Bitcoin staged a sharp rebound late last week, surging approximately 12% from a Thursday low near $60,000 to trade around $70,000-$71,000 by Friday, in what analysts characterize as a short squeeze rather than a sustainable recovery driven by fresh buying demand.

Short Squeeze Fuels Rapid Rally

The rally triggered $283.42 million in crypto futures liquidations over 24 hours, with Bitcoin shorts accounting for an overwhelming 83.96% of liquidated positions, according to data from Coinglass. The forced buying created a rapid feedback loop as bearish traders scrambled to cover positions, propelling prices higher in a classic squeeze pattern.

Analysts Sound Caution on 'Dead Cat Bounce'

Market observers warn the bounce exhibits characteristics of a "dead cat bounce" — a temporary recovery in a declining market that does not signal a genuine reversal. Several technical indicators support this interpretation.

The Coinbase Premium Index, which measures price differences between the major U.S. exchange and global averages, has remained negative for 25 consecutive days, currently at -0.0864%. This persistent negative premium signals institutional selling pressure rather than accumulation. "Such a large negative premium suggests strong selling pressure from institutions is causing both price declines and premium widening," CryptoQuant analyst Darkfost noted.

Open interest in Bitcoin futures has fallen below $50 billion, reaching its lowest level since March 2025, indicating sustained deleveraging across derivatives markets. Bloomberg reported that Bitcoin's recovery "rings hollow" as derivatives positioning remains bearish.

Trump Reserve Speculation Adds Fuel

Speculation emerged during the selloff after CNBC commentator Jim Cramer said on Friday he had "heard at $60,000 the President is gonna fill the Bitcoin Reserve." The U.S. government holds approximately 328,372 BTC worth over $23 billion, according to Arkham data, though no new purchases have been detected in the Treasury wallet.

The strategic reserve, established by executive order in March 2025, is currently funded solely through assets forfeited in criminal and civil proceedings. White House crypto czar David Sacks previously stated the administration "won't bail out" Bitcoin and lacks authority to compel purchases using public funds.

Broader Market Context

The rebound follows Bitcoin's worst week since November 2022, with the cryptocurrency plunging roughly 17% in five days before finding support. Bitcoin has fallen more than 50% from its all-time high above $126,000 reached in October 2025.

Despite the volatility, research firm Bernstein maintains its 2026 price target of $150,000, noting that spot Bitcoin ETF outflows remained below 5% during the correction, suggesting institutional conviction remains intact. The firm describes the current environment as "the weakest bear case in history."

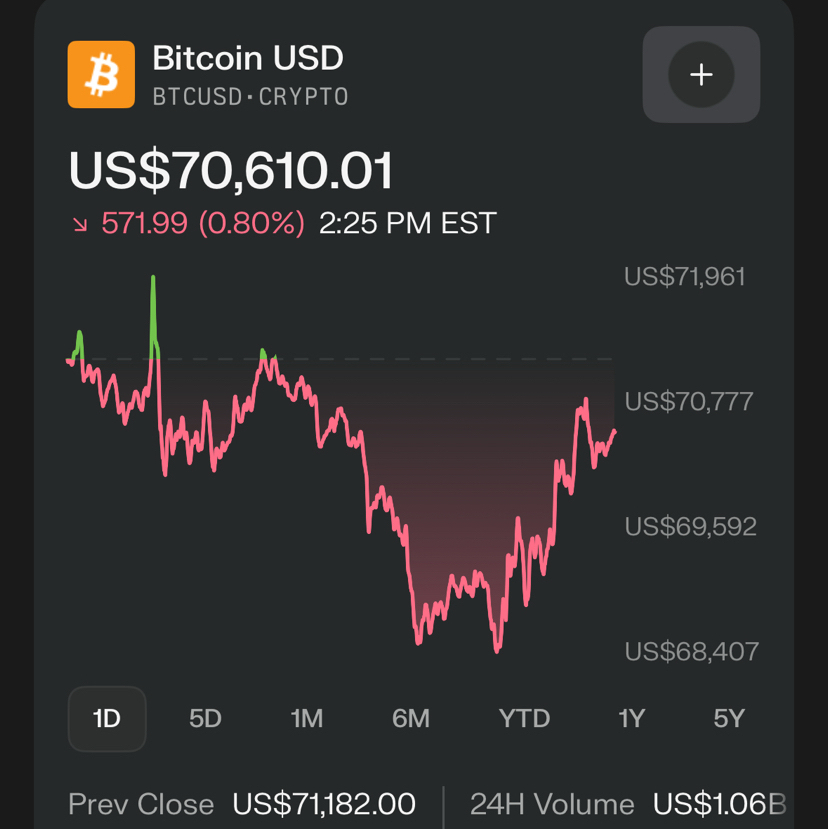

For now, traders are monitoring whether genuine demand materializes above $70,000 or whether the squeeze exhausts itself as forced buying subsides.

Bitcoin's technical picture remains mixed after the recent 12% rebound, with momentum indicators showing short-term oversold relief but broader bearish structure intact. As of February 9, 2026, Bitcoin trades around $70,542, up 1.8% from the prior day but still down sharply from January peaks near $95,000.[1]

Key Support Levels

Critical supports cluster between $60,000-$62,000, aligning with the February 6 intraday low, the 200-week moving average, and long-term holder cost bases per Glassnode data. A break below $65,925 could accelerate downside toward $62,510 or even $59,800, invalidating recent bounce patterns.

Key Resistance Levels

Immediate overhead resistance sits at $72,000-$73,000, with denser supply at $80,000 and $85,000-$90,000 where institutional selling has dominated. Clearing $72,828 decisively would target $78,000-$80,000, but failure here reinforces the dead cat bounce narrative.

Momentum Indicators

RSI readings have rebounded from oversold territory below 30 (early February) to neutral around 65, leaving room for upside but flashing caution on daily charts. MACD shows bullish histogram expansion at 880 but remains vulnerable to negative divergence if volume doesn't follow. Bollinger Bands position Bitcoin 1.10 above the middle band, suggesting testing upper limits without extreme overbought conditions yet.

Price Action Outlook

Weekly charts display a bullish engulfing pattern post-correction, hinting at potential recovery to $89,000 if supports hold. However, declining open interest and negative Coinbase Premium confirm the rally's squeeze-driven nature rather than fundamental buying. Traders watch for sustained volume above $71,000 to validate bulls.