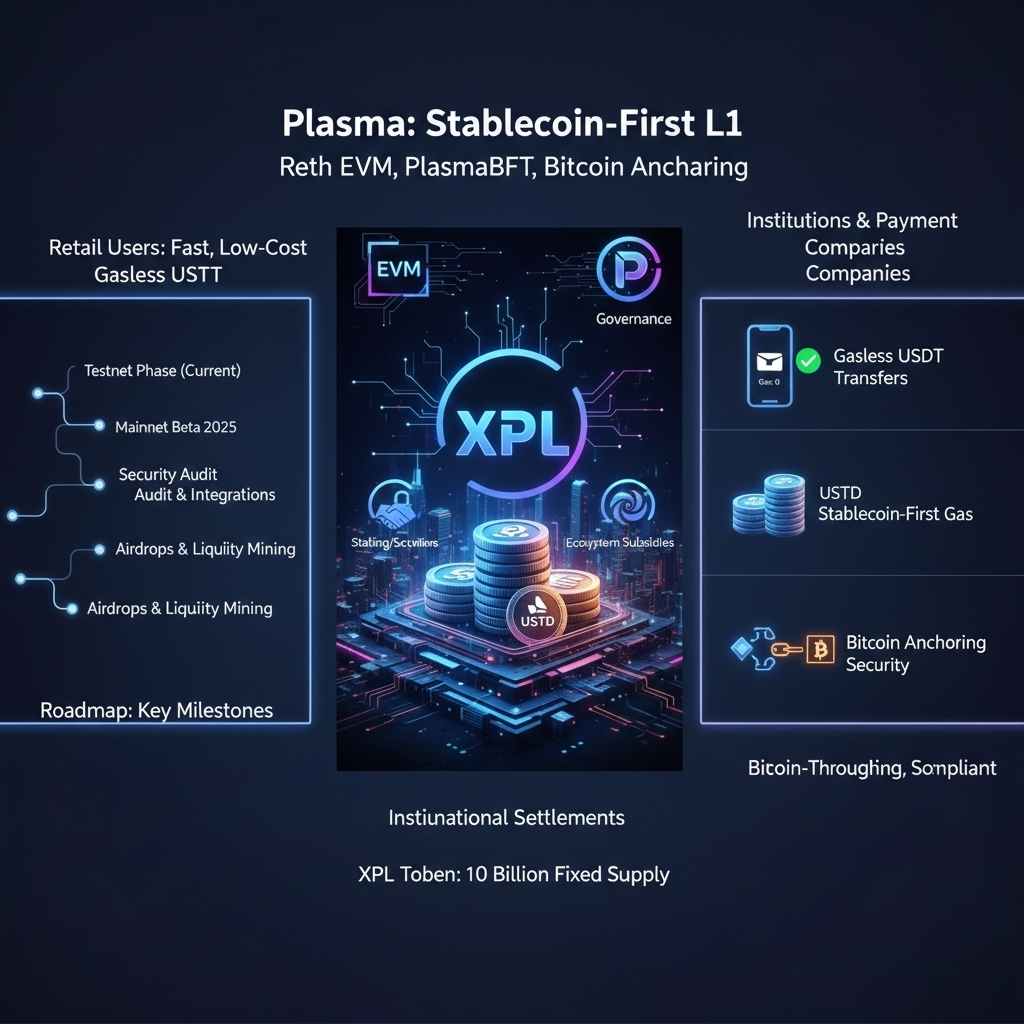

It elevates stablecoins (especially USDT) from the "application layer" to the "system-level" priority, aiming to minimize friction in daily payments settlements and large transactions The network claims to be fully compatible with the EVM (called Reth) and uses a consensus mechanism called PlasmaBFT to achieve sub-second finality, while enhancing security and neutrality by writing critical checkpoints to the Bitcoin chain.

Stablecoins have become the closest thing to "currency" in the crypto world: they handle the vast majority of cross-border payments, counterparty settlements, and daily small transactions. Traditional general-purpose chains treat stablecoins as applications to be carried, resulting in transaction fees, congestion, and settlement delays often mixing with other on-chain activities, affecting the payment experience. The starting point of Plasma is: if stablecoins are the primary value carriers, the underlying infrastructure should be optimized for them—this has practical significance for both retail high-frequency use cases and institutional-level settlements. Treating stablecoins as first-class citizens can reduce the trust and efficiency costs associated with bridging, token wrapping, and multi-chain fragmentation.

technical points

Reth fully EVM compatible Plasma supports almost seamless smart contracts and toolchains with the Ethereum ecosystem allowing developers to reuse existing Solidity contracts and infrastructure

PlasmaBFT Sub-second Finality This is a Byzantine Fault Tolerance consensus optimized for payment scenarios aiming to reduce transaction confirmation time to sub-second levels while ensuring security thereby accommodating retail payment and high-frequency settlement needs

Bitcoin Anchoring Security Plasma enhances censorship resistance and neutrality by anchoring critical states or checkpoints to the Bitcoin chain leveraging Bitcoin's computational power and decentralized attributes This design attempts to strike a balance between performance and extremely high security.

