I remember the first time I tried to trade during a fast market on-chain. Price was moving, my wallet confirmed the transaction, and then I just sat there watching the spinner. By the time it settled, the entry I thought I had was gone. That quiet gap between intention and execution is where a lot of traders lose money, and it’s exactly the gap Fogo is trying to shrink.

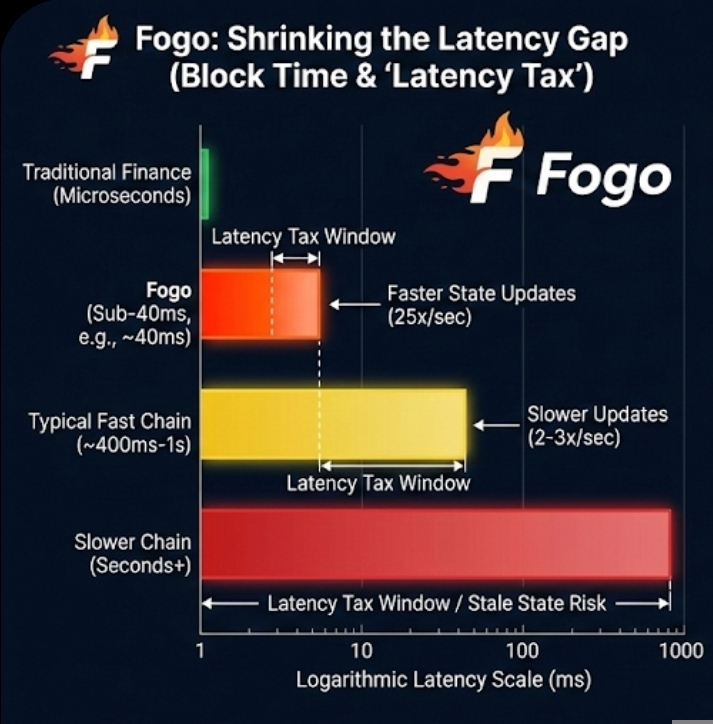

When I first looked at Fogo, what struck me wasn’t branding or ecosystem noise. It was latency. Fogo is targeting block times measured in tens of milliseconds, often cited around the sub-40ms range. That number by itself doesn’t mean much until you compare it. A 400ms block time means almost half a second between state updates. Forty milliseconds is one tenth of that. In trading terms, that’s the difference between reacting inside the move and reacting after it.

On the surface, faster blocks mean transactions confirm quicker. Underneath, it changes how price discovery works. If the chain updates state 25 times per second instead of two or three, arbitrage cycles compress. Liquidity providers can adjust quotes more frequently. Traders see a market that feels less stale. That texture matters because stale state is where slippage hides.

Fogo’s architecture builds on the Firedancer client, originally designed for high-performance validation. Translated into plain terms, it focuses on pushing more transactions through the system with less delay between validators agreeing on the next block. Consensus is still there, but it’s tuned for speed. If blocks finalize in under a second, and propagate in tens of milliseconds, the window for front-running shrinks.

Right now, on many chains, that window can be hundreds of milliseconds or more. That’s enough time for sophisticated bots to detect a large order in the mempool and insert their own transactions ahead of it. This is the so-called latency tax. You don’t see it on your trade ticket, but you feel it in the fill price. If Fogo consistently keeps block propagation tight, that window narrows. Not eliminated, but reduced.

