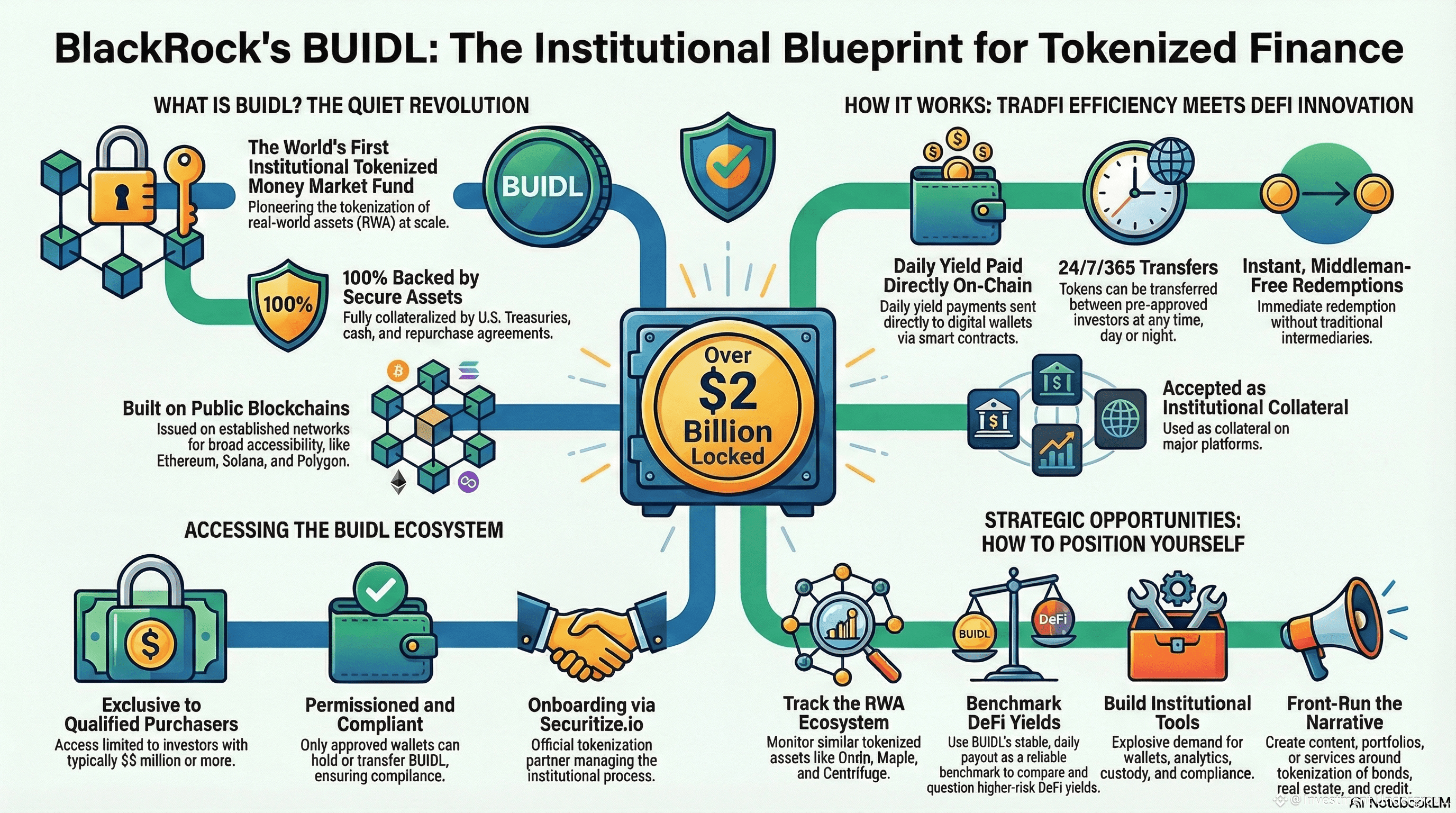

While retail debates DeFi, BlackRock quietly tokenized $2B+ in U.S. Treasuries and pays daily yield on-chain. No ads. No hype. Just execution.

👉🏻FOLLOW INVESTMENT UNDERGROUND!

This is BUIDL — the world’s first tokenized money market fund by the largest asset manager on Earth.

✅ Backed 100% by Treasuries, cash, and repos

✅ Tokenized on Ethereum, Solana, Polygon

✅ Pays yield daily via smart contracts

✅ Transferable 24/7 between approved wallets

✅ Accepted as collateral on Deribit, Crypto.com

This isn’t crypto. It’s TradFi merging with DeFi — with compliance, permissioned access, and institutional-grade infrastructure.

---

🔍 How to Profit (Even If You Can’t Buy BUIDL)

- Track RWA protocols like Ondo, Maple, Centrifuge

- Compare DeFi yields to BUIDL’s payout — if it’s higher, ask why

- Build tools for institutions: custody, analytics, compliance

- Create content around tokenized bonds, real estate, credit

- Use BUIDL as your benchmark for real-world asset tokenization

---

📺 Full breakdown now live on Investment Underground YouTube Channel

💸 Watch, share, rotate early.

BUIDL #BlackRock #RWA #TokenizedFinance #DeFi #BinanceSquare #InvestmentUnderground #YieldOnChain #TradFiMeetsDeFi #Ethereum #Solana #Polygon #Ondo #Maple #Centrifuge #CryptoCollateral #InstitutionalAlpha