now, let's talk about XPL. The native token of Plasma serves multiple purposes, but here's what matters most: you don't always need it. Yeah, you read that right. For simple USDT transfers, Plasma covers the gas costs through a paymaster system funded by the Plasma Foundation. It's like having someone else pick up your tab every time you send stablecoins.

But XPL isn't useless—far from it. Validators stake XPL to secure the network. Complex smart contract operations require XPL for gas. And as Plasma grows, XPL becomes the governance token, giving holders a say in protocol decisions. The tokenomics are actually pretty well thought out, with a deflationary mechanism where base fees get burned, EIP-1559 style.

The total supply? 10 billion XPL. Token distribution was split between public sale (10%), ecosystem growth (40%), team (25%), and investors (25%). The public sale raised $373 million—seven times oversubscribed. That tells you something about investor confidence, even if the post-launch price action has been... let's say "humbling."

Real-World Use: Plasma One

This is where Plasma stops being just another blockchain and becomes something tangible. Plasma One is their neobank app, and it's slick. Imagine holding USDT in your wallet, earning 10%+ yield on it, and still being able to spend it instantly with a debit card. No conversion fees. No waiting periods. Just seamless.

I've seen plenty of crypto cards, but most feel clunky or limited. Plasma One works in 150+ countries with 150+ million merchants. You get up to 4% cashback in XPL. Virtual cards issued in minutes. And here's the kicker—no seed phrases required. Just biometric authentication and hardware-backed keys.

For people in countries with unstable currencies or limited banking access, Plasma One could be genuinely life-changing. Remittances, cross-border payments, dollar savings accounts—all without traditional banking bureaucracy. That's the vision, anyway.

The Elephant in the Room

Let's address the obvious: XPL's price has crashed. Hard. From an all-time high of $1.68 in late September 2025 to around $0.08-$0.14 now. That's an 85%+ decline. Ouch.

Why? Mostly yield farming mercenaries. When Plasma launched with $2 billion in TVL, most of that money was chasing XPL rewards in lending protocols. When XPL dropped, yields evaporated, and people left. The TVL fell from $6.6 billion to around $2.1 billion. Still significant, but the momentum clearly stalled.

There's also the looming token unlock in July 2026—2.5 billion XPL (25% of total supply) hitting circulation. That's... a lot. Historical data shows similar unlocks cause massive sell pressure. But here's the thing: if Plasma can prove real adoption before then, maybe it survives. Big "if," though.

Why I'm Still Watching

Despite the price carnage, Plasma has something most projects don't: actual infrastructure being used. Aave on Plasma became the second-largest Aave market globally. The network maintained significant TVL even after cutting incentives by 95%. That suggests some real utility beneath the speculation.

The technology is solid. The backing is strong—Peter Thiel's Founders Fund, Framework Ventures, Tether's CEO Paolo Ardoino. These aren't random crypto VCs; they're serious money betting on Plasma long-term.

And the problem Plasma is solving? It's not going away. Stablecoins are growing exponentially. Cross-border payments are still broken. If Plasma can capture even a fraction of that market, XPL holders could see serious returns.

The bottom line: Plasma is a high-risk bet on stablecoin infrastructure becoming critical to global finance. It's not a guaranteed winner. But it's one of the few projects building something that might actually matter in five years. And in crypto, that's worth paying attention to.