Dusk has been building since 2018, and it feels like it was designed by people who understand a simple truth: most real finance happens quietly. Not because it’s shady—because it’s sensitive. Strategies, client positions, investor lists, deal terms… those things aren’t supposed to be broadcast to the world. But here’s the catch: regulated markets also need proof. Auditors need trails. Regulators need visibility. Counterparties need confidence. Dusk is trying to make those needs stop fighting each other.

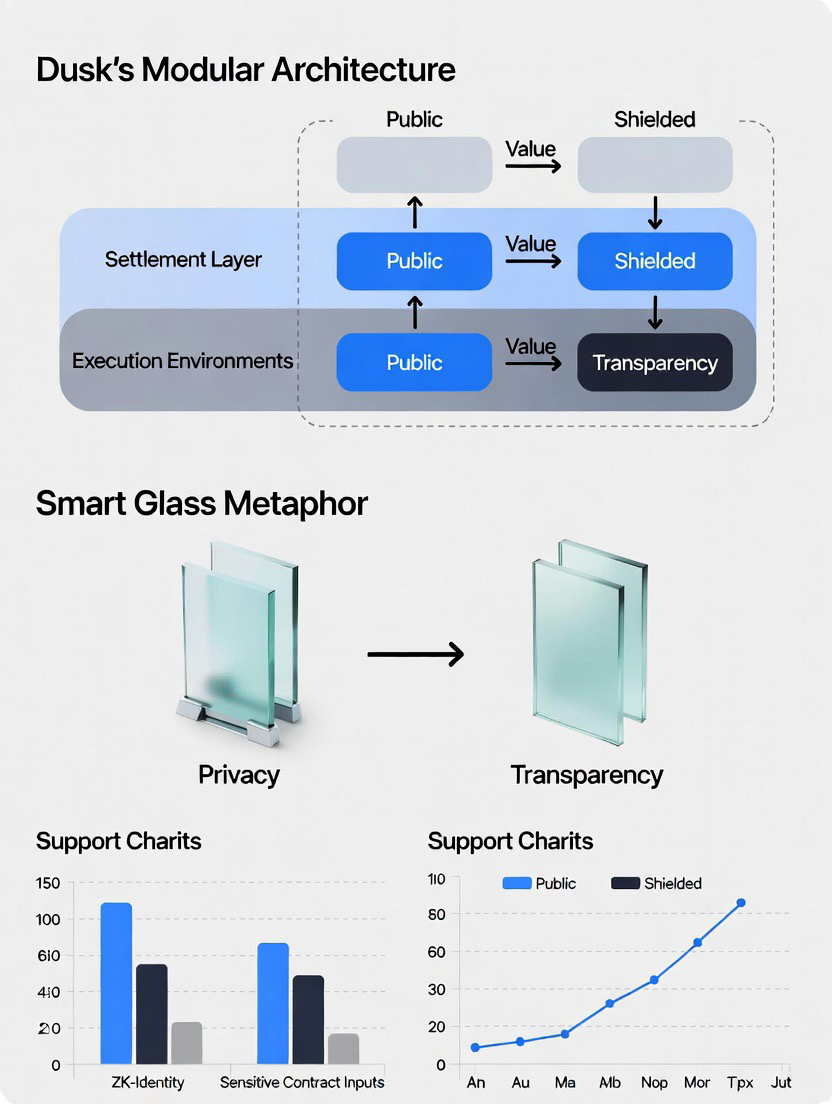

What I like about Dusk’s approach is that it doesn’t act like privacy is a dramatic escape hatch. It treats privacy as something you should be able to use the same way you close the door during a meeting—normal, expected, and still accountable. On the base chain, DuskDS, you can move value in a public way when that’s appropriate, or in a shielded way when details shouldn’t leak. Same network, same settlement truth—different levels of visibility depending on what the situation actually calls for.

The modular architecture is another very “grown-up” choice. Dusk keeps its settlement layer focused on doing one job well: finalizing what’s true. Then it lets execution environments sit above that so developers can build without constantly disturbing the foundation. That’s important if you want institutions to take you seriously, because institutions are allergic to systems where the ground shifts under their feet every time a new feature is added.

Where it gets more interesting is when you think about smart contracts. In finance, the sensitive part is often not the transfer—it’s the rules around the transfer. Who is allowed in, what restrictions apply, what gets disclosed, what gets proven later. Dusk’s privacy tooling direction aims to let contracts keep sensitive inputs protected while still producing evidence that the contract behaved correctly. In plain terms: keep things private, but don’t make the outcome a mystery.

Identity is the other awkward reality. Regulation requires “who,” but users shouldn’t have to hand over their personal data to every app they touch. Dusk’s ZK-identity approach (Citadel) is trying to shrink that risk by letting people prove eligibility without spreading raw identity information everywhere. That’s less about crypto ideology and more about basic safety in a world where data leaks are everywhere.

Recent updates show how Dusk behaves when the messy parts show up—bridges being a classic example. In January 2026, Dusk paused bridge services after unusual activity connected to bridge operations, while saying the base chain itself wasn’t impacted. That’s not flashy, but it’s the kind of response that sounds like infrastructure: isolate the edge risk, keep the core steady, and harden before reopening.

If you want a human metaphor, Dusk is trying to be smart glass. From the outside, you can verify the structure and the rules. Inside, sensitive financial life doesn’t have to be exposed to the whole internet. And when legitimate oversight is needed, visibility can be granted precisely—only what’s required, only to the right people—without turning privacy into a loophole or transparency into a spotlight.