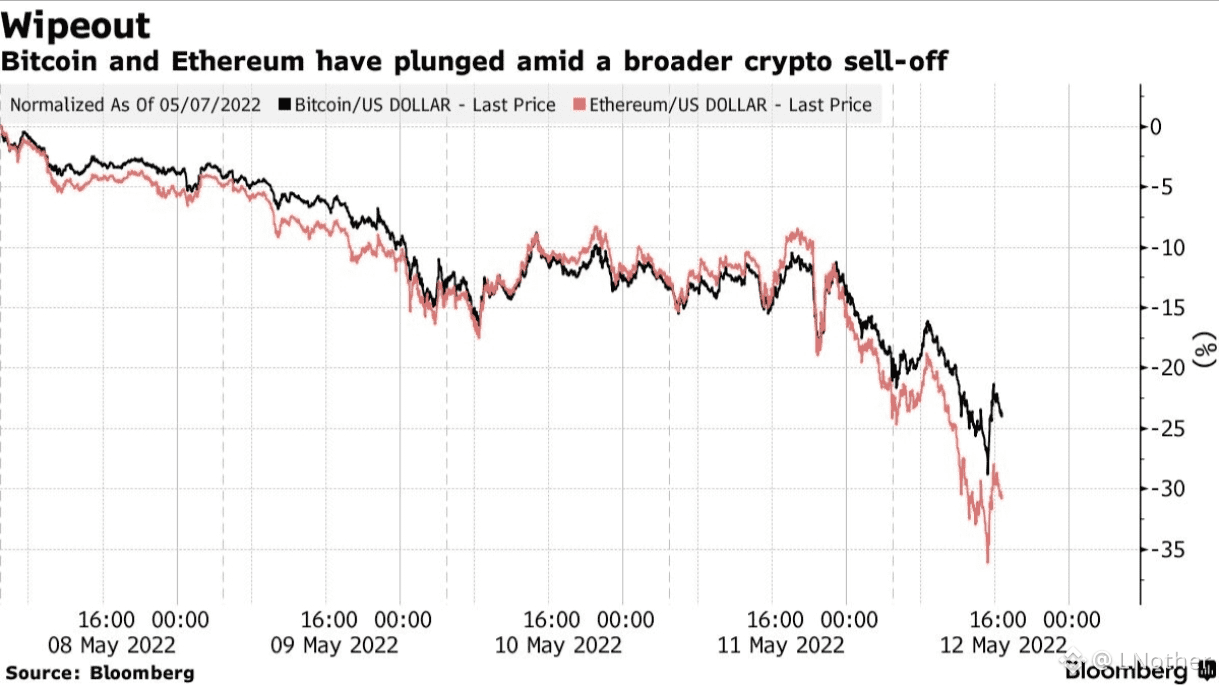

Bitcoin (BTC) saw a sharp drop today, triggering fear across the crypto market. The selling pressure was fast and broad, signaling more than a routine technical pullback. Below is a clear breakdown of the key news and factors that pushed investors away from risk assets like crypto.

1) Global Risk-Off Sentiment Strengthens

Global markets have shifted into risk-off mode—investors are reducing exposure to risk assets (stocks, crypto) and moving toward safe havens such as gold and bonds. The main drivers are geopolitical tensions and uncertainty around global economic policy. In this environment, Bitcoin often comes under pressure as it’s still viewed as a high-risk asset.

2) Policy Threats & Economic Rhetoric

Hawkish statements around trade policy/tariffs and the direction of monetary policy have intensified market anxiety. When tighter liquidity becomes more likely, speculative capital that usually flows into crypto tends to pull back—adding pressure to BTC prices.

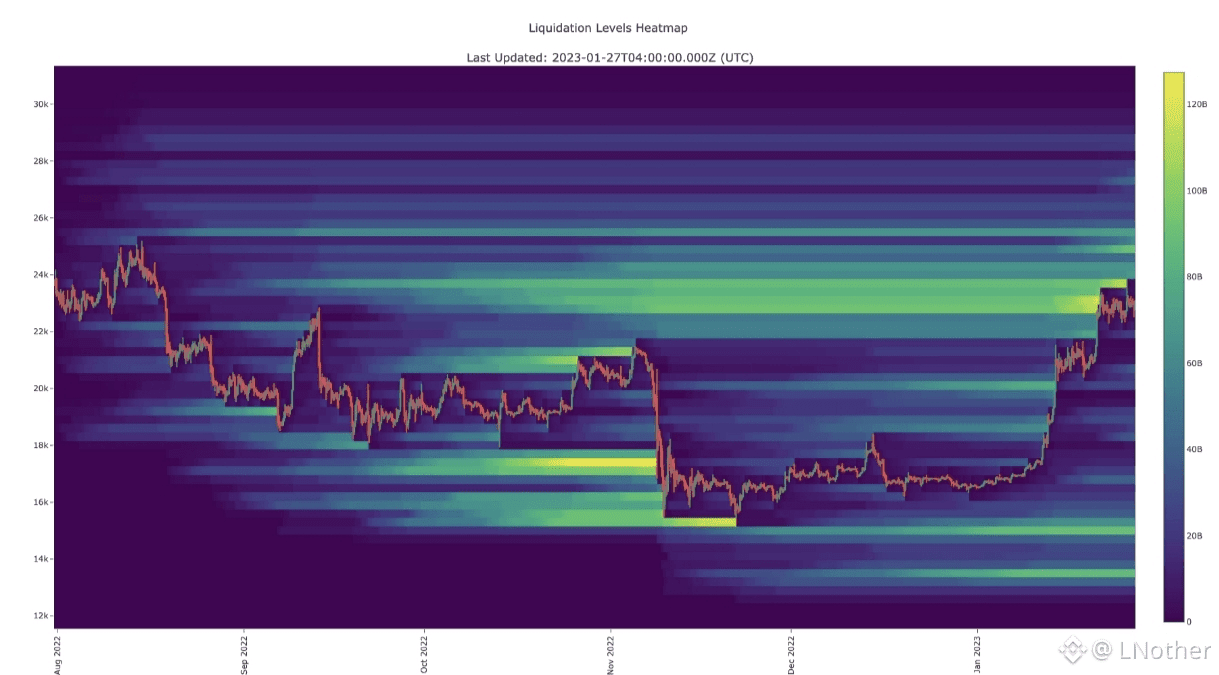

3) Large-Scale Leverage Liquidations

The initial decline triggered forced liquidations in leveraged positions (margin/futures). Once price broke key technical levels, exchanges automatically closed over-leveraged trades. This domino effect accelerated the sell-off, producing long red candles in a short time.

4) Broad Selling Across the Crypto Market

This wasn’t limited to BTC—major altcoins also dropped. The decline in total crypto market capitalization indicates broad-based selling rather than a single-asset issue. Such conditions typically worsen sentiment and suppress short-term buying interest.

5) Psychology: Fear & Profit Taking

After a prior rally, many participants engaged in profit taking. As prices started to fall alongside negative headlines, fear took over—prompting reactive selling and amplifying the move.

Conclusion

Today’s Bitcoin drop is the result of a combination of macro and geopolitical concerns, policy rhetoric, leverage liquidations, and a shift to risk-off sentiment. Short-term volatility remains elevated. Markets usually wait for global sentiment to stabilize and for technical confirmation before a healthier rebound.

Note: Traders should prioritize risk management and key technical levels. Long-term investors often view volatility like this as part of the cycle—always align decisions with your risk profile.

BTC67,851.98+1.88%

BTC67,851.98+1.88%