Volatility is the lifeblood of financial markets and nowhere is this more evident than in crypto. When $BTC spikes 8% in an hour or altcoins swing double digits overnight, traders face a defining question:

Do algorithms outperform human intuition when markets turn chaotic?

Let's break it down

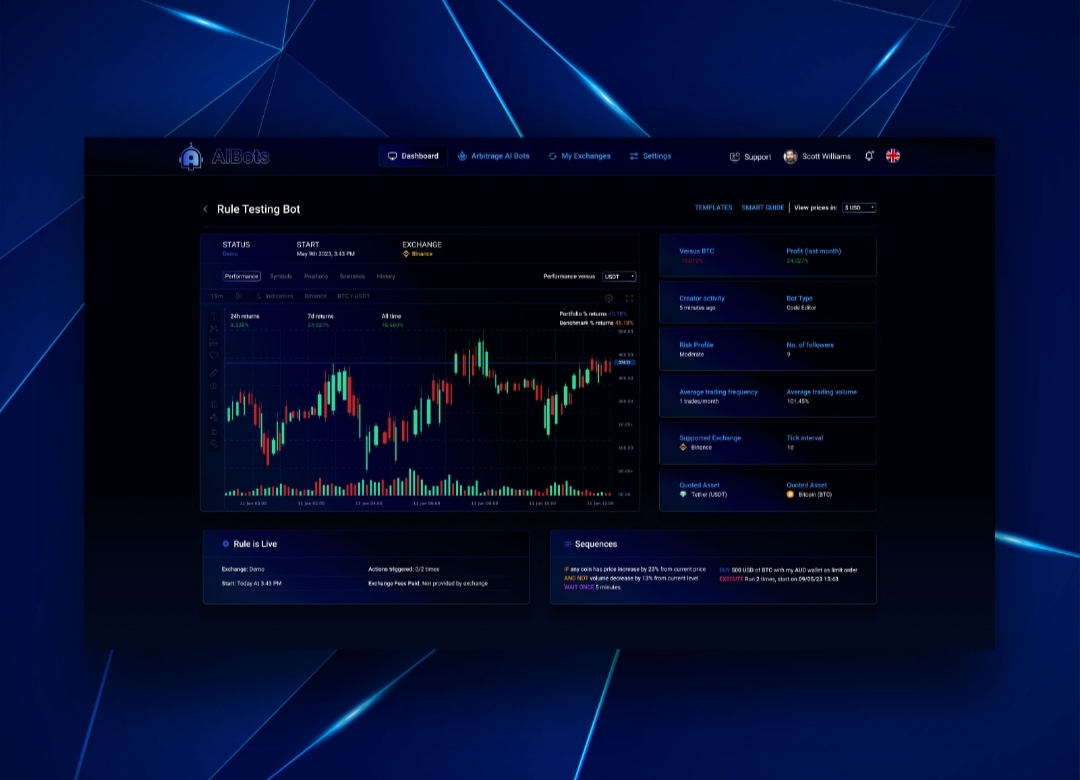

What Are AI-Driven Trading Bots

AI-driven trading bots are automated software programs that use artificial intelligence and machine learning to analyze market data and execute trades without human intervention.

Instead of a trader manually watching charts, these bots:

Scan large amounts of real-time data

Identify patterns and probabilities

Generate buy/sell signals

Execute trades automatically

Manage risk based on preset rules

Why Bots Thrive in Volatile Markets

1. Speed & Execution Markets can move in milliseconds. Bots execute instantly no hesitation, no emotional delay.

2. 24/7 Operation Crypto never sleeps. Bots monitor markets around the clock without fatigue.

3. Data Processing Power AI models analyze order books, funding rates, volatility clusters, and on-chain metrics simultaneously.

4. Emotionless Decisions Fear and greed destroy human traders during flash crashes. Bots follow predefined rules.

Where Bots Struggle

Overfitting to past data

Poor performance during black swan events

Strategy breakdown in regime shifts

Dependence on clean liquidity and stable infrastructure

When volatility becomes irrational rather than statistical, bots can malfunction or amplify losses.

What Is Manual Trading?

Manual trading is when a human trader personally analyzes the market and executes buy or sell orders without automated systems making decisions for them.

Every step from chart analysis to clicking buy or sell is controlled by the trader.

The Case for Manual Trading

Manual trading relies on discretion, macro interpretation, market psychology, and experience.

Why Humans Still Matter

1. Context Awareness Humans understand narratives ETF approvals, regulatory shocks, geopolitical risk.

For example, during major news tied to Bitcoin or Ethereum, discretionary traders can react to tone and sentiment before models adjust.

2. Adaptive Thinking Markets change regimes trending, ranging, panic-driven. Experienced traders can shift strategies faster than rigid algorithms.

3. Creative Risk Management Humans can reduce exposure, hedge creatively, or step aside entirely during extreme uncertainty.

Where Humans Fail

Emotional bias (revenge trading, FOMO, panic selling)

Inconsistent discipline

Slower execution

Fatigue in 24/7 markets

In highly volatile environments, emotions become the biggest liability.

Performance in Volatile Markets: Who Has the Edge?

1. Structured Volatility (Trending + Liquidity Present)

Bots often outperform.

Momentum models and breakout algorithms thrive.

2. News-Driven Spikes

Manual traders may win.

Context and interpretation beat pure pattern recognition.

3. Flash Crashes / Liquidity Gaps

Mixed results.

Bots can either capture arbitrage instantly or get liquidated rapidly.

4. Extended Sideways Chop

Both struggle but disciplined humans may preserve capital better.

What Is the Hybrid Model in Trading?

The hybrid model in trading is a combination of AI-driven automation and human decision making.

Instead of choosing between bots or manual trading, traders use both allowing technology to handle speed and data, while humans manage strategy and risk.

How the Hybrid Model Works

1. AI Handles the Heavy Lifting

Scans markets 24/7

Detects patterns and volatility shifts

Generates trade signals

Executes trades instantly

2. Humans Provide Oversight

Adjust strategy during regime changes

Interpret macro events and narratives

Manage portfolio-level risk

Override or pause systems during extreme conditions

The Hybrid Model: The Real Winner

Increasingly, professional traders combine both approaches:

AI for signal generation

Automation for execution

Human oversight for risk control

Institutional desks use algorithms to exploit micro-inefficiencies while portfolio managers oversee macro exposure.

The edge is no longer bot vs human.

It’s bot plus human.

Key comparison between AI trading and Manual trading

1.Speed

AI Bots: Instant

Manual Trading: Slower

2. Emotional Control

AI Bots: Perfect

Manual Trading: Vulnerable

3. Adaptability

AI Bots: Depends on model

Manual Trading: High (if experienced)

4. 24/7 Capability

AI Bots: Yes

Manual Trading: Limited

5. Narrative Awareness

AI Bots: Weak

Manual Trading: Strong

In conclusion, In highly volatile crypto markets, the winner often depends on the type of movement unfolding. During short-term, high-frequency chaos, AI-driven bots typically have the advantage thanks to their speed and precision. But when markets shift due to powerful narratives or macro regime changes, experienced human traders tend to perform better because they can interpret context and adapt quickly.

Over the long run, however, neither speed nor intuition guarantees success disciplined risk management does. The real edge isn’t about ego or raw intelligence; it’s about structure and consistency. Markets don’t consistently reward who is smartest they reward who manages risk best. And in volatile conditions, the trader who controls downside exposure whether human or algorithm is the one who ultimately survives and wins.