In blockchain design you often face a fundamental choice. You can structure data like unspent coins or you can structure it like account balances. Each path has clear trade-offs. The UTXO model offers strong privacy and parallel processing. The account model simplifies smart contract development and interoperability. Most networks pick one. Watching DUSK's approach to its Hedger component reveals a different intent. They are attempting a synthesis. This hybrid model is not an academic exercise. It is a practical response to a specific problem. The problem is composability within a regulated financial environment.

Think about a traditional asset transaction. A bond trade for instance involves multiple steps. There is the order placement the matching the settlement and the custody update. In a pure UTXO system each of these steps could be a distinct transaction output. This creates a natural audit trail and privacy through seclusion. But programming complex logic that interacts across many UTXOs can become cumbersome. It is like having singular puzzle pieces that are hard to assemble dynamically. A pure account model makes that assembly easier. Everything is in one stateful place. Yet that consolidation can reduce privacy and create bottlenecks. All activity centers on a single public account state.

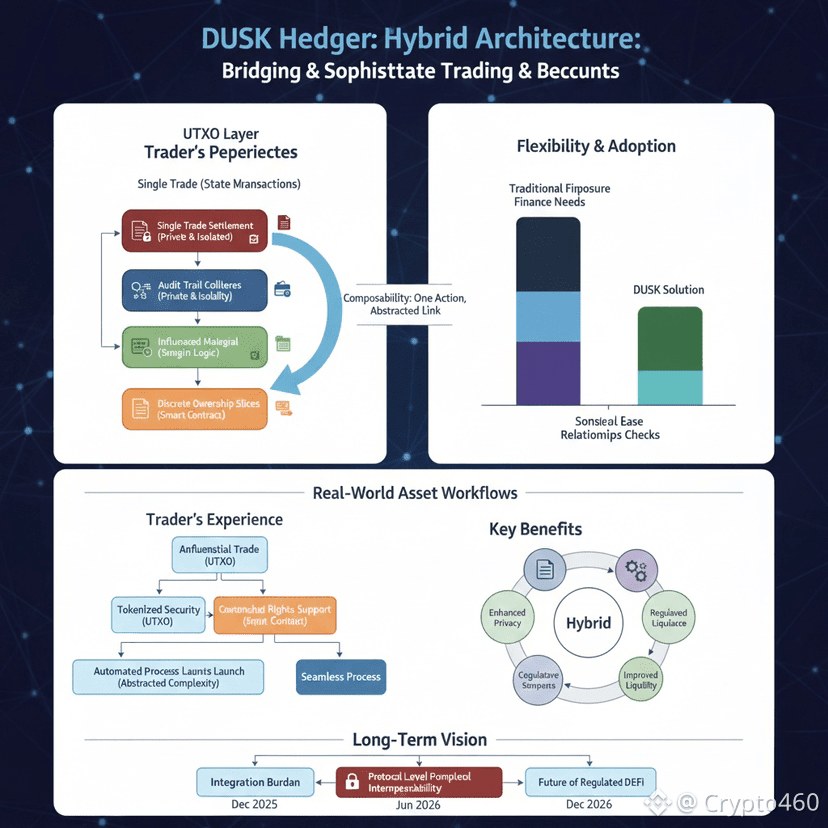

The Hedger exists to facilitate confidential trading. It is the counterparty for DUSK's obscured order books. Its job requires handling many discrete transactions simultaneously while also managing ongoing relationships and positions. This is where the hybrid idea shows its logic. The system can treat a single trade settlement as a confidential UTXO. That transaction is isolated and private. Yet the Hedger itself can maintain an internal account-based state. This state tracks overall exposure or user margins across many trades. The composability emerges from letting these two models talk to each other. The UTXO layer handles the finality of discrete events. The account layer manages the continuous state.

This architecture suggests a focus on real world asset workflows. A tokenized security is not just a token. It represents a chain of ownership rights dividend payments and compliance checks. A UTXO can perfectly represent a specific ownership slice at a moment in time. Its history is self-contained. An account model might better handle the recurring dividend payment logic applied to all holders. The Hedger's design seems to acknowledge that both representations are necessary. The system needs to be composable not just with other DeFi lego blocks but with the existing procedures of finance. Those procedures are rarely linear. They are often parallel and stateful.

From a trader's perspective this might translate to a certain fluidity. You could engage in a confidential trade represented as a UTXO. That trade could then automatically influence your collateral position within the Hedger's account system. One action composes into another without exposing the link publicly. The smart contract logic governing your margin would interact with the account layer. The final settlement proof would live on the UTXO layer. This bifurcation is mostly invisible to the user. What you perceive is a seamless process. The complexity is abstracted away. Yet that abstraction is precisely what enables more sophisticated products to be built. Developers are not forced into one paradigm.

Adoption of such a system depends on this subtle flexibility. Traditional finance institutions are particular about data structure. They require clear audit trails which UTXOs provide. They also demand automated continuous processes which accounts facilitate. Offering both within a single cohesive framework like the Hedger lowers the integration burden. It is an architectural concession to reality. The system does not ask the old world to fully adapt to the new chain paradigm. It attempts to speak both languages. This is a long term bet on interoperability at the protocol level not just the asset level.

The success of this model will not be measured by hype. It will be measured by the quiet onboarding of complex financial instruments. It will be evident if we see tokenization projects using DUSK for structures that are awkward on other chains. The hybrid approach is a tool for a specific niche. It acknowledges that better composability sometimes means building a bilingual system. One that can narrate a transaction as a discrete event and also as part of an ongoing story. Watching how developