Ada ceva fascinant atunci când te oprești puțin pentru a privi Lorenzo Protocol: nu este doar un alt proiect „cripto”, ci mai degrabă un pod fin între lumea financiară bine stabilită și visul Web3 mai deschis. Lorenzo nu pare a fi o revoluție a gadgeturilor mici; mai degrabă, este o revoluție a stilului de viață financiar, oferind o modalitate diferită de a gândi despre bani, randament și ce înseamnă „securitate” în ecosistemul economic digital.

În esență, Lorenzo Protocol aduce ceva destul de elegant: un Fond Tranzacționat On-Chain (OTF) care utilizează un stablecoin numit USD1. Dar acesta nu este un yield farming obișnuit. Fondul Lorenzo adună fluxuri de venit din trei surse diferite, active reale (RWA), strategii cuantice în CeFi și protocoale DeFi. Apoi, le combină într-un singur traseu de investiție care poate fi accesat din portofelul tău. Aceste fluxuri nu sunt simple speculații, ci sunt foarte structurale, măsurabile și — ceea ce este cel mai interesant, toate rezultatele sunt soluționate în USD1.

Imagine you deposit at least 50 USD1 (or USDC/USDT depending on support) into the Lorenzo system. Because of that, you mint sUSD1+ - a non-rebase token which means your token balance will not shift, but its internal value rises as the NAV (Net Asset Value) of this fund grows. Each increase in NAV represents real growth from the managed strategy: not just token inflation, but real yield combined from real-world assets and quantitative trading strategies. This feels like giving new life to the concept of “institutional funds”, but this time everyone can access it as long as they are willing to deposit stablecoins.

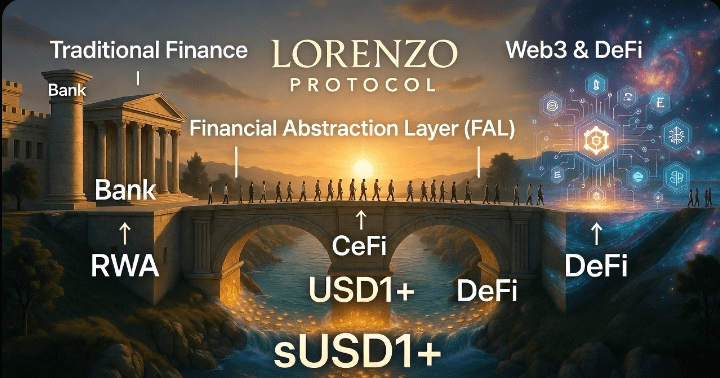

What makes Lorenzo even more interesting is its infrastructural approach, namely the Financial Abstraction Layer (FAL). It’s as if it is a conceptual and technical bridge: a bridge between the traditional world (banks, real assets) and the Web3 world (blockchain, smart contracts). With FAL, Lorenzo is able to bridge the CeFi and DeFi ecosystems, while bringing real-world assets (which were previously only held by large institutions) into the publicly accessible DeFi flow. Such a vision is not just a futuristic idea, Lorenzo has already tested it hard: USD1+ OTF has moved from testnet to mainnet on BNB Chain.

Recent (large update), Lorenzo officially launched USD1+ OTF on the mainnet BNB Chain, with a target APR in the first week of up to 40%. This is an important milestone: not just a trial, but a real implementation on the production network, showing that Lorenzo is willing to execute the vision of institutional yield on a public scale. This product is truly on-chain: from funding, execution of strategies, to withdrawals completed via smart contracts, without fully relying on a closed off-chain system.

However, behind all these ambitions, Lorenzo also faces a regulatory landscape that cannot be ignored. Combining real-world assets means this project must navigate the boundaries of tokenization regulations. Many regulators are still anxious about “speculative” blockchain assets, and the tokenization of real securities is still in the process of careful rule-making. This raises the question: how far can Lorenzo grow without violating legal boundaries or losing its decentralized identity?

From a tokenomics perspective, we also cannot turn a blind eye. The BANK token is at the core of Lorenzo’s governance: BANK holders can earn veBANK, granting voting rights in protocol decisions. Furthermore, the presence of BANK on several exchanges and even listing on Binance Futures shows that this project is not just about on-chain asset management theory, but also has ambitions for liquidity and large market access. But volatility remains a shadow, as it is important to remember that the price of BANK can rise and fall sharply, reflecting both speculative interest and long-term confidence in its utility.

Now, let's take a moment to reflect: what does Lorenzo mean in the big picture of DeFi? To me, Lorenzo is one of the most realistic stories about how the traditional world and the crypto world can unite not just as an idealistic concept, but as a real product that many people can use. It proposes that yield is not just a game of hunting new tokens, but can become a stable, transparent stream of income, and most importantly, colored by assets that have fundamental value.

Of course, the risks are there: regulatory dynamics, operational risks from CeFi strategies, and long-term liquidity challenges. But if Lorenzo can successfully weave all these threads together—RWA, CeFi, DeFi—harmoniously, then this protocol could become the spearhead of the future of digital finance. Institutional finance may no longer be exclusive to large hedge funds; anyone with stablecoins can reap the benefits, without having to be a trading expert or have access to large trading desks.

Finally, the Lorenzo Protocol is not just about yield. It’s about giving new meaning to “ownership” of assets, where stable capital can grow through smart strategies, and where blockchain transparency is used to organize a more equitable and accessible financial system. For anyone dreaming of a Web3 world where stability and innovation can go hand in hand, Lorenzo is one of the most prominent stories to follow.