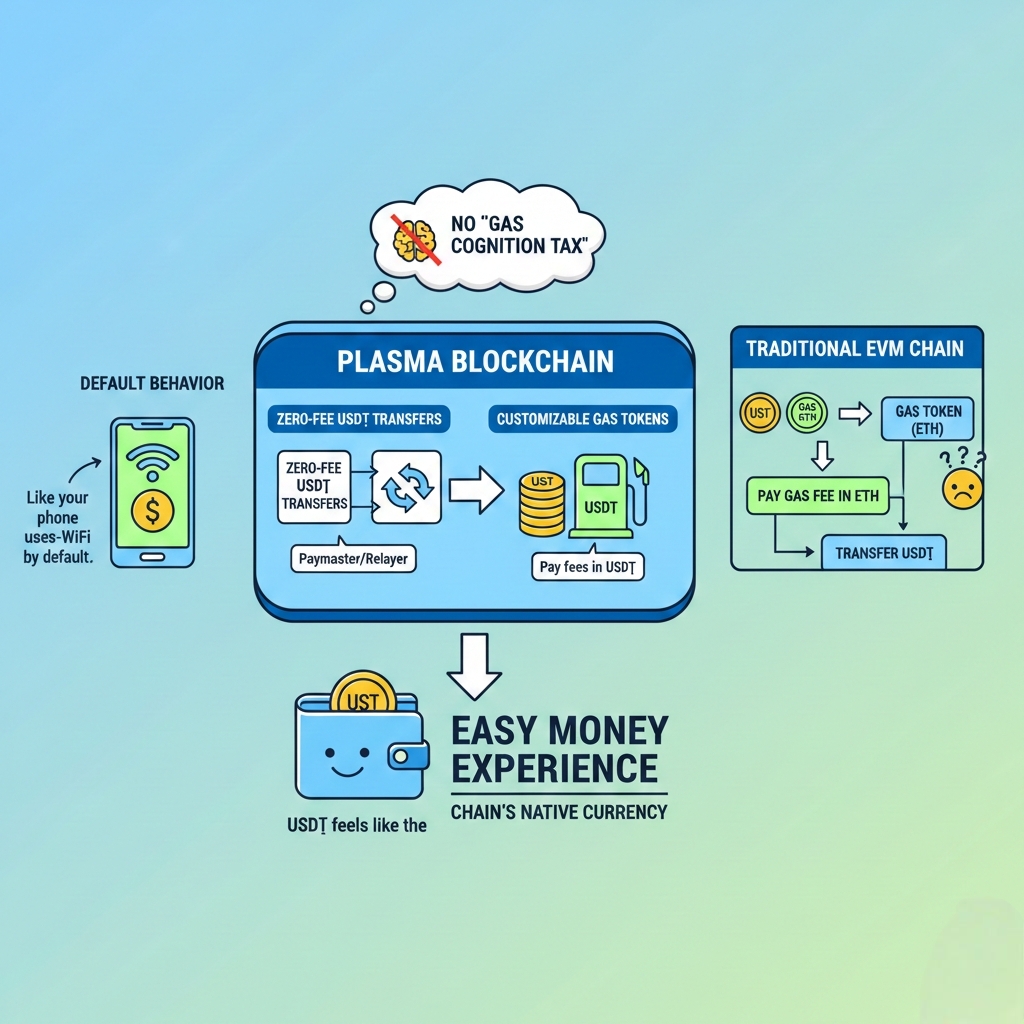

When I look at Plasma, I don’t mentally file it under “another fast EVM chain,” because the more interesting thing is the attitude it takes toward stablecoins: instead of treating USD₮ like an app that happens to run on a blockchain, Plasma is trying to make USD₮ feel like the default behavior of the chain itself, in the same way your phone quietly treats Wi-Fi as the default network when it’s available, so you never stop to think about which radio is doing the work.

That framing matters because stablecoin adoption doesn’t stall on the last mile due to ideology, it stalls because the experience keeps asking people to learn small, annoying rules at exactly the moment they want money to behave like money, and one of the most annoying rules has always been the “gas cognition tax,” where you’re forced to buy, hold, and manage a separate token just to move the stablecoin you already have; Plasma’s docs lean directly into removing that friction through a paymaster/relayer approach for zero-fee USD₮ transfers and through customizable gas tokens so fees can be paid in approved assets like USD₮ rather than a native token for ordinary usage.

What makes this feel less like a marketing claim and more like a product philosophy is that Plasma doesn’t describe “gasless” as a magical property of the universe, it describes it as a scoped service with boundaries, because their own documentation frames the mechanism as sponsored execution for direct USD₮ transfers with controls designed to prevent abuse, which is the kind of unglamorous detail you only bother to build if you’re serious about payments being a day-to-day primitive rather than a demo feature that looks good in a thread.

latest update: that isn’t a rehash of announcements, the cleanest place to look is the chain itself, and right now the USDT0 contract on Plasmascan is a live heartbeat that tells you whether the stablecoin lane is actually being used; as of the explorer snapshot, USDT0 is showing a price around $0.9983, with ~5.63M transactions attributed to the contract, and the recent transfer feed even shows recognizable exchange-labeled accounts moving in and out, which is the kind of mundane plumbing signal that tends to show up before anyone writes a victory lap post about “ecosystem growth.”