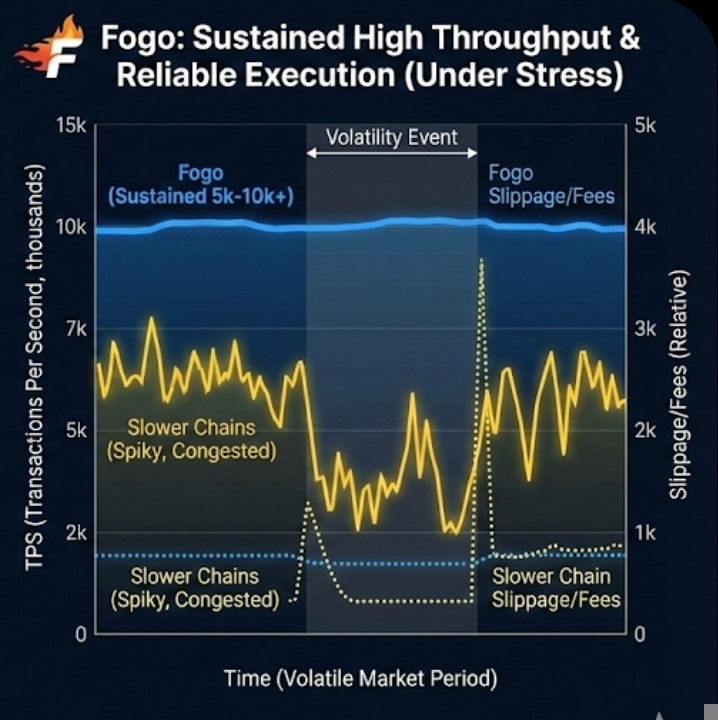

That momentum creates another effect. Order book style trading on-chain becomes more realistic. Most decentralized exchanges rely on automated market makers because slower chains can’t handle high-frequency order updates. But if a network can process thousands of transactions per second and confirm them quickly, central limit order books start to make sense again. Early performance discussions around Fogo suggest throughput in the tens of thousands of transactions per second under optimized conditions. Even if real-world sustained numbers are lower, say 5,000 to 10,000 TPS, that’s still enough to support dense on-chain activity.

And numbers only matter if they hold under stress. During volatile markets this year, Bitcoin has seen intraday swings of 5 to 8 percent within hours. In those windows, transaction demand spikes. Gas fees rise on slower chains, blocks fill up, and confirmation times stretch. If Fogo maintains low latency during congestion, that reveals something important. It means its design is not just fast in a lab, but steady under pressure.

Meanwhile, institutional traders are watching on-chain markets more closely. ETF inflows in 2024 and 2025 pushed Bitcoin daily volumes into the tens of billions of dollars on peak days. If even a fraction of that activity moves on-chain, infrastructure has to feel familiar to those participants. Sub-second confirmations start to resemble centralized exchange execution. That familiarity lowers psychological barriers.

Understanding that helps explain why low latency isn’t just a speed race. It’s about matching the cadence of modern markets. High frequency firms operate on microseconds in traditional finance. Crypto won’t reach that on a public chain anytime soon, but compressing from 500ms to 40ms is a meaningful step. It changes how strategies are designed. It makes on-chain arbitrage, perps, and even structured products more viable without relying entirely on centralized venues.

There’s another layer underneath. Faster consensus often requires tighter coordination between validators and potentially higher hardware requirements. That raises a fair concern. If only well-resourced operators can run nodes effectively, decentralization can thin out. A network with 1,000 validators that struggle to keep up may be less secure than a network with 200 that operate efficiently, but the tradeoff remains real. If Fogo leans heavily toward performance, it has to prove that validator participation remains broad and economically accessible.

Then there’s the question of MEV. Even with low latency, sophisticated actors adapt. If blocks are produced every 40ms, searchers will optimize for 40ms. The advantage shifts but doesn’t disappear. However, a shorter cycle means less time for complex extraction strategies to propagate across the network. That might reduce the size of extractable value per block, which in turn changes incentives.

What I find interesting is how this fits into the current market mood. Over the past year, narratives have cooled slightly. Traders are less impressed by slogans and more focused on metrics. Smart contract usage, daily active addresses, sustained volume. If Fogo can show consistent daily transaction counts in the hundreds of thousands, and not just one-day spikes, that builds credibility. A chain handling 800,000 transactions per day with average confirmation under a second tells a different story than one that peaks at 2 million during an airdrop and then drops to 50,000.

That steady usage becomes the foundation. It attracts builders who need predictable performance. DeFi protocols that require rapid liquidations, options platforms that depend on timely pricing, even gaming applications where latency directly affects user experience. The surface benefit is speed. Underneath, it’s about reliability.

Of course, the obvious counterargument is that traders are already comfortable on centralized exchanges. Binance processes massive volumes with near-instant matching. Why move on-chain at all? The answer isn’t that on-chain replaces centralized venues tomorrow. It’s that the boundary is getting thinner. If on-chain execution begins to feel comparable in speed, but retains self-custody and transparent settlement, the value proposition strengthens.

And that connects to a broader pattern I keep noticing. The industry is shifting from building chains that can theoretically do everything to chains that are tuned for specific workloads. Some focus on data availability. Some on privacy. Fogo seems focused on execution speed as its core identity. That specialization feels earned rather than decorative.

If this holds, we may see a future where traders choose chains the way they choose exchanges today. Not by marketing claims, but by measurable latency, average slippage, and uptime during volatility. Low latency becomes a competitive metric, like fee tiers or liquidity depth.

It remains to be seen whether Fogo can sustain its performance as adoption scales. Early signs suggest the architecture is serious about that goal. But performance claims need months of real-world trading to feel earned.

Still, the direction is clear. On-chain trading is no longer content with being slower but more transparent. It is quietly chasing parity with centralized speed. And if Fogo keeps compressing that gap, the quiet space between clicking buy and actually owning the asset may finally start to disappear.