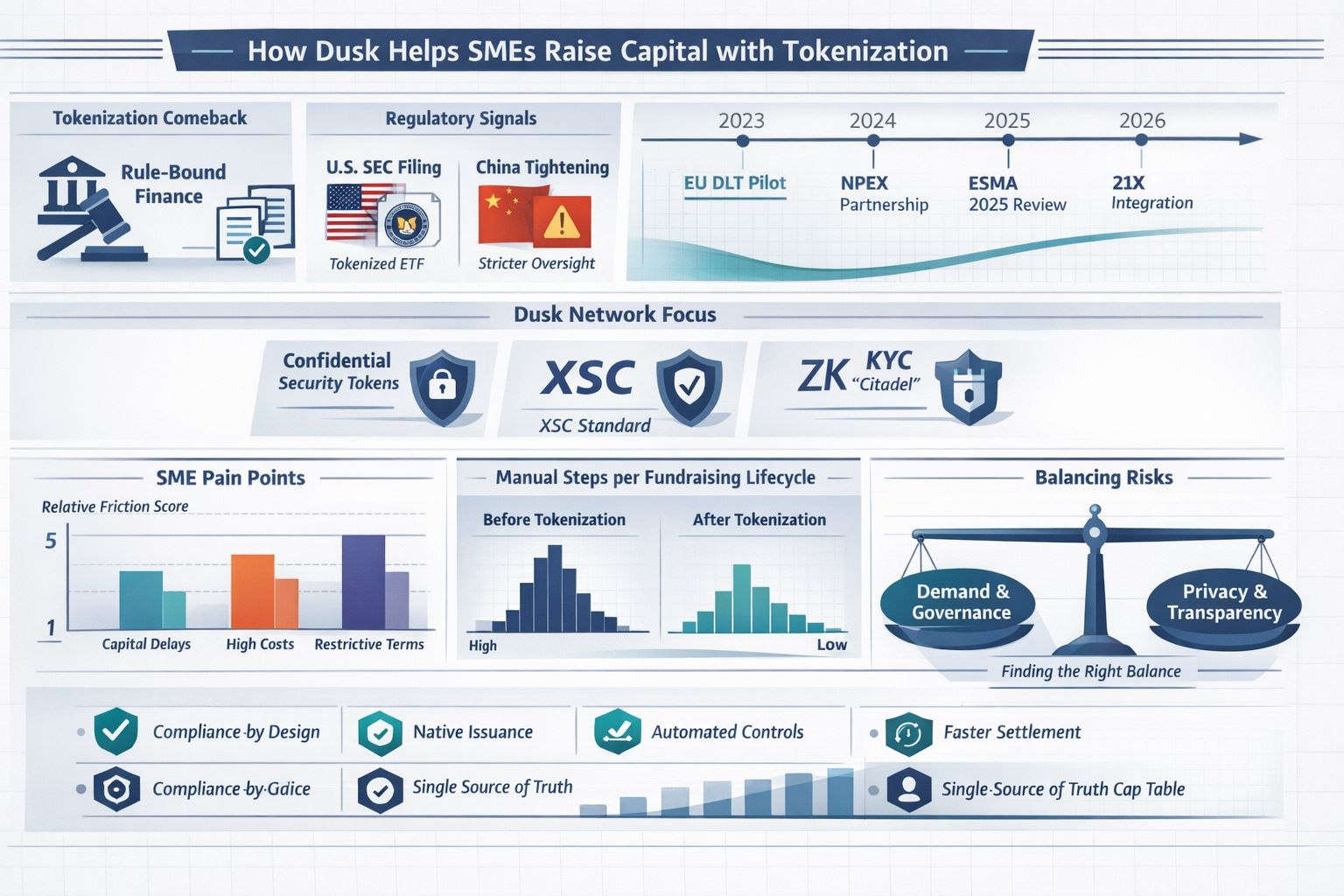

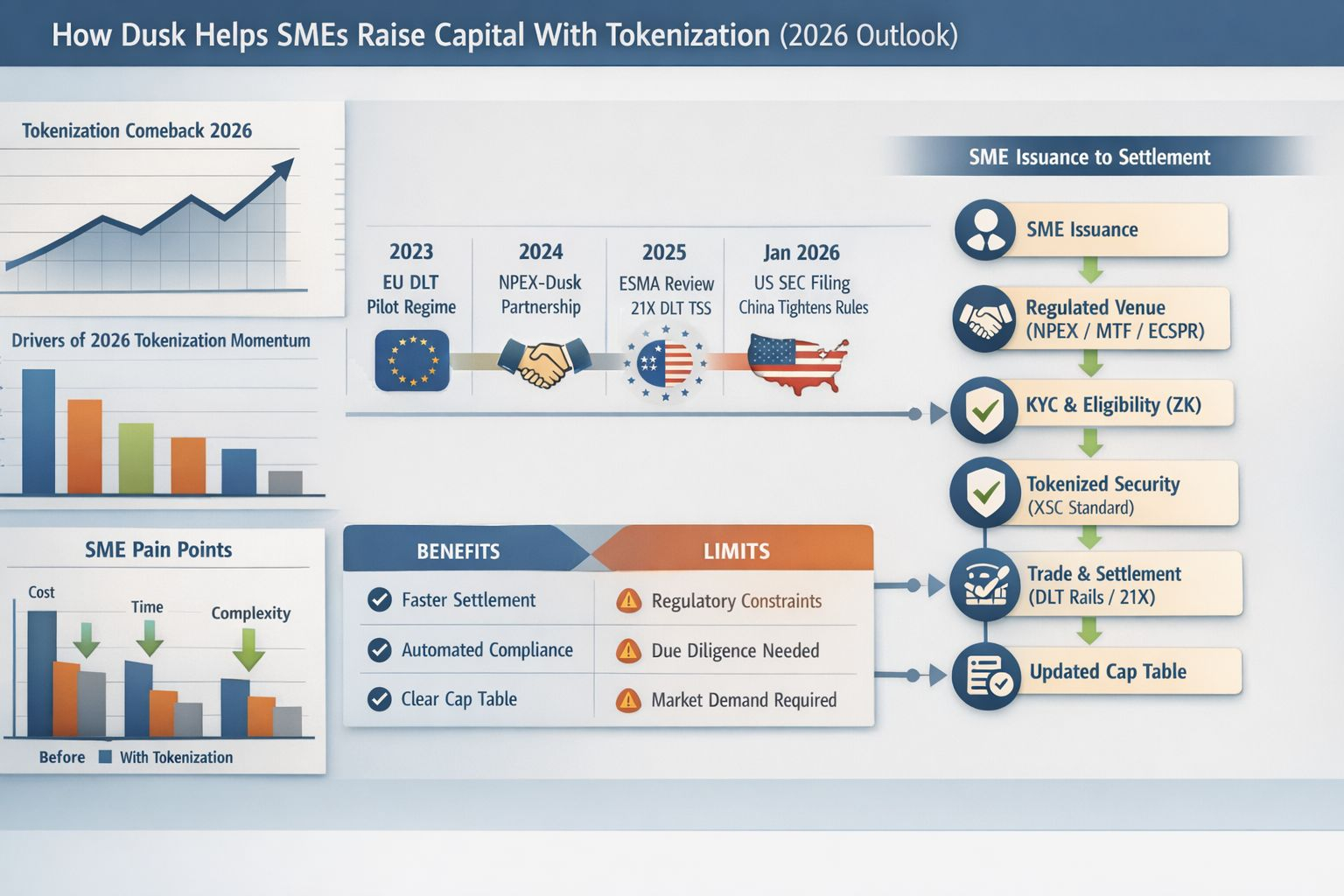

@Dusk Tokenization is having a strangely quiet comeback. A few years ago it was pitched as a way to hop over markets, regulators, and paperwork, as if the messy parts of finance were just optional. That framing earned the backlash it got. What feels different heading into 2026 is that the momentum isn’t coming from the loudest corners of crypto. It’s coming from the rule-bound side of finance, where the ambition is modest and, honestly, overdue: modernize the plumbing—ownership records, settlement, and compliance checks—so they can be repeated cleanly and audited without heroics. The World Economic Forum has flagged tokenization as a leading trend entering 2026, pointing out that traditional financial institutions are leaning in rather than standing back.

If you run a small or mid-sized business, this matters in a very specific way. SMEs rarely fall over because they can’t build. They fall over because money arrives late, costs too much to raise, or comes wrapped in terms that quietly restrict what the company can do next. That’s where tokenization starts to sound less like a slogan and more like a practical tool. In plain language, it’s the idea of representing a share or a bond as a regulated digital security so ownership and transfers can be tracked, restricted when they need to be, and settled with clear rules.

Tokenization’s getting talked about with a lot less swagger lately, because regulators are paying attention right as usage is taking off. In the U.S., Reuters reported that F/m Investments filed with the SEC to tokenize shares of its Treasury bill ETF on a permissioned blockchain—basically, trying to do this inside the rules instead of route around them. Meanwhile in China, Reuters reported the securities regulator tightened oversight of offshore tokenized ABS tied to onshore assets, explicitly flagging speculation and financial-stability risk. The vibe is shifting to: “yes, but…” not “anything goes.”

