Stablecoins have quietly become one of the most useful inventions in crypto. People use them for payments, savings, remittances, and business settlements every single day. Yet most blockchains were not built with stablecoins in mind. Plasma changes that. It is a Layer 1 blockchain designed specifically for stablecoin settlement, with every technical choice aimed at making stablecoin usage faster, simpler, and more reliable.

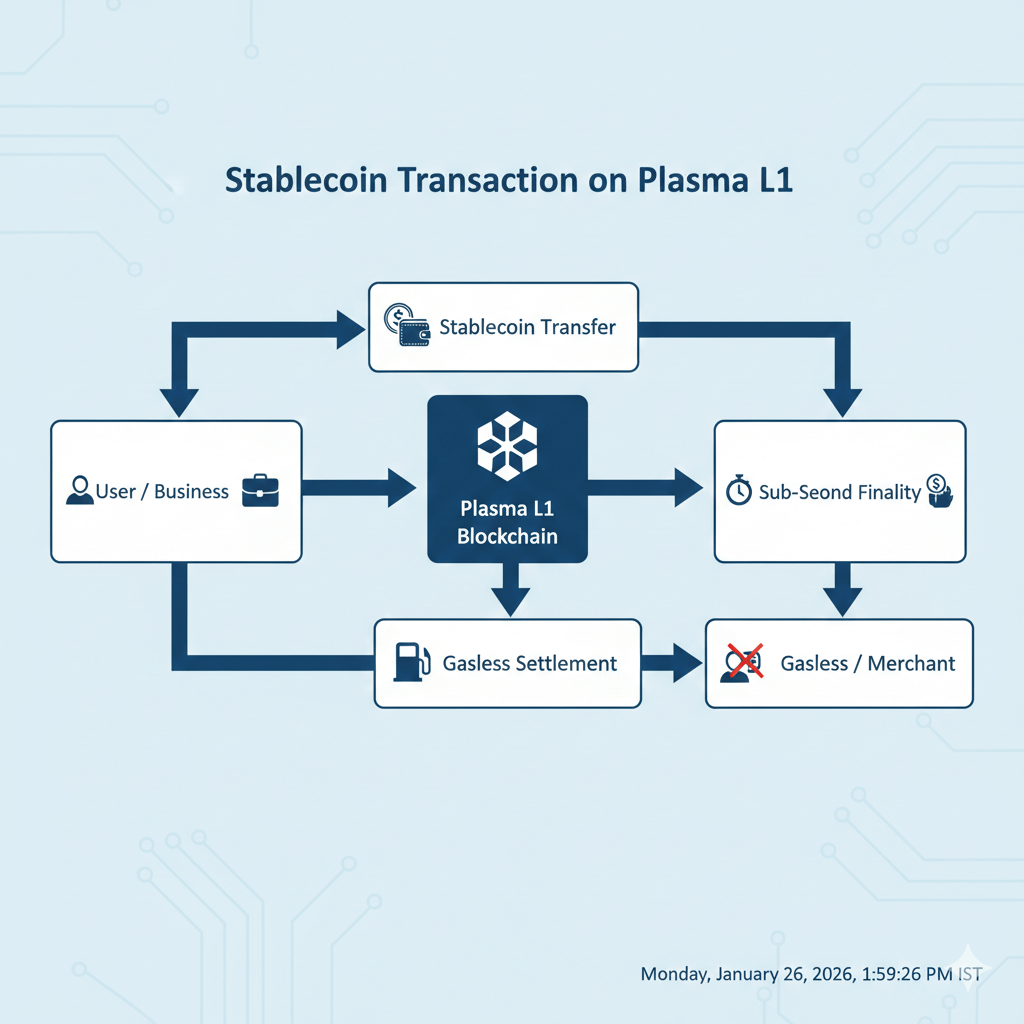

The first thing that makes Plasma stand out is its clear focus. Instead of being a general-purpose chain trying to support everything at once, Plasma optimizes for one core use case: moving stable value efficiently. This focus shows up in features like gasless USDT transfers. Users do not need to hold a separate volatile token just to send money. They can simply transfer USDT the way people expect to send digital cash. Stablecoin-first gas goes a step further by allowing transaction fees to be paid directly in stablecoins. For everyday users and businesses, this removes confusion and makes costs predictable.

Under the hood, Plasma remains friendly to developers. Full EVM compatibility through Reth means Ethereum smart contracts can run on Plasma without major changes. Developers can use familiar tools, wallets, and frameworks while benefiting from a network optimized for payments. This lowers the barrier to entry and makes Plasma attractive for teams building wallets, payment apps, DeFi tools, and financial infrastructure.

