Many blockchains present immutability as the highest expression of trust. Code is locked. Rules are frozen. Human intervention is treated as a flaw rather than a fact. It feels elegant, even moral, in its purity. But the moment real finance steps in, that elegance begins to fracture.

Finance does not fear change. It depends on it.

Regulatory language shifts. Risk committees revise thresholds. Fraud evolves faster than any static model. A new market opens, a jurisdiction tightens definitions, an audit introduces fresh conditions. Financial systems are not monuments; they are organisms. They survive by adapting continuously, not by standing still. The real challenge has never been whether systems change, but whether they can change without eroding confidence.

This is where Vanar takes a different path, one that feels less dramatic and far more consequential.

Vanar does not glorify rigidity. It designs for controlled evolution.

Instead of treating a blockchain as a sacred, unalterable object, Vanar treats it as an accountable system. One that can evolve in full view, without undermining its own credibility. That philosophy matters more to real finance than raw speed, headline metrics, or ideological purity.

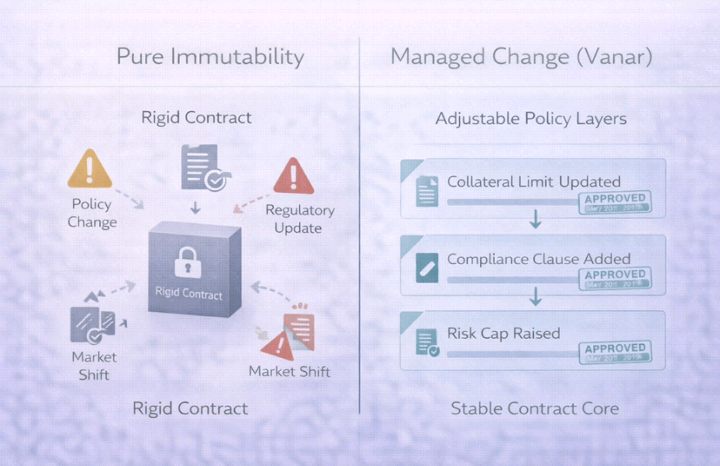

Within crypto culture, smart contracts are often celebrated precisely because they cannot change. Yet this rigidity is foreign to institutions. Banks do not operate on “final” logic. They operate on living rulebooks. The core machinery remains stable, but the rules governing its behavior are reviewed, approved, revised, and archived. Stability comes from process, not paralysis.

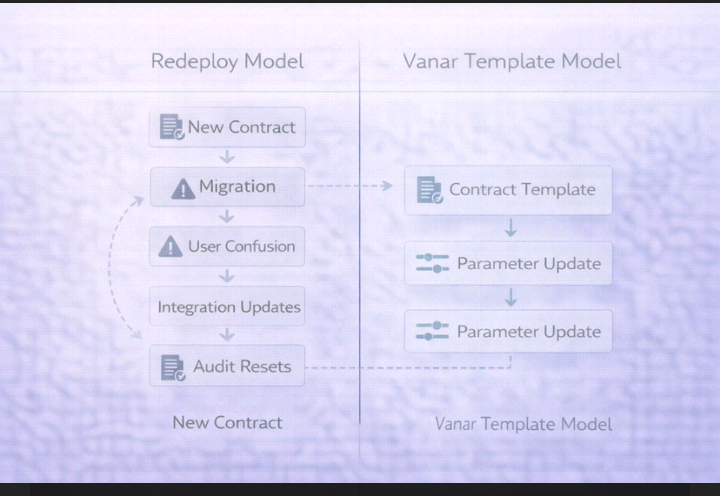

Traditional smart contracts impose a painful dilemma. Either redeploy contracts every time the real world changes breaking integrations, fragmenting users, and introducing migration risk or rely on shadowy admin privileges that quietly alter behavior without clear oversight. One option is fragile. The other is frightening. Neither aligns with how serious financial systems are built.

Vanar’s innovation is not louder features. It is structural discipline.

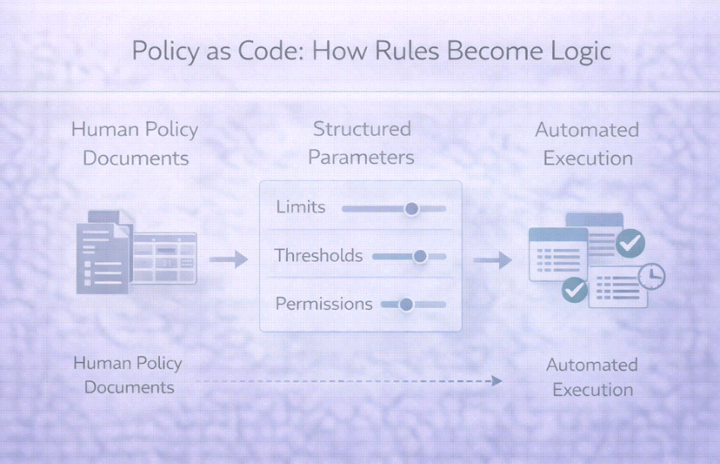

With its V23 framework, Vanar reframes smart contracts as stable templates governed by adjustable parameters. The logic remains constant. The policies evolve. Change is not an act of destruction and replacement; it is a bounded, transparent adjustment within known limits.

