Most public blockchains were never designed to operate inside regulated financial systems. They emerged from environments where probabilistic settlement, anonymous governance, and incentive-driven security were acceptable compromises. For institutional token service providers, those compromises are not workable. Financial institutions operate under regulatory scrutiny, audit obligations, and fiduciary duties that demand determinism, traceability, and clearly defined accountability.

Hedera Hashgraph is increasingly evaluated through this institutional lens because it approaches distributed ledger technology as infrastructure rather than ideology. Its architecture prioritizes settlement certainty, auditability, and governance clarity—qualities that mirror the design principles of traditional financial market infrastructure.

At the foundation of Hedera is the Hashgraph consensus algorithm, an asynchronous Byzantine Fault Tolerant system that does not rely on blocks, miners, or leaders. Instead of batching transactions into blocks and resolving competing histories, Hedera uses a gossip-based communication model where nodes continuously share transactions along with cryptographic references to prior events. This creates a shared data structure that allows every honest node to independently compute consensus order and timestamps using virtual voting.

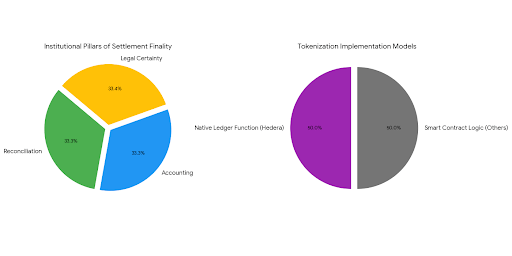

The result is deterministic finality. Once a transaction reaches consensus on Hedera, it is final and irreversible. There are no chain reorganizations and no probabilistic confirmation windows. For institutional systems, this property is critical. Settlement finality underpins reconciliation, accounting, and legal certainty. Without it, institutions are forced to introduce compensating controls that add cost and operational risk. Hedera’s consensus model removes that uncertainty at the protocol level.

Equally important is how Hedera treats tokenization. In many blockchain systems, tokens are defined entirely by smart contracts, pushing critical logic into application code. While flexible, this approach increases the audit surface and introduces execution variability. Hedera instead implements tokenization as a native ledger function through the Hedera Token Service. Tokens are first-class objects governed by protocol-enforced rules.

Supply controls, administrative permissions, account associations, freezing, and KYC enforcement are embedded directly into the ledger. This allows token issuers and service providers to enforce compliance policies at the infrastructure layer rather than relying on custom contract logic. For regulated token service providers, this significantly reduces complexity, improves predictability, and aligns more closely with existing control frameworks used in traditional financial systems.

Provenance and auditability are addressed through Hedera’s separation of transaction ordering from data storage. Using the Hedera Consensus Service, institutions can anchor events—such as token issuance, reserve attestations, corporate actions, or compliance signals—to a publicly verifiable consensus timeline without exposing sensitive data on-chain. Only hashes or references are recorded, while the underlying data remains within controlled off-chain systems.

This design supports regulatory requirements around data privacy and confidentiality while still providing non-repudiable audit trails. Auditors and regulators can independently verify that events occurred in a specific order at a specific time, without requiring access to proprietary or personal data. For institutions, this combination of transparency and discretion is essential.

Governance is another area where Hedera diverges from most public networks. Rather than anonymous validator sets or informal social governance, Hedera is overseen by a governing council composed of known global enterprises. These entities operate consensus nodes and participate in protocol stewardship under documented governance rules and defined terms.

From an institutional perspective, governance is not a philosophical concern but a risk consideration. Identifiable governing entities enable regulatory engagement, legal accountability, and predictable change management. While this model departs from permissionless ideals, it substantially reduces governance ambiguity—one of the most significant barriers preventing institutional adoption of public ledgers.

In real-world deployments, Hedera is typically used as part of a hybrid architecture. Custody, KYC and AML screening, accounting, and risk management remain off-chain within systems already approved by regulators. Hedera provides the shared settlement layer for token transfers and the immutable ordering layer for audit and compliance events. This separation allows institutions to modernize settlement and record-keeping without compromising regulatory obligations.

The strategic relevance of Hedera becomes clear when evaluated against institutional requirements rather than crypto-native benchmarks. Its strengths are not centered on speculative yield or permissionless experimentation. They lie in environments where settlement certainty, governance clarity, and auditability are mandatory. Stablecoins, tokenized deposits, regulated digital instruments, and inter-institution settlement networks naturally align with this design philosophy.

Hedera does not attempt to replace existing financial infrastructure wholesale. Instead, it offers a way to extend it with shared, verifiable digital rails that reflect how regulated finance actually operates. Its consensus model prioritizes certainty over probability, its token framework embeds policy at the ledger level, and its governance structure acknowledges the role of accountability in public infrastructure.

For institutional token service providers, the relevant question is not whether Hedera aligns with crypto ideology. The question is whether it provides defensible settlement, provable provenance, and manageable operational risk. Viewed through that lens, Hedera Hashgraph is best understood not as another blockchain competing for attention, but as public digital infrastructure designed to integrate with the global financial system as it exists today.

If you want, I can:

Tailor this specifically for banks, stablecoin issuers, or regulators

Rewrite it for Medium, LinkedIn, or a whitepaper format

Or align it to a specific ecosystem narrative (payments, RWAs, tokenized deposits)

Just tell me the direction.