On the token page view, the same asset is showing a supply in the neighborhood of ~1.396B USDT0 and a holder count around ~182k, along with an on-chain market cap display around $1.39B, and I’m intentionally calling these “signals” rather than “proof,” because numbers don’t automatically mean product-market fit, but they do strongly suggest the chain is not sitting idle, and that stablecoin usage is not merely hypothetical in the way it often is for infrastructure projects that are still living mostly in slide decks.

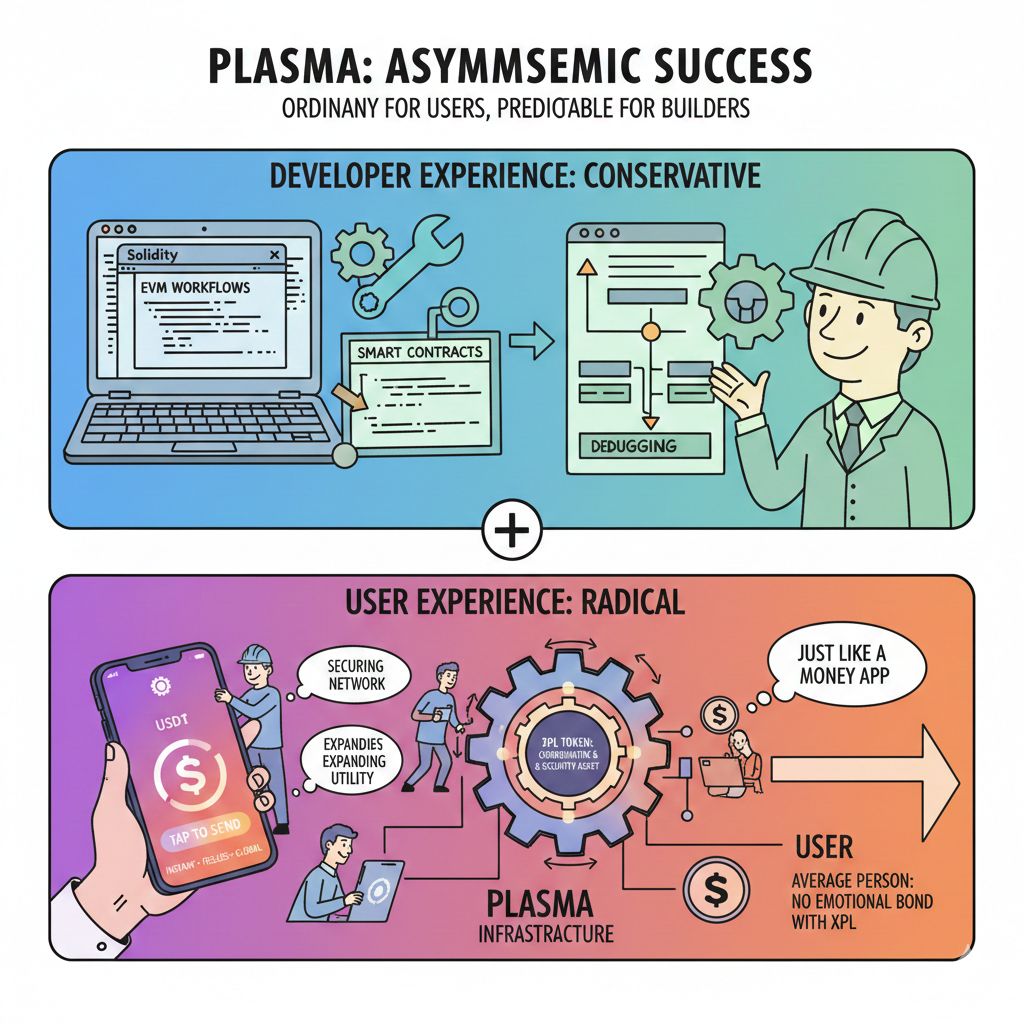

The part that feels subtly clever, and honestly a bit underappreciated, is that Plasma is making the developer experience conservative while making the user experience radical, because from a builder’s perspective you get the familiar comfort of EVM workflows, while from an end user’s perspective the goal is that sending USD₮ stops feeling like a blockchain interaction and starts feeling like tapping “send” in a money app, and that asymmetry is exactly how successful infrastructure usually works, since the best systems are the ones that are completely ordinary for the people using them and comfortably predictable for the people integrating them.

Where the native token fits into this picture is also more practical than poetic, because Plasma’s own tokenomics framing describes XPL as the coordinating and security asset intended to intensify network effects across crypto and traditional markets, which reads to me like an “engine room” token rather than a “front desk” currency, meaning the average person sending stablecoins shouldn’t need to emotionally bond with XPL for the system to work, while validators, liquidity programs, and builders are the ones who care about XPL’s role in securing and expanding the network.

If you’re trying to picture what Plasma is aiming for, the closest analogy I can offer is not “a better bank,” but “a better cash register rail,” where the trick is to make the stablecoin transfer so frictionless and predictable that nobody talks about it anymore, and the chain fades into the background the way you never think about the specific routing protocols that make a video call feel instant; the on-chain USDT0 activity gives Plasma a tangible claim to that direction today, and the stablecoin-first mechanics described in the docs explain why they’re betting that the most valuable feature in global payments is not novelty, but invisibility.