🔍 What’s Going On Now

The global crypto market cap is around $4.03–4.07 trillion, showing modest shifts day-to-day.

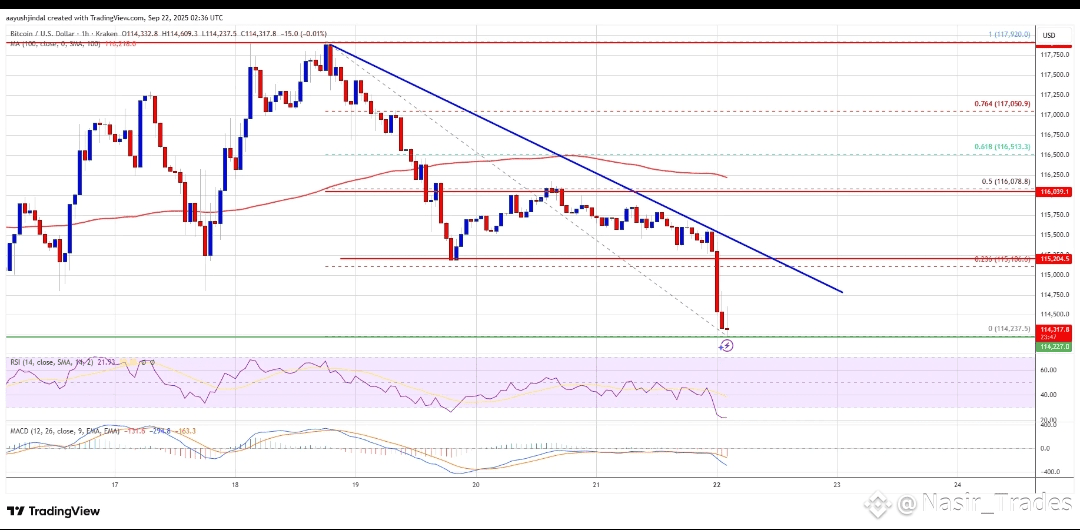

Bitcoin (BTC) is hovering between $115,000–116,000 in intraday trading.

BNB (Binance Coin) has shown strong momentum lately. Forecasts point toward positive gains in the near term (weeks to a month) and possibly more significant upside over the next few months.

📈 What’s Likely to Happen in the Next Days/Weeks

Scenario Drivers Possible Outcomes

Continued BNB Upside Strong investor interest, positive technicals (moving averages, resistance/support zones), and favorable market sentiment. BNB might test resistance in the $1,100–$1,200 range. If broken, could accelerate to higher levels. If resistance holds, a pullback might take it near $1,000 or slightly below.

BTC Range-bound Before Breakout Consolidation around $115K, while broader market sentiment watches external factors like macroeconomic news, regulation, rate cuts. Could oscillate in the $110,000–$120,000 range. If a positive catalyst (e.g. favorable regulation or institutional influx) hits — possibility to break above $120,000. On the downside, risk of slipping toward $100,000 if sentiment sours.

Altcoins Catching Fire When BTC stabilizes, often money flows into altcoins, especially those with recent positive news or upgrades. Also, if staking/loan/yield tools or listings get triggered — alt season vibes may increase. Select altcoins could see sharp gains. Expect volatility: big winners & losers. Altcoins tied to projects with strong fundamentals likely to outperform.

⚠️ What Could Go Wrong

Macroeconomic shocks (interest rate surprises, regulation crackdowns) could trigger downside across the board.

Overbought signals — if some assets run too fast, a correction is possible.

Liquidity crunches or bad news (security, policy) can trigger rapid sell-offs.

🔮 My Prediction: What to Watch For

BNB has a good chance to grow 5–15% over the next few weeks if resistance is successfully breached.

Bitcoin will likely remain in a range-bound mode unless triggered upward by institutional buying or regulatory clarity.

A few altcoins will likely outshine, especially those with fresh listings, strong development activity, or utility stories — keep your eye on them.