Dusk Network sits in a specific corner of this landscape: tokenization designed for regulated capital raising, not anonymous assets moving in the dark. Dusk describes its approach as “confidential security tokens,” including its XSC standard, built to support tokenized securities while keeping sensitive details private. The interesting part isn’t the vocabulary. It’s the intent behind it. If you want businesses and regulated investors to take on-chain securities seriously, you can’t ask them to publish their positions, counterparties, and behavior to the whole internet by default. In normal finance, that information is controlled for a reason.

The clearest real-world path Dusk points to runs through NPEX, a Dutch SME exchange. NPEX describes itself as a venue where investors can buy and trade shares and bonds of Dutch SMEs, and it states that NPEX BV has MTF and ECSPR licenses and is under supervision by the AFM and the Dutch central bank. That kind of “licensed and supervised” detail can sound like small print, but for an SME it’s the difference between a funding channel you can explain to your board and one you’ll spend months justifying.

In 2024, Ledger Insights reported that NPEX partnered with Dusk to work toward a DLT-powered exchange and planned to apply for the EU’s DLT Pilot Regime, noting that the regime can allow an MTF to take on certain post-trade settlement functions that are typically handled elsewhere. NPEX’s own announcement framed the partnership as preparation for an application to that regime. This is the point where tokenization stops being a theoretical improvement and becomes a question of market plumbing: who holds the record, who can trade, how settlement happens, and what happens when something goes wrong.

So what does “raising capital on-chain” look like when you strip it down to the basics? In the cleanest version, an SME issues equity or debt through a regulated channel, investors are verified, and the security exists in digital form so ownership updates happen as the transaction settles—not later, not after someone reconciles a spreadsheet, not after a string of emails that end with “please confirm.” That’s not glamorous, but it’s exactly where small raises get bruised. Dusk has argued that “native issuance” matters here—meaning the asset is issued and managed on-chain from the start, rather than mirrored on-chain while the real lifecycle still depends on legacy systems.

The “after” part of fundraising is where SMEs often feel the most friction. A company might take a dozen investors in one round and then spend months answering the same questions whenever a new investor appears: Who owns what right now? Are there transfer restrictions? Are they eligible? Are we sure the cap table matches the legal docs? It’s tiring work, and it’s easy for mistakes to creep in because everyone is maintaining their own version of the truth. Software-first securities can make that quieter. Rules can be checked before a transfer goes through, and the ownership record can update as settlement happens. Less chasing, less ambiguity, fewer “we’ll fix it later” moments.

Europe’s timing is part of why this conversation feels more real in 2026. The EU’s DLT Pilot Regime has been active since 2023 and is explicitly designed to test trading and settlement of financial instruments on DLT under supervision. ESMA’s 2025 review discusses authorizations under the regime, including 21X as a DLT Trading and Settlement System (DLT TSS). Dusk has announced a strategic collaboration with 21X, starting with Dusk being onboarded as a trade participant and pointing to deeper technical integration. For founders, this isn’t a headline you celebrate at a launch party—but it is the kind of signal that suggests regulated rails are being built, not just promised.

Privacy, in this context, isn’t a side quest. It’s often the difference between a financing plan and a rumor mill. Dusk’s Citadel describes a zero-knowledge approach to KYC where users can prove they meet requirements while controlling what personal information gets shared. If selective disclosure works reliably in production, compliance can feel less invasive without becoming loose—and that’s a real quality-of-life improvement for investors and issuers alike.

None of this guarantees a better outcome for every company. Tokenization doesn’t fix poor governance, it doesn’t remove the need for diligence, and it doesn’t create demand where there is none. A security can be easier to transfer and still be hard to sell. And privacy-preserving markets are always a balancing act: issuers and investors want confidentiality around positions and strategy, while regulators and market operators need enough visibility to keep the system trustworthy. The regulatory trendlines—especially the tightening described by Reuters in China—make it hard to imagine a future where “trust us” is accepted in place of controls.

The most valuable wins here will look boring in the best way: fewer manual steps, fewer mismatched records, fewer delays between “we agreed” and “the transaction is truly settled.” If Dusk helps SMEs raise capital, it will likely be because compliant issuance and shareholder administration become less fragile—not because fundraising turns into a click. Tokenization is trending now because the work has shifted from slogans to infrastructure—pilot regimes, filings, and compliance controls—and that’s the point where SMEs can finally benefit without gambling on the hype.