- Stablecoin-first features: including gasless USDT transfers (users can complete USDT payments without holding native tokens) and stablecoin-first gas (prioritizing stablecoins for fee calculation or settlement), these are experience improvements tailored for payment scenarios.

Plasma's native token is usually referred to as XPL (or a similar code), with key points including: a fixed total supply of 10 billion, used for staking, security incentives, governance, and ecosystem subsidies. The public distribution ratio, early financing, and airdrop arrangements have been detailed in various reports: approximately 10% for public distribution, with early financing including multiple rounds of investment such as seed round, Series A, and public fundraising. The project has also attracted liquidity and users thru large-scale stablecoin airdrops or incentive programs. The tokens serve both network security (staking) functions and are used for governance and ecosystem incentives.

Ecology and target users

The target users of Plasma are divided into two categories:

- Retail users: Especially those in markets with high stablecoin usage (such as certain emerging markets or regions with intensive cross-border payments), they need a low-cost, instant settlement stablecoin payment experience.

- Institutions and payment companies: Banks, payment clearing institutions, and large merchants hope to achieve high throughput and low-latency settlements on-chain while maintaining compliance and audit capabilities. Plasma attempts to attract these institutions to migrate their settlement traffic on-chain thru a stablecoin-prioritized design. Ecologically, priority will be given to the development of payment gateways, clearing nodes, stablecoin issuers, and compliance tool providers.

Roadmap known milestones and schedule

Public information shows that Plasma has entered the testnet phase and plans to launch Mainnet Beta in 2025 specific timelines may be adjusted according to development and audit progress The early focus is on completing the security audit of the consensus and cross-chain anchoring mechanisms, launching the native features of the stablecoin (such as gasless transfers), and integrating with major stablecoin issuers and payment channels. Ecosystem incentives such as airdrops and liquidity mining are used as initial user acquisition methods Please note that the roadmap details will be adjusted according to changes in the market and regulatory environment.

The risk of reliance on a single stablecoin If the ecosystem becomes overly dependent on a single stablecoin USDT any compliance or credit issues with that stablecoin will directly impact on-chain activities and trust.

The trade-off between decentralization and neutrality Anchoring checkpoints to Bitcoin can enhance censorship resistance, but the implementation method who submits the checkpoints and the incentives and governance structure for the submitters will all affect the actual neutrality of the system Technically "borrowing" security for Bitcoin does not automatically equate to governance decentralization.

Regulatory and compliance pressure: Stablecoins themselves are at the center of global regulatory attention, and any payment-oriented chain may be required to implement stricter KYC/AML, transaction monitoring or compliance integration with traditional finance which can affect decentralized design and user privacy

- Ecological appeal and network effects: To migrate payment volumes from existing networks (such as Ethereum, Tron, etc.), strong liquidity incentives, partner support, and developer tools are needed. In the short term, the cost of user migration and their habits are obstacles.

- Technical Maturity and Security Audit: The implementation details of PlasmaBFT and Reth, as well as the cross-chain anchoring logic, need to undergo multiple rounds of audits and practical tests. Any vulnerabilities could pose financial and trust risks.

Our observations and thoughts (opinions and suggestions)

Putting stablecoins at the center of chain design is a pragmatic starting point: payment and settlement scenarios have clear requirements for latency, fees, and certainty, and general-purpose chains often compromise on these dimensions. Plasma's technical combination (EVM compatibility + sub-second finality + Bitcoin anchoring) on paper appears to be a deliberate compromise of the "speed, security, compatibility" triangle. In reality, the key lies in who is using it, who is maintaining it, and who bears the legal responsibility. If the goal is to become a mainstream payment layer, the project needs to simultaneously address compliance access, stablecoin diversity, and integration with traditional finance.

Plasma offers a clear design philosophy: to treat stablecoins as the first citizens of the blockchain, rather than as ancillary applications. This positioning has real value in payment and settlement scenarios, especially in markets where stablecoin usage is high and there is sensitivity to speed and cost. Technically, it combines EVM compatibility, low-latency finality, and Bitcoin anchoring, attempting to strike a balance between usability and security. The real challenges come from the regulatory and credit risks of the stablecoin itself, the costs of ecosystem migration, and the details of governance and decentralization implementation. For investors and practitioners, the focus should be on: the depth of cooperation with stablecoin issuers, the results of mainnet security audits, early payment and settlement partners, and the project's ability to implement within a compliance framework. Overall, Plasma is an experiment worth paying attention to: it adopts "payment first" as its underlying philosophy, which may bring meaningful practices and lessons on the path to further integrating stablecoins with on-chain settlements in the future.