The crypto crowd has flipped extremely bearish after Bitcoin dumped to the $60K region. Even with a modest rebound on Friday, Feb 6, 2026, sentiment remains deeply negative across the market.

Data from CoinMarketCap shows the Fear & Greed Index plunging to 5/100, its lowest level in over three years. At the same time, more than 580,000 traders were liquidated in the past 24 hours, wiping out $2.5B, with longs taking the majority of the hit.

Traders Expect More Downside

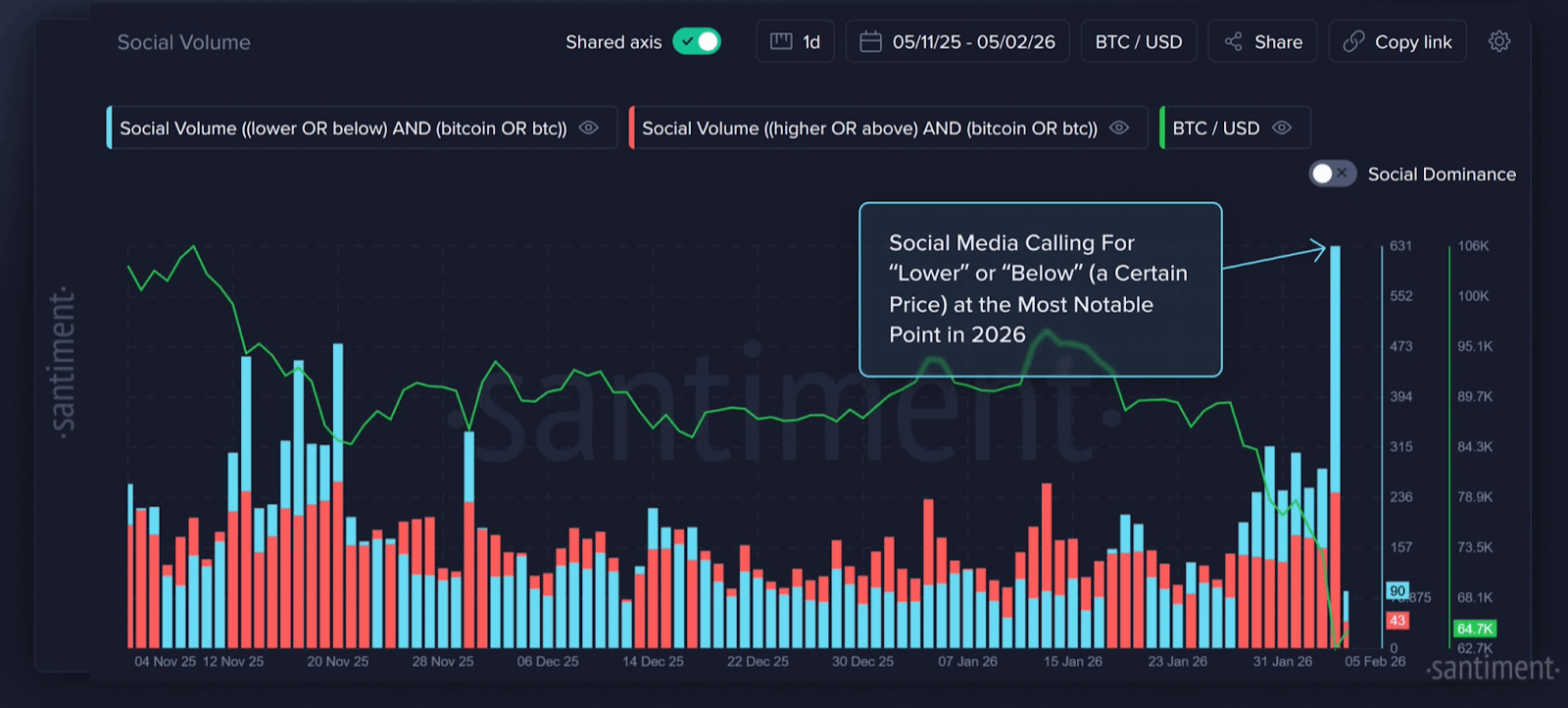

Santiment data suggests most crypto users on social media are still calling for further downside. That view is echoed by Kalshi’s prediction market, which currently prices a 90% chance of BTC dipping below $60K. Mentions of “lower” and “below” continue to dominate over “higher” and “above,” reinforcing bearish crowd psychology.

Santiment cautions that the current bounce could be a classic dead-cat bounce, driven by sentiment rather than strength. Historically, if the crowd turns optimistic too quickly after such rebounds, it often leads to another wave of capitulation.

