There is a kind of money that travels the way people actually live now. It moves in small bursts and big sweeps. It crosses borders before lunch. It shows up in family group chats, merchant QR codes, freelance invoices, late night emergencies, and the quiet monthly ritual of sending support back home. This money does not want to be a speculative object. It wants to be a utility. It wants to feel like water from a tap.

Plasma is built around that feeling.

Most blockchains were designed like multipurpose cities. They can host anything, from complex financial machines to digital collectibles, but they also inherit city problems. Congestion. Confusing toll systems. Unpredictable costs. A sense that every simple action is forced to share space with everything else happening on the network. For a person who just wants to send a dollar stablecoin quickly and reliably, that world can feel like paying highway tolls with a separate currency you did not ask for.

Plasma begins with a calmer question. What if stablecoin settlement is not just one activity among many. What if it is the main verb. What if the chain treats sending stable value not as a side feature, but as the center of gravity.

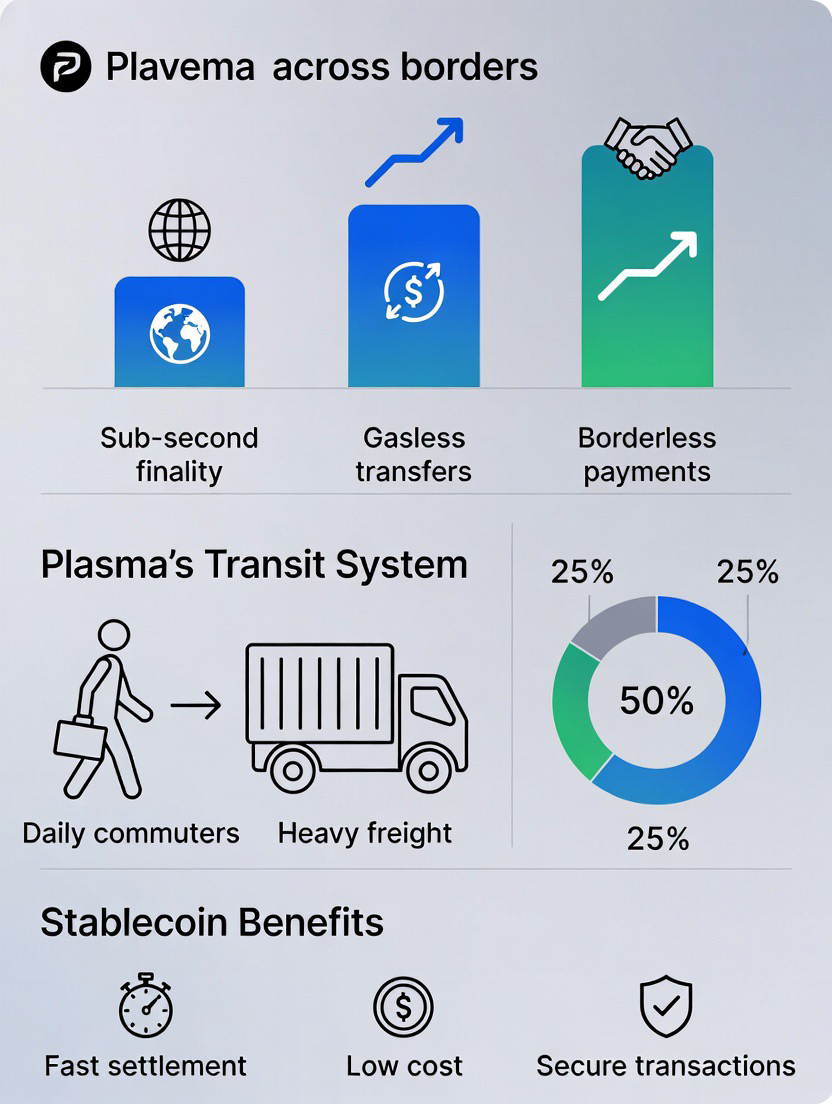

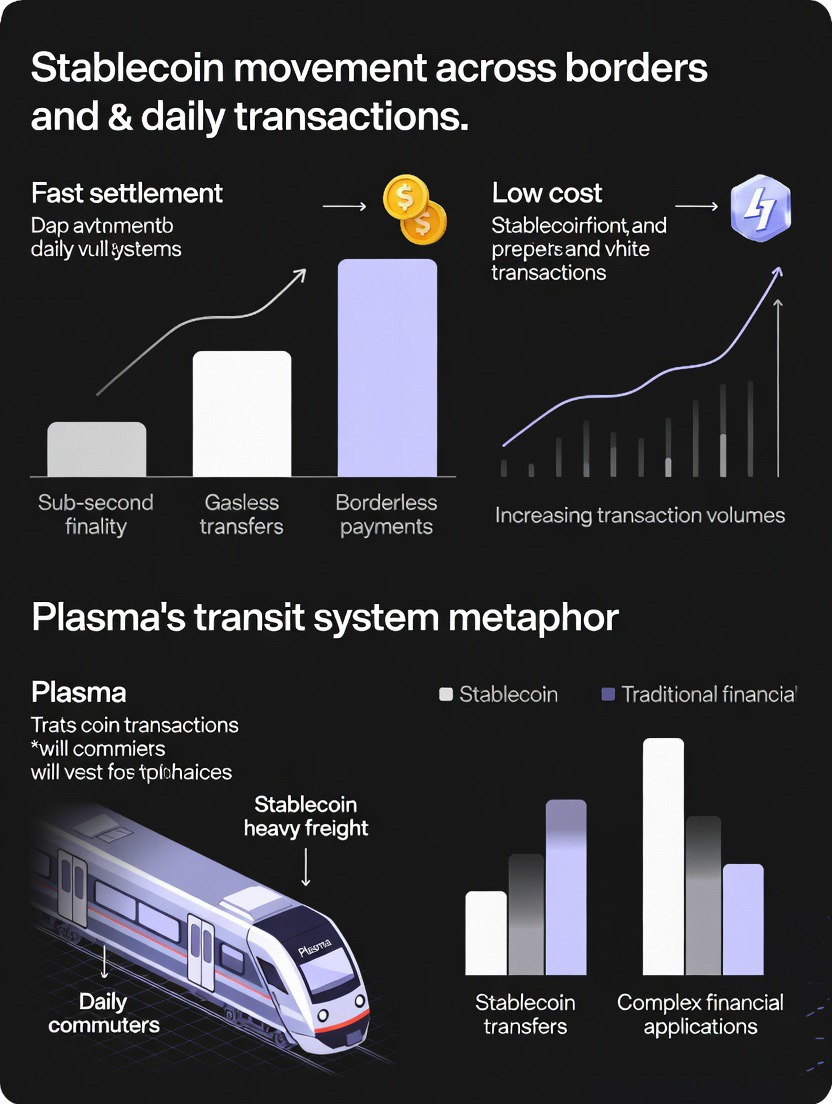

This is why the project pairs two ideas that usually live in different rooms. On one side, it keeps the developer experience familiar by staying fully compatible with the mainstream smart contract environment. That means existing tools, existing patterns, and the ability to port applications without rewriting the universe. On the other side, it tries to make the user experience feel closer to payments infrastructure than to crypto ritual by aiming for sub second finality through a dedicated consensus design.

But Plasma is not only chasing speed. Speed is a visible number. The deeper target is normality.

Normality means you can send stable value without thinking about the mechanics of fees. It means you do not need to juggle a separate volatile token just to pay for a transfer. It means the act of moving stablecoins stops feeling like entering a technical domain and starts feeling like sending a message.

This is where Plasma makes a bold product choice. It introduces the idea of gasless stablecoin transfers for simple wallet to wallet movement. Not for everything. Not for complex interactions that can be abused or that consume heavier resources. But for the most human use case, sending money from one person to another.

That decision carries a philosophy and a strategy at the same time. Philosophically, it says that basic money movement should be treated like public infrastructure. Strategically, it creates a powerful adoption slope. People come for the frictionless transfer, then stay for the ecosystem that grows around that stable balance.

Still, free is never truly free. Any system that subsidizes core actions has to defend itself from being eaten by its own generosity. The risk is not just spam. The risk is an economy that cannot support the people securing the network, or a network that becomes dependent on continuous subsidy rather than sustainable demand. Plasma’s approach is to draw a line between money movement and money logic. The simplest transfers can be sponsored. The heavier actions, swaps, lending, complex applications, should carry fees because they consume more resources and because users engaging in those activities are already in a value seeking mode where fee payment is expected.

