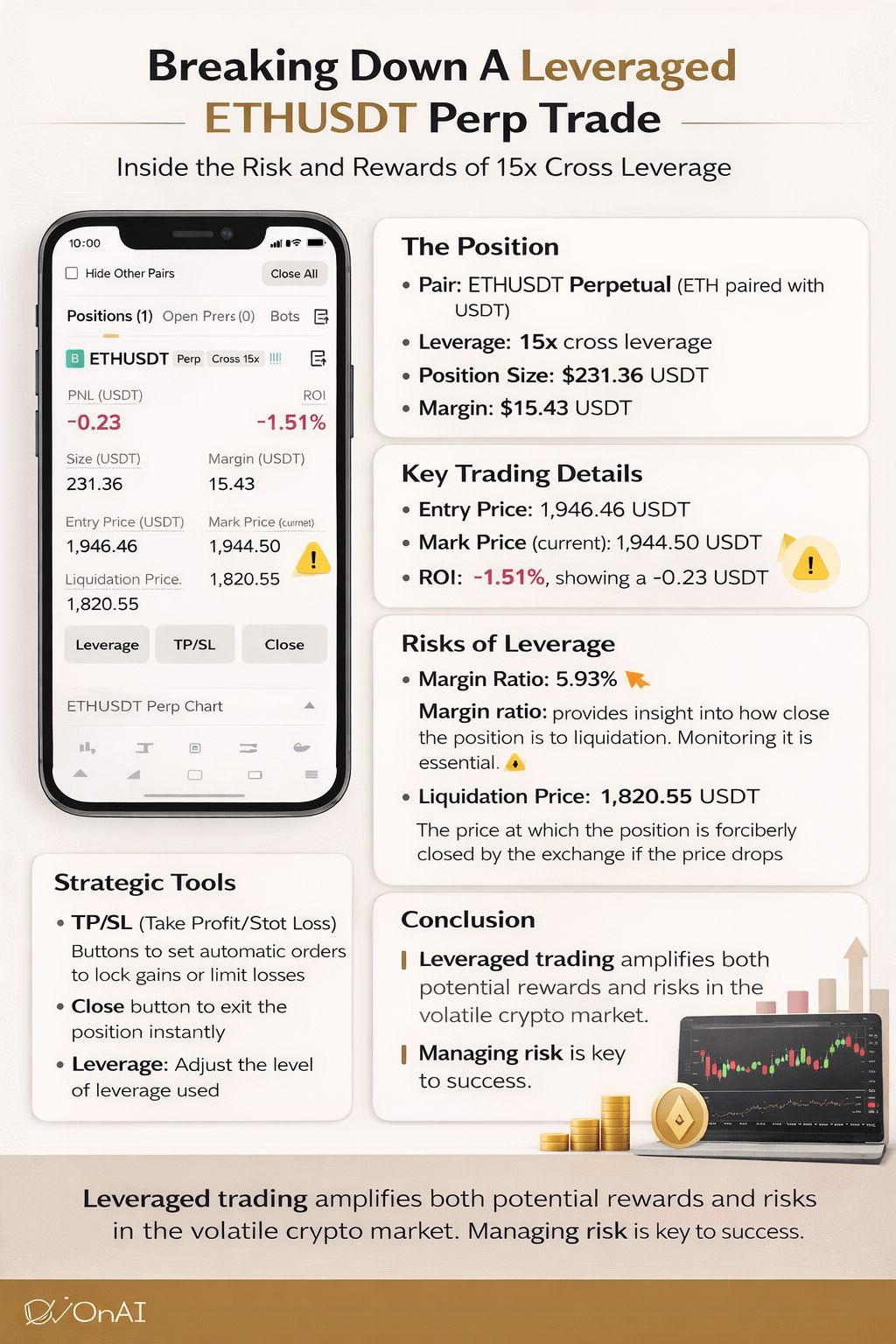

The entry price is listed at 1,946.46 USDT, while the current mark price stands at 1,944.50 USDT. The difference between these two prices explains the small unrealized loss shown on the screen. The PNL (Profit and Loss) is currently -0.23 USDT, with an ROI of -1.51%. Although this loss appears minor, it demonstrates how even slight market movements can impact leveraged trades.

One important detail in the screenshot is the liquidation price, which is shown at 1,820.55 USDT. This is the critical level where the exchange would automatically close the position to prevent further losses beyond the trader’s margin. Liquidation is one of the biggest risks in futures trading, especially when using higher leverage. The distance between the entry price and liquidation price shows that there is still room before the position is at serious risk, but volatility in crypto markets can change conditions quickly.

The margin ratio, displayed at 5.93%, provides insight into how close the position is to liquidation. A lower margin ratio generally indicates a safer buffer, while a rising margin ratio signals increasing risk. Monitoring this metric is essential for risk management.

This image also highlights the strategic tools available to traders. Buttons like “Leverage,” “TP/SL” (Take Profit/Stop Loss), and “Close” allow traders to adjust their risk exposure instantly. Setting a Stop Loss can limit downside risk, while a Take Profit order can automatically secure gains when the market moves favorably. These tools are vital for disciplined trading, especially in volatile markets like Ethereum futures.

Overall, this screenshot tells a larger story about modern crypto trading. It reflects how accessible futures trading has become, allowing individuals to participate in complex financial instruments directly from a mobile device. At the same time, it serves as a reminder that leveraged trading demands careful planning, emotional control, and strict risk management.

In conclusion, while the current loss of -0.23 USDT may seem insignificant, it represents the dynamic nature of cryptocurrency markets. Every tick in price affects leveraged positions instantly. Success in such an environment depends not only on predicting price direction but also on managing risk wisely. This image is more than just numbers on a screen—it is a snapshot of strategy, opportunity, and responsibility in the world of crypto futures trading.

$ETH #ETH #ETHUSDT #ETHTraders