My strategy for navigating this "risk-off" environment:

In the current "Extreme Fear" phase of February 2026, the crypto market is characterized by high sensitivity to geopolitical tension and a distinct "risk-off" mood. Managing volatility now requires a shift from aggressive growth to capital preservation through disciplined position sizing and strict technical boundaries.

1. Managing Volatility through Position Sizing

The primary goal in a volatile market is survival; avoiding a "total wipeout" is more critical than catching the bottom.

The 1-2% Rule: Many experts recommend risking no more than 1% to 2% of your total trading capital on any single trade. This means if you have a $10,000 account, your maximum loss on a single trade should not exceed $100–$200.

The 3-5-7 Strategy: For more structured exposure, some traders use this rule:

3%: Maximum risk on a single trade.

5%: Maximum total exposure across all open trades.

7%: Minimum profit target for winning trades to maintain a healthy risk-reward ratio.

Volatility-Based Sizing: Adjust your position size based on the asset's current Average True Range (ATR). When volatility is high, shrink your position size to keep your dollar risk constant despite wider price swings.

2. Avoiding High Leverage

High leverage is the leading cause of "liquidation cascades," where forced selling during a dip pushes prices even lower.

Liquidation Risk: At 100x leverage, a mere 1% price move against you wipes out your entire capital. Even at 10x leverage, a 10% move results in total loss.

Emotional Stress: High stakes often lead to panic-driven decisions, which are compounded by the 24/7 nature of the crypto market.

Safe Alternatives: For those seeking extra exposure, conservative leverage of 2x or 3x provides more breathing room while still enhancing returns.

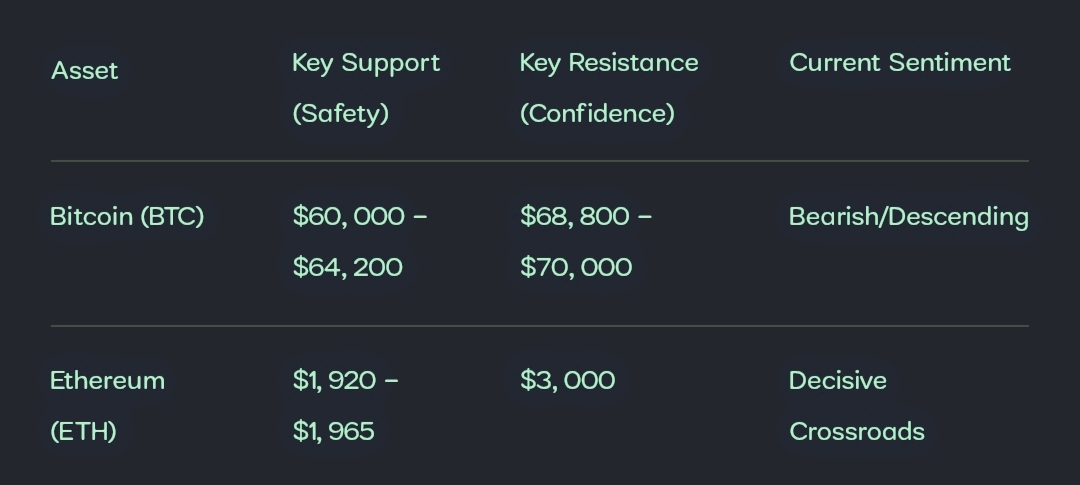

3. Key Technical Levels for February 2026

Technical charts for today, February 18, 2026, show both major assets trading within descending channels.

Bitcoin Strategy: BTC is currently struggling to maintain its footing near $67,500. A drop below the $60,000–$64,000 support zone could trigger a deeper pullback toward $50,000.

Ethereum Strategy: ETH is at a "decisive crossroads." While it is trading near $2,000, a reclaim of the $3,000 psychological barrier is required to signal a return of broad market confidence.