With FOGO recently appearing on Binance Alpha and becoming available for spot trading, it’s a good moment to step back and objectively assess what this project is, what problem it’s trying to solve, and whether it deserves attention from the market.

This article is not investment advice, but a structured breakdown of the key elements investors usually evaluate: technology, team, tokenomics, and market positioning.

What Is FOGO and What Problem Does It Solve?

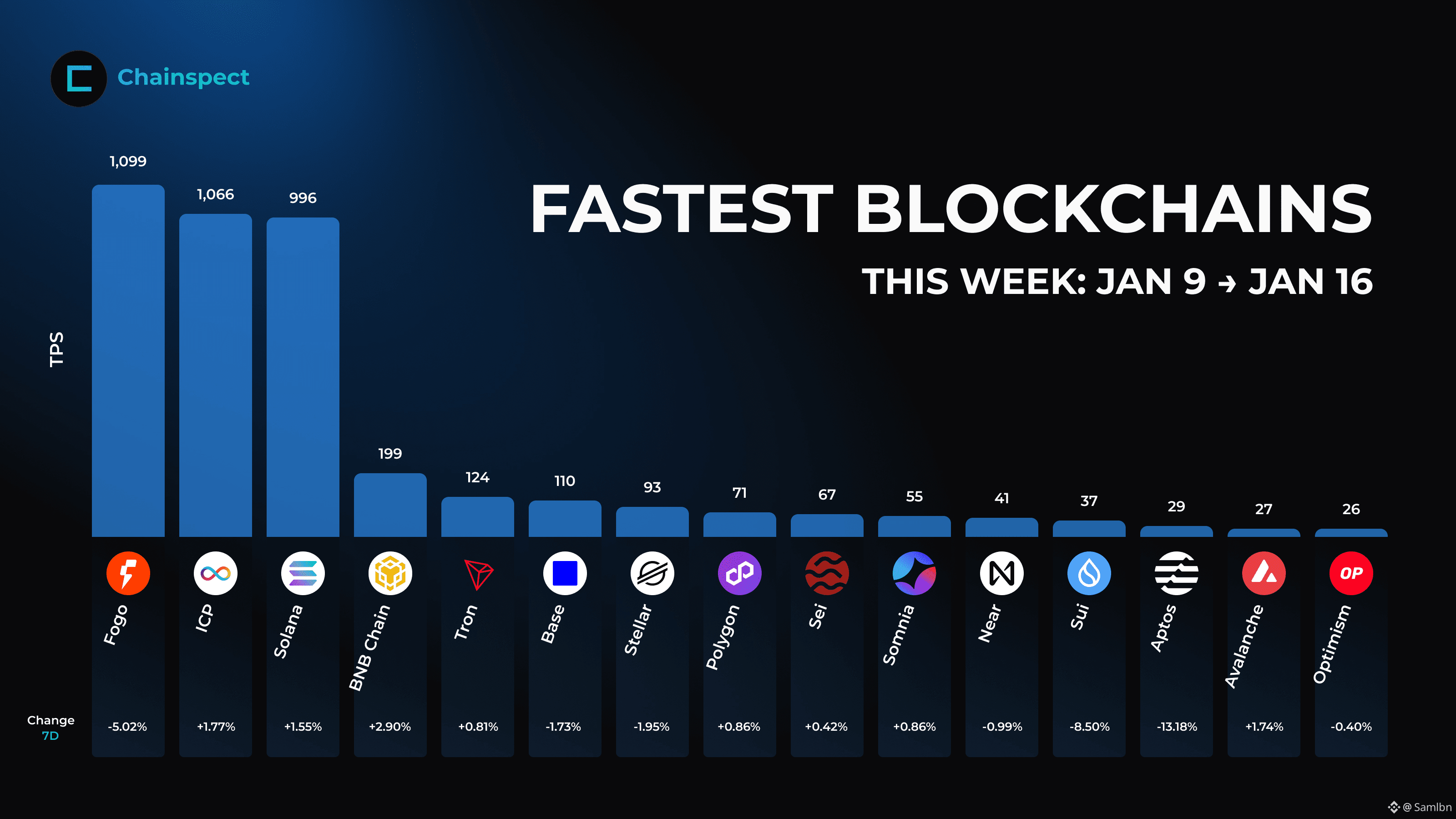

FOGO is a Layer 1 blockchain built on the Solana Virtual Machine (SVM).

Its core focus is performance, specifically reducing latency and improving transaction finality under heavy load.

While many blockchains struggle with congestion during peak activity, FOGO approaches the problem by:

Preserving Solana’s high-throughput execution model

Reorganizing validator participation to reduce network distance

Enforcing high-performance validator standards

In simple terms, FOGO is designed for fast confirmations and high-pressure environments, with trading and DeFi as clear target use cases.

Who Is Behind FOGO?

The credibility of a Layer 1 project often depends heavily on the people building it.

FOGO is backed by a team with strong backgrounds in institutional trading and crypto infrastructure, including:

Robert Sagurton — former executive at Jump Crypto, with experience bridging institutional finance and digital assets

Doug Colkitt — former Citadel quantitative trader, focused on high-performance trading systems and market infrastructure

The broader ecosystem and foundation also include contributors and advisors with experience in global markets and crypto infrastructure.

This positions FOGO as a builder-driven project, rather than a marketing-first initiative.

Tokenomics Overview

From a supply perspective, FOGO has a relatively large headline number, which makes understanding distribution and vesting important.

Key figures:

Total supply: 10 billion FOGO

Circulating supply: approximately 3.7 billion FOGO

A significant portion of the remaining supply is locked, with:

Vesting schedules ranging from 1 to 4 years

Unlocks occurring gradually rather than all at once

This means dilution risk exists over time, but it is spread out, making unlock schedules an important metric to monitor.

FOGO also follows a staking-based economic model, with validator rewards and a long-term inflation rate designed to support network security.

Market Cap Context and Competition

FOGO currently sits in the mid-cap range, well below established Layer 1 networks such as:

While it operates in the same high-performance category, its valuation is still significantly smaller, which reflects both:

Earlier market positioning

Higher execution risk

Competition in this segment is intense, and long-term success will depend less on raw performance claims and more on real adoption, liquidity, and developer activity.

What to Watch Going Forward

Rather than focusing on short-term price movements, a more useful framework for evaluating FOGO includes:

Adoption: Are real users and applications choosing the network?

Ecosystem growth: Is trading volume and DeFi activity increasing?

Token unlocks: How does the market absorb future supply releases?

Validator decentralization: Does performance come at the cost of excessive centralization?

Final Thoughts

FOGO presents an interesting approach: a Solana-compatible Layer 1 optimized for speed and trading performance, built by a team with deep experience in financial infrastructure.

It is a project that deserves monitoring, especially for those interested in high-performance blockchains — but like all Layer 1s, its future will ultimately be decided by adoption and execution, not specifications alone.

This article is for educational purposes only and does not constitute investment advice.