#CPIWatch January 2026 US CPI expected to be released today (13 Feb 2026).

EconoTimes

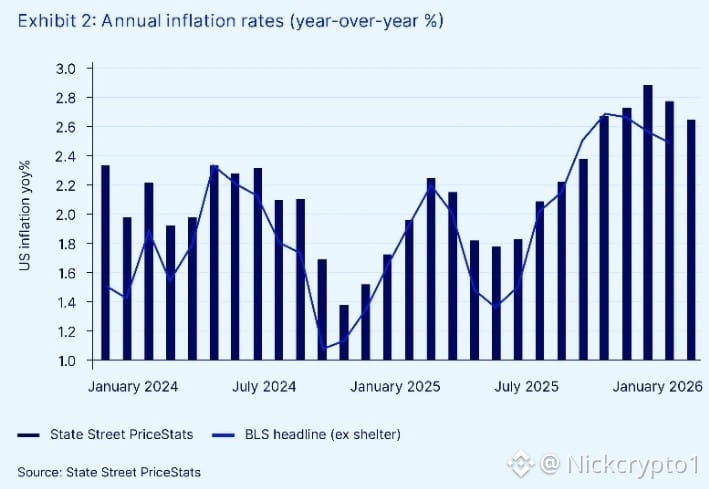

Headline CPI likely slowed to about 2.5 % year-on-year, down from 2.7 % in Dec 2025.

Trading Economics

Monthly (Jan) CPI is forecast at +0.3 % — same as Dec.

Trading Economics

Core CPI (excluding food & energy) is also expected around 2.5 % year-on-year, lowest in several years.

Trading Economics

If the data confirms slower inflation, it supports “disinflation” momentum. If higher than expected, markets may react negatively.

EconoTimes

#CPIWatch refers to close monitoring of the upcoming US Consumer Price Index release. (This is the key inflation report markets watch.)

Investors and traders use the CPI data to predict interest-rate decisions by the Federal Reserve — especially whether cuts are likely.

FinancialContent

A cooler CPI reading (“slower inflation”) increases the odds of future rate cuts. A hot print keeps rate cuts off the table.

FinancialContent

Market Reaction Ahead of CPI

U.S. stock futures were slightly weaker ahead of CPI data, as markets prepare for potential volatility.

Strong recent U.S. jobs data has reduced expectations of near-term rate cuts, strengthening the USD and pressuring gold.

TMAStreet

Tech and risk assets have been more volatile leading into CPI.

📍Broader & Related Highlights

Analysts describe the upcoming CPI report as a “key litmus test” for the U.S. economy’s soft landing from inflation pressures.

FinancialContent

Economists forecast some stickiness in services inflation, even as overall inflation cools.

FinancialContent

Different methods of measuring CPI (official vs. new base models) can show slightly different outcomes — still important for policy and markets.

ET Now

📌 Bottom Line (as of early 13 Feb 2026)

📍 Today’s CPI reading is crucial — it will shape expectations for monetary policy, risk assets (stocks/crypto), and interest-rate forecasts for 2026.

📍 If inflation is weaker than forecasts (cooling), markets may rally; if stronger (“sticky”), markets may react negatively.

📍 This week’s economic data (jobs + CPI) is high-impact and driving volatility.