Is BTC Approaching a Bottom?

Liquidity inflows into crypto have remained weak, especially as capital chased the parabolic rally in gold and silver. Combined with regulatory delays in the U.S., institutional momentum has slowed, allowing selling pressure to overwhelm buyers.

From a macro perspective, Bitcoin is trading in a structure similar to the post-2021 bear phase. CryptoQuant’s Market Cycle Signals suggest BTC may be nearing an accumulation zone around $54.6K.

The Bigger Picture

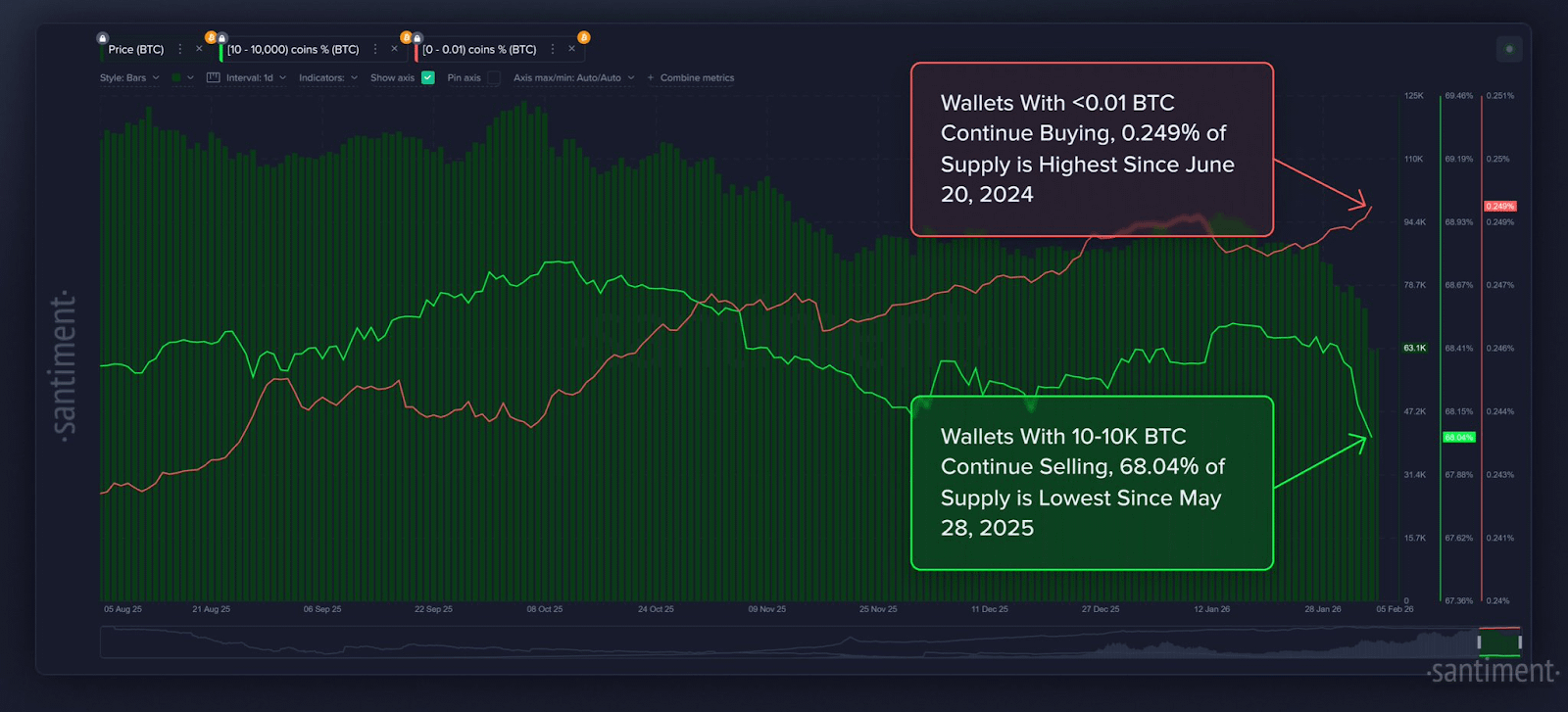

Unlike precious metals, crypto failed to sustain a strong rally due to low conviction from both whales and retail. On-chain data from Santiment shows whale capitulation over recent months, even as smaller wallets steadily accumulate.

Despite current weakness, the market has quietly built stronger fundamentals over the years. A potential rotation of capital from precious metals back into Bitcoin — supported by improving regulatory clarity — could eventually set the stage for a V-shaped recovery.