This approach mirrors how mature software systems have long been built. Code expresses behavior. Configuration expresses rules. Interest rates, thresholds, limits, and permissions change without rewriting the engine itself. Vanar brings this long-established separation into the on-chain world, where it has been missing for too long.

Under this model, institutions can modify loan-to-value ratios, collateral requirements, compliance constraints, geographic limits, or risk tolerances without redeploying contracts. Nothing breaks. Nothing migrates. Only approved parameters move, and every movement is recorded, time-stamped, and auditable.

For real-world asset tokenization, this shift is fundamental.

RWA products exist in constant motion. Collateral rules tighten when markets turn volatile. Regulatory definitions shift across borders. Compliance teams add constraints in response to audits. Products expand globally and inherit new obligations. In immutable systems, each adjustment becomes a disruptive event a fork, a redeploy, or an awkward upgrade ceremony that introduces technical and reputational risk.

Vanar treats this turbulence as normal.

By anticipating change rather than resisting it, the template-plus-parameter model turns chaos into process. Policy evolution becomes expected, limited, and verifiable. The contract is no longer a rigid stone; it is a machine with clearly labeled dials, and everyone knows which dials can be turned.

This design is not just cleaner. It is safer.

Every redeploy is a moment of vulnerability. New addresses, new integrations, new opportunities for mistakes or exploitation. Reducing redeploys reduces exposure. Risk is not denied; it is constrained. The system evolves without repeatedly tearing itself open.

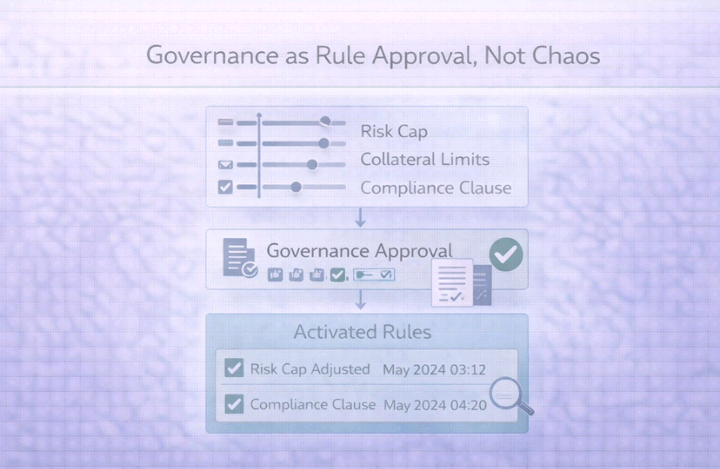

Governance, in this context, becomes essential rather than decorative.

In a dynamic system, trust depends on clarity: who can change what, how changes are approved, and how they are recorded. Vanar’s Governance Proposal 2.0 frames governance as an approval layer, not a popularity contest. Parameters are proposed. Decisions are documented. Authority is explicit and traceable.

This mirrors how real organizations function. Not through noise, but through records. Not who argued the loudest, but what was approved, when, and by whom.

Imagine an on-chain lending product built this way. The issuance logic, collateral monitoring, and repayment mechanics remain stable. What evolves are the policies: acceptable collateral, risk bands, regional access, compliance triggers. Users are never forced to migrate. Auditors can follow the full history of changes. Developers are not rebuilding integrations every quarter.

At that point, on-chain finance stops feeling like an experiment and starts behaving like infrastructure.

This is why Vanar’s direction feels unusually grown-up. While much of the industry chases novelty, Vanar is designing for endurance. The goal is not spectacle, but survivability — across regulatory cycles, market stress, and institutional scrutiny.

Immutability is often mistaken for trust. In reality, trust emerges from reliability: predictable behavior paired with visible, accountable change. Banks, payment networks, and regulated systems change constantly, yet confidence persists because the process is structured, approved, and auditable. Vanar aligns blockchain with that reality rather than denying it.

The V23 vision brings smart contracts closer to how the real world actually works. Stable foundations. Adjustable rules. Compliance and risk expressed as logic. Policies that can be simulated before deployment. Regional variations without fragmentation. Change that is controlled instead of feared.

If Vanar continues to constrain change to approved parameters, document it rigorously, and enforce governance with clarity, it will become more than another chain. It will become a platform where finance can evolve without losing coherence.

In the long run, the systems that survive will not be the ones that promise permanence. They will be the ones that adapt without breaking.

Vanar’s quiet message is simple, and powerful: trust is not about never changing. It is about changing well.