Comprehensive Analysis of Fogo ($FOGO): The New Frontier of Institutional L1s

As of mid-February 2026, Fogo ($FOGO) has solidified its position as a "specialist" Layer 1 blockchain. While the general crypto market remains fixated on Ethereum’s L2 scaling and Solana’s retail dominance, Fogo has carved out a distinct niche: Institutional-Grade High-Frequency Trading (HFT).

1. Technical Underpinnings: The Speed of Light

Fogo is not a general-purpose chain in the traditional sense; it is a vertically integrated stack built for speed. Its architecture is based on the Solana Virtual Machine (SVM) but utilizes the Firedancer client to achieve sub-40ms block finality.

Enshrined Liquidity: Unlike other chains where liquidity is fragmented across multiple decentralized exchanges (DEXs), Fogo features an "enshrined" central limit order book (CLOB) built directly into the protocol. This ensures that every trade, regardless of the front-end used, taps into a single, massive pool of liquidity.

Multi-Local Consensus: To solve the "speed of light" problem, Fogo validators are organized into regional clusters. This allows trades to be sequenced locally before global finalization, providing a "local-first" experience for traders in London, New York, and Tokyo.

2. Market Performance & Price Action (February 2026)

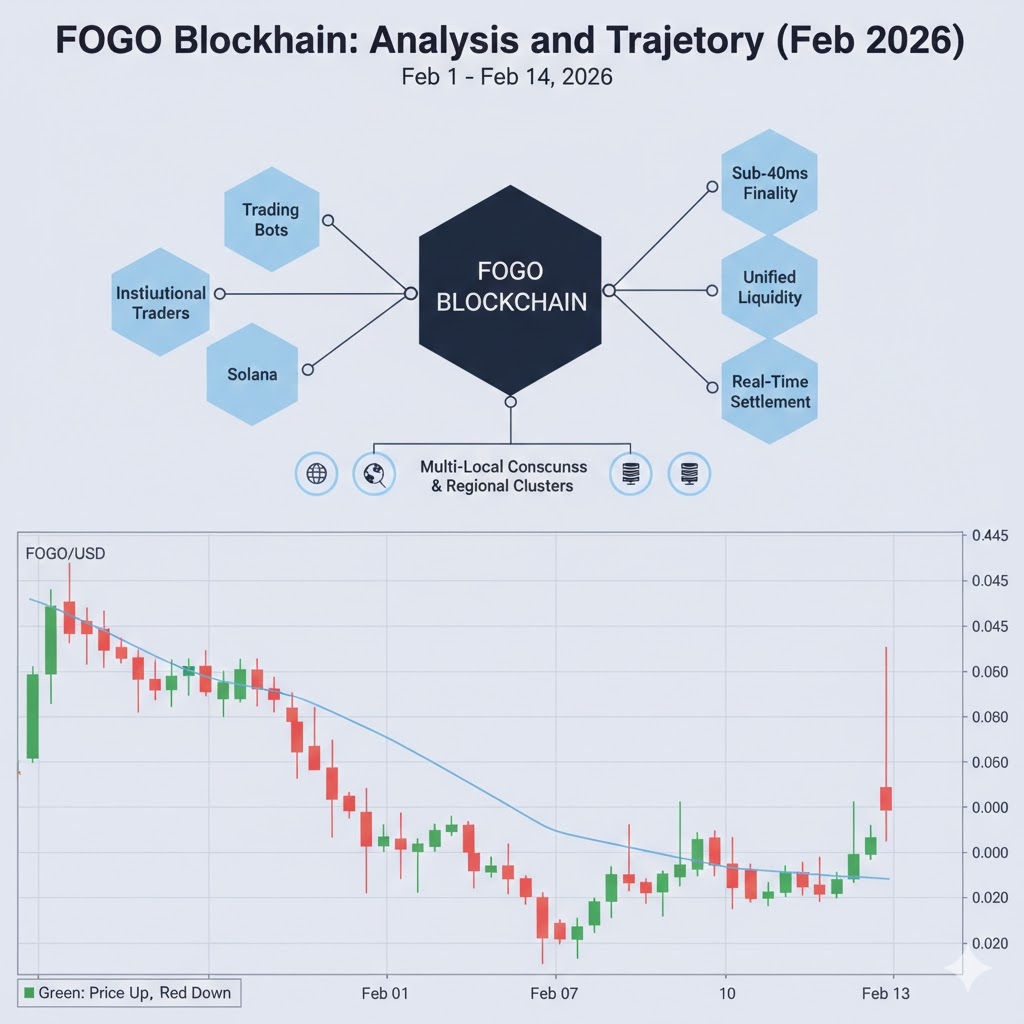

The following candlestick chart tracks FOGO’s price discovery phase during the first half of February 2026. After the initial post-launch hype, we are seeing the classic "stabilization" pattern.

Chart Breakdown:

The Early February Slump: From Feb 1 to Feb 7, the token underwent a heavy correction, dropping from $0.042 to roughly $0.023. This was largely attributed to early private-round seed investors de-risking.

The Stabilization Floor: Since Feb 10, FOGO has consistently found buyers at the $0.020 - $0.021 range. This indicates a "value floor" where institutional buyers are likely accumulating.

Volume Profile: Despite the price decline, trading volume has remained high ($25M+ daily), suggesting that the network is actively being used for its intended purpose rather than just being held as a speculative asset.

3. Ecosystem Dynamics: The Institutional Push

Fogo's value proposition isn't just speed—it’s the people behind it. Founded by former high-frequency traders from Citadel Securities and Jump Trading, the project has successfully onboarded several major liquidity providers.

Valiant DEX: Currently the largest protocol on Fogo, Valiant accounts for 60% of the network’s Total Value Locked (TVL). It offers perpetual futures with 50x leverage and near-zero slippage.

RWA Integration: Fogo has announced a pilot program to tokenize US Treasury Bills directly on-chain. Because the chain is fast enough to handle the settlement speeds required by traditional finance, it is a prime candidate for the multi-trillion-dollar Real World Asset (RWA) market.

4. Tokenomics: The September Cliff

The $FOGO token serves two primary purposes: gas for transactions and staking for network security. However, investors must be aware of the supply schedule.

Current Circulation: 3.77 Billion FOGO.

The "September Event": A significant unlock of 1.5 billion tokens (15% of total supply) is scheduled for September 2026. Historical data suggests that such unlocks often lead to short-term price volatility. Smart money will likely look to exit before this date or re-enter once the supply has been absorbed by the market.

essing: Fogo employs mechanisms like "gas-free sessions" for certain operations and highly parallelized transaction processing to minimize friction and maximize throughput. These features are designed to handle the massive transaction volume

6. Future Outlook: Risk vs. Reward

Fogo is a high-conviction bet on the professionalization of crypto.

The Bull Case: If Fogo becomes the "Nasdaq of Web3" and successfully migrates even 1% of the institutional HFT volume from centralized exchanges, the $0.02 price point will look like a historical anomaly. The potential for a 10x - 20x return in the next bull cycle is real, given its small market cap.

The Bear Case: Specialized L1s are notoriously difficult to maintain. If Fogo fails to attract a diverse developer ecosystem and remains only a playground for a few HFT firms, it may suffer from a lack of "retail soul," leading to eventual stagnation.

Final Verdict

Fogo is currently in its "accumulation" phase. The technical superiority is proven, but the network effect is still being built. For investors, the current support level at $0.020 represents a high-risk, high-reward entry point before the next major ecosystem announcement.