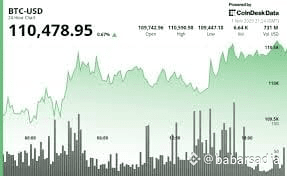

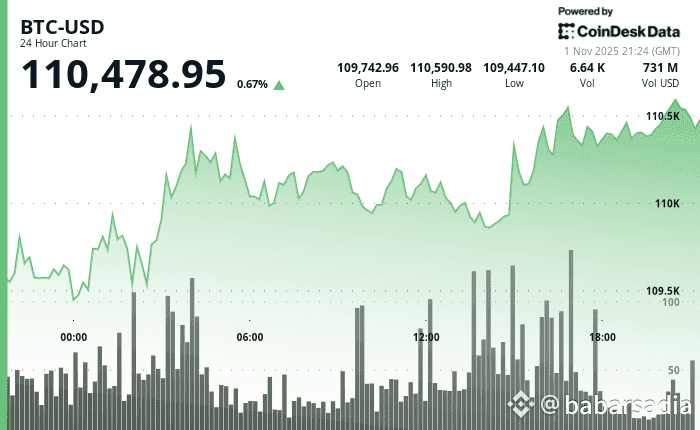

Stock market information for Bitcoin (BTC)

Bitcoin is a crypto in the CRYPTO market.

The price is 96262.0 USD currently with a change of -698.00 USD (-0.01%) from the previous close.

The intraday high is 97236.0 USD and the intraday low is 94137.0 USD.

Here’s a short, up-to-date analysis of Bitcoin (BTC) as of mid-November 2025:

🔍 Key Themes & Drivers

Institutional Demand Remains Strong

Spot Bitcoin ETFs continue to be major buy-side drivers. (AInvest)

Corporates are also holding BTC on their balance sheets, further tightening circulating supply. (AInvest)

Macro Tailwinds — But Risks Persist

Recent cuts in U.S. interest rates have reduced the opportunity cost of holding Bitcoin, benefiting non-yielding assets. (AInvest)

Geopolitical uncertainty (e.g., trade tensions) is providing a rationale for Bitcoin as a hedge. (AInvest)

On the flip side, a hawkish or volatile Fed or a U.S. government shutdown could spook markets. (The Currency analytics)

Scarcity & On-Chain Dynamics

Bitcoin’s fixed supply and reduced issuance (post-halving) are structural supports. (seoskil.com)

Some on-chain data suggest re-accumulation by long-term holders around current price levels. (Reddit)

Seasonality — November’s Mixed Record

Historically, November has been a volatile month for BTC: while the average return is very high, the median return is much more modest.

Analysts warn not to lean on “Moonvember” narratives too heavily — seasonality can help contextualize, but it’s not a guarantee.

Possible Upside, But Also a Downside Risk Zone

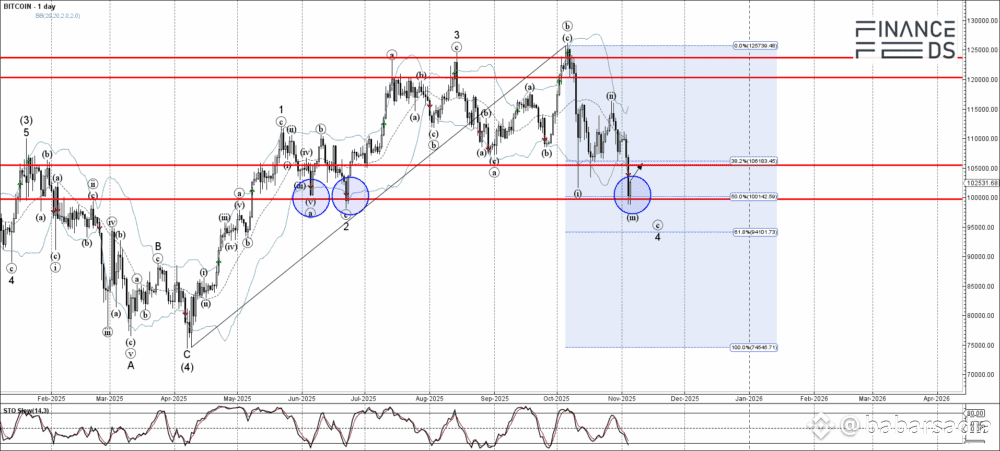

Long-term forecasts from on-chain and institutional models suggest BTC could aim for $140K–$170K in 2025, assuming strong ETF flows and sustained demand. (HubSpot)

