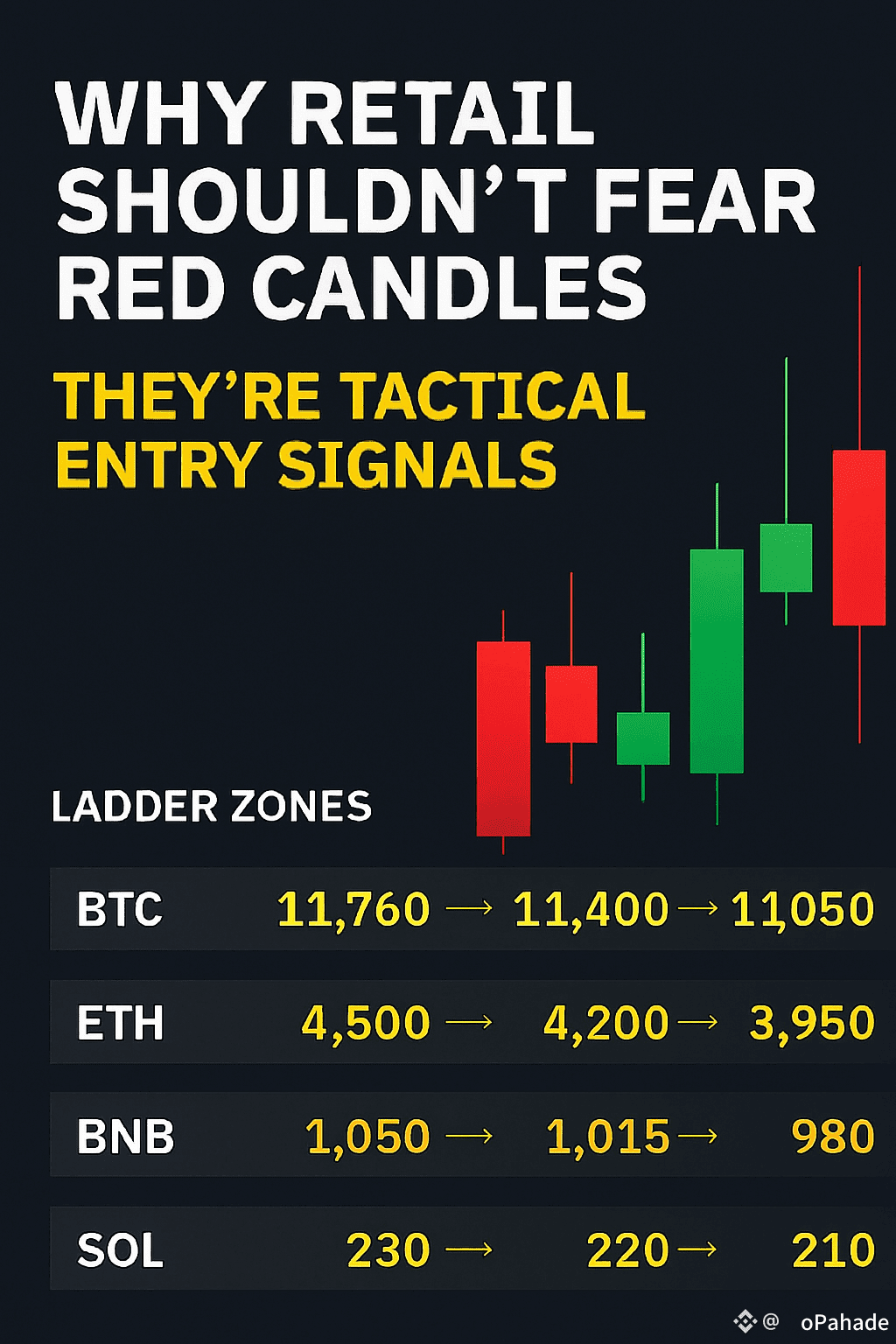

Crypto charts are bleeding. Red candles everywhere. Retail panic sets in. But here’s the truth: red isn’t danger—it’s opportunity. If you’re laddering with conviction, this is exactly when you lean in.

Most traders see red and assume something’s broken. But red candles often mean weak hands are exiting, sentiment is turning fearful, and funding rates are flipping negative. That’s not collapse—it’s a setup.

Laddering flips the script. You’ve already defined your price zones. You’ve split your capital into tranches. You’ve reserved USDT buffers for deeper flushes or rotation pivots. Now, when BTC hits $11,400 or ETH drops to $4,200 with negative funding and flushed sentiment—you deploy. Calmly. Strategically.

Here’s how conviction looks:

- BTC: $11,760 → $11,400 → $11,050

- ETH: $4,500 → $4,200 → $3,950

- BNB: $1,050 → $1,015 → $980

- SOL: $230 → $220 → $210

These aren’t predictions. They’re pre-approved zones. You don’t chase. You wait. And when the market delivers fear—you act.

“If you fear red, you’ll miss green.

Flushes are where conviction is built—not broken.”

Red candles don’t hurt you. Emotional entries do. Laddering protects you from both.

*Disclaimer: This is not financial advice. All data must be verified before acting. Laddering logic should be adapted to personal risk tolerance and market conditions.