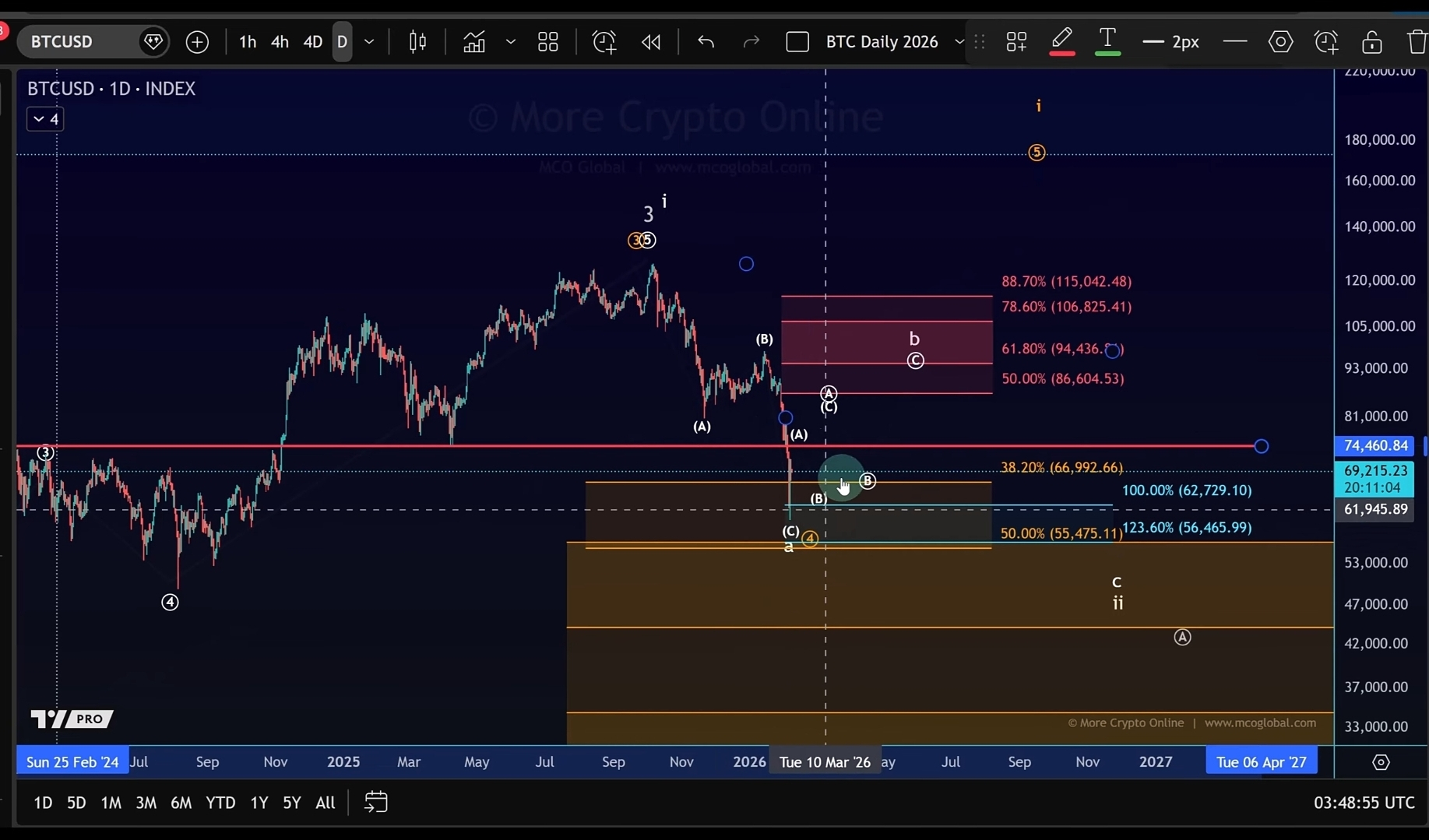

Bitcoin remains relatively quiet as we head into Sunday, with price action still capped below the key $70,000 level. On the daily time frame, BTC continues to consolidate, and the next major objective for the bulls is clear: reclaim the resistance around $74,460.

This level, marked by the red resistance line on the chart, is crucial. A successful break and hold above it would signal renewed upside momentum. For now, the market is watching closely to see whether buyers can generate enough strength to push through this barrier.

Bigger Picture: B-Wave Bounce Still in Play

At the moment, price action still supports the idea of a potential B-wave bounce. That said, another low cannot be ruled out.

If Bitcoin fails to gain upside traction, a deeper retracement could occur, with the $55,000 to $56,000 zone likely being tested before a more meaningful low forms.

On the flip side, should bullish momentum accelerate, the upside targets remain ambitious. In the event of further strength:

$98,000 to $98,500 could be tested

This aligns with the January 14 high

Additional Fibonacci resistance levels to watch include:

50 percent retracement: $86,600

61.8 percent retracement: $94,436

These levels also align with prior structural resistance, including the April low and the March 24 high.