If you want a metaphor that does not feel like marketing, think of it like a transit system. Daily commuters need affordability and smooth passage. Heavy freight needs to pay for the wear it creates. Plasma tries to make everyday stablecoin movement feel like the commuter lane, while keeping the economic engine running through higher intensity activity.

The stablecoin first gas concept is the second part of this effort. The most common point of confusion for mainstream users is paying fees in something that is not the thing they are sending. A payment rail that demands an extra currency to operate forces people to learn a new mental model. Plasma tries to collapse that mental distance by making stablecoins the natural fuel of the network.

Under the hood, Plasma also leans into a security narrative designed to matter in the real world, not just in online debates. Settlement rails attract pressure. Financial infrastructure always does. So Plasma connects its security posture to an external anchor that is designed to strengthen neutrality and censorship resistance. The aim is to make the settlement layer feel less like a private corridor and more like a public road that is harder to capture.

This is not only a technical preference. It is a social stance. When stablecoins become everyday money for millions of people, neutrality stops being a nice slogan and starts becoming a survival feature. People do not just need speed. They need confidence that the rail will not bend easily when the weather changes.

Plasma also arrives at a moment when the stablecoin world is evolving beyond trading. The center of activity has been drifting toward payments, payroll, merchant settlement, cross border movement, and treasury operations. Stablecoins are becoming a behavior pattern, not just an instrument. That trend is pulling infrastructure to specialize. The market is slowly carving out a new category of networks optimized for stable value movement, where user experience, predictability, and operational clarity can outweigh maximal generality.

So what might Plasma become if it executes well.

It could become the invisible chain. The rail that users do not talk about, because it simply works. The place where stable value settles quickly, where fees are not a constant emotional irritation, and where the act of sending money feels less like navigating a technical maze and more like using a basic utility.

And if it fails, it will likely fail for the most interesting reason. Not because stablecoins were a bad focus, but because making money movement feel effortless is a promise that has to be backed by economics, security, and governance that can survive scale. Gasless transfers can be a doorway or a trap. Stablecoin first gas can be clarity or complexity disguised. Fast finality can be a blessing or a new surface for centralization pressure.

Plasma’s real test is whether it can hold all these tensions at once. Familiar smart contracts for builders. Payment like simplicity for users. Strong settlement confidence for institutions. A subsidy model that feels generous without being fragile. A neutrality story that is not just aesthetic.

If it pulls that off, it will not just be another chain with better numbers. It will be something rarer. A place where stablecoins stop feeling like a crypto feature and start feeling like the internet’s default settlement layer.

If you want, I can rewrite this again in an even more intimate narrative voice, like a short story that keeps the same analysis but feels like following one person and one business through the experience of using a stablecoin rail that finally behaves like money.