Stablecoins have become one of the most practical innovations in crypto. People use them daily for payments, remittances, trading, and business settlements. Yet most blockchains were never designed with stablecoins as the main priority. Plasma changes that narrative. It is a Layer 1 blockchain built from the ground up for stablecoin settlement, focusing on speed, simplicity, and neutrality rather than chasing every possible use case.

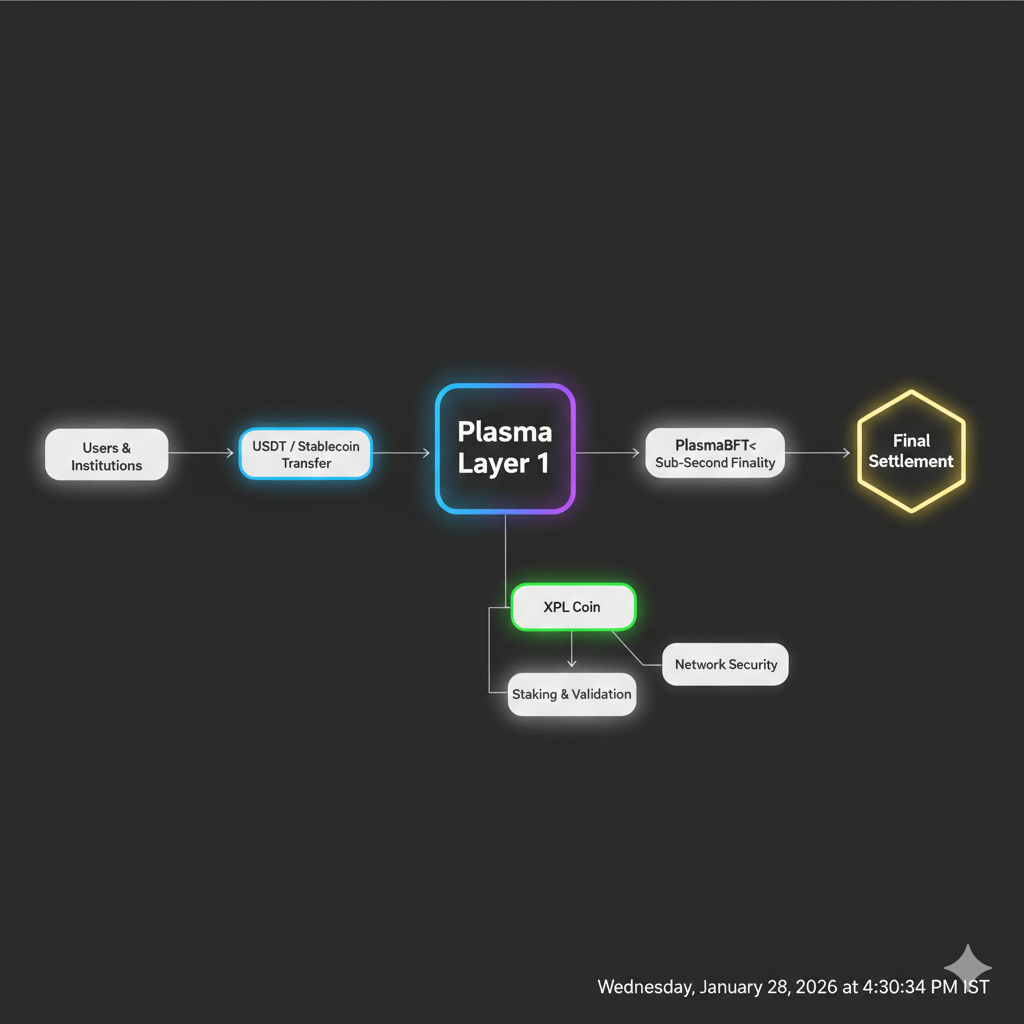

The core idea behind Plasma is simple but powerful: if stablecoins are becoming digital money, then the blockchain supporting them should feel like financial infrastructure, not an experiment. Plasma delivers this by combining full EVM compatibility through Reth with a settlement-focused consensus mechanism called PlasmaBFT. This allows Plasma to support existing Ethereum smart contracts while offering sub-second finality. For users, this means transfers feel almost instant. For institutions, it means reduced settlement risk and smoother operations.

One of Plasma’s most user-focused innovations is its stablecoin-centric design. Gasless USDT transfers remove one of the biggest pain points in crypto. Users no longer need to hold a separate volatile token just to pay transaction fees. They can send USDT as easily as sending a message. Stablecoin-first gas takes this further by allowing transaction fees to be paid directly in stablecoins. This creates predictable costs, easier accounting, and a much more intuitive experience, especially in regions where stablecoins already function as everyday money.

From a developer perspective, Plasma avoids reinventing the wheel. With full EVM compatibility, developers can deploy Ethereum-based applications using familiar tools, wallets, and libraries. This lowers the barrier to entry and allows projects to focus on building useful products rather than adapting to new environments. Plasma’s performance improvements make it especially attractive for payment apps, wallets, and financial services that depend on speed and reliability.

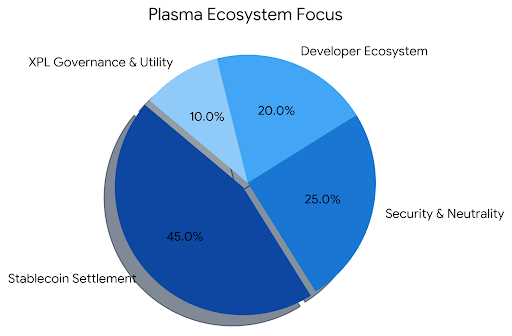

Security and neutrality are central to Plasma’s long-term vision. By anchoring key elements of its security model to Bitcoin, Plasma leverages Bitcoin’s proven decentralization and censorship resistance. This approach strengthens trust and positions Plasma as a neutral settlement layer that does not rely on centralized control. For global payments and cross-border finance, this neutrality is essential. Institutions and users alike need assurance that the network will remain reliable regardless of geography or politics.

Plasma’s target audience reflects real-world demand. Retail users in high-adoption markets benefit from fast, low-friction stablecoin transfers that feel natural and accessible. At the same time, institutions in payments and finance gain a settlement network with predictable fees, fast finality, and strong security assumptions. By serving both groups, Plasma bridges the gap between everyday usage and large-scale financial infrastructure.

In a crowded Layer 1 ecosystem, Plasma XPL stands out by staying focused. It does not try to be everything for everyone. Instead, it aims to do one thing extremely well: provide a fast, secure, and user-friendly settlement layer for stablecoins. As stablecoins continue to move deeper into mainstream finance, Plasma has the potential to become a key piece of the infrastructure that supports how value moves across the world.@Plasma #Plasma $XPL