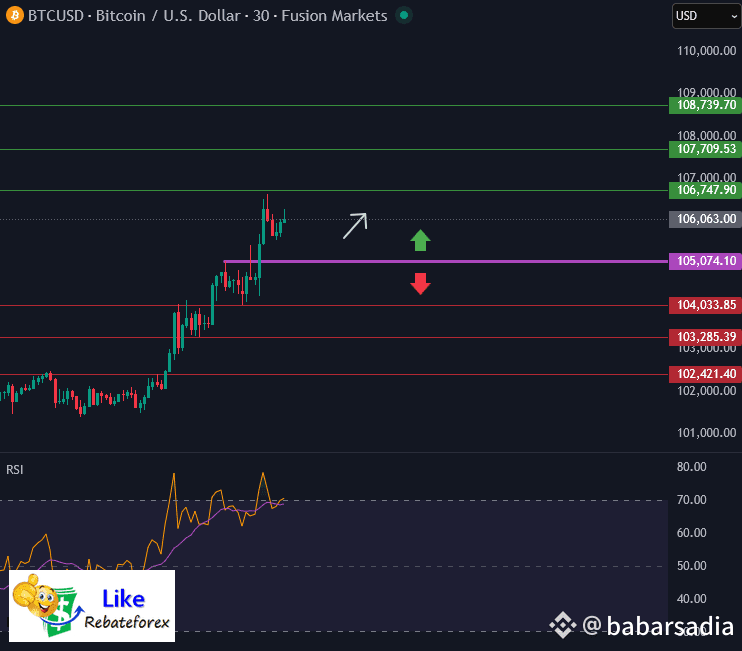

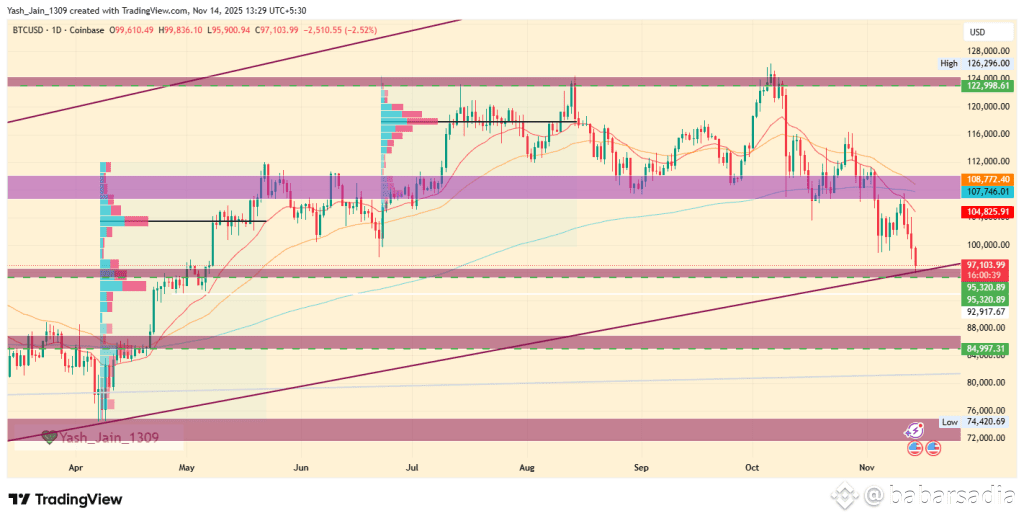

But if support zones (near ~$95K–$100K) break, that could trigger a deeper correction. (goodfinancer.com)

📈 Current Market Sentiment

Short to medium term: Cautious optimism. The institutional bid is real, but macro risks (liquidity, regulation) are not trivial.

Long term: Favorable if institutional adoption continues and BTC maintains its narrative as a macro hedge/scarce asset.

Risk factors to watch: Regulatory slowdown, liquidity shocks, or aggressive profit-taking by large holders.

✅ Bottom Line

Bitcoin’s 2025 rally is not just speculative hype — it’s increasingly underpinned by real institutional demand, macro drivers, and supply-side scarcity. That said, near-term risks remain. If you’re bullish, the long-term case looks compelling; but trading here requires respect for volatility and clear risk management.

If you like, I can run a technical chart analysis (with potential support/resistance zones + scenario playbook) — do you want me to do that?

#MarketPullback #BuiltonSolayer #StablecoinLaw #CFTCCryptoSprint #AmericaAIActionPlan