Speed is another critical part of the story. PlasmaBFT delivers sub-second finality, which is essential for settlement-focused systems. When someone sends money, waiting several seconds or minutes feels outdated. With Plasma, transactions are confirmed almost instantly. For institutions handling large volumes of payments, fast finality reduces settlement risk and improves operational efficiency.

Security and neutrality are treated as long-term priorities. Plasma anchors key security elements to Bitcoin, leveraging Bitcoin’s proven decentralization and censorship resistance. This Bitcoin-anchored design helps Plasma position itself as a neutral settlement layer that does not depend on a single authority or region. For global payments and cross-border finance, this neutrality is crucial.

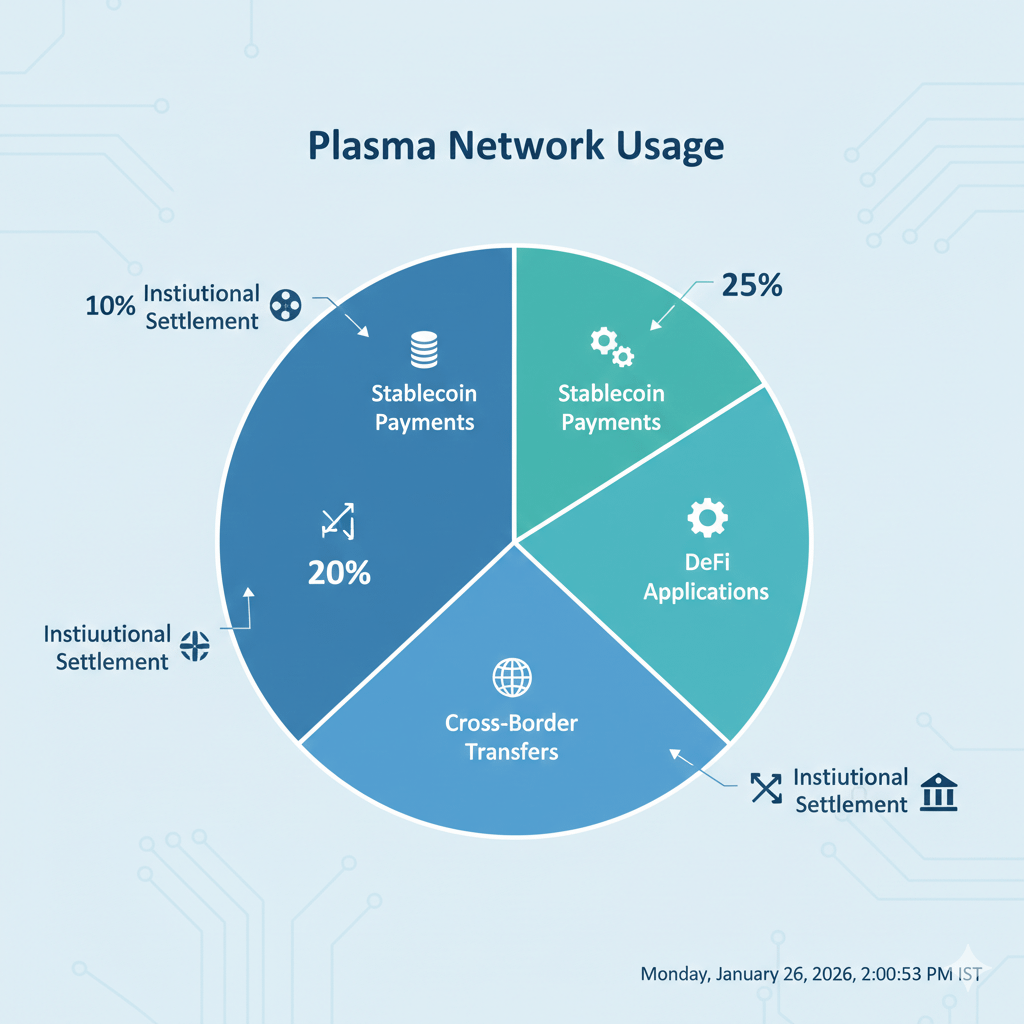

Plasma’s target users reflect its real-world mindset. Retail users in high-adoption markets benefit from a smooth, low-friction stablecoin experience that feels intuitive. Institutions in payments and finance gain access to a settlement network with predictable fees, strong security assumptions, and near-instant confirmation. By serving both ends of the spectrum, Plasma builds a bridge between everyday usage and serious financial infrastructure.

In a crowded Layer 1 ecosystem, Plasma XPL stands out by being honest about its mission. It is not chasing hype or trends. It is building the infrastructure stablecoins actually need to scale globally. As stablecoins continue to move deeper into mainstream finance, Plasma could play a key role in shaping how value moves across borders and markets.@Plasma #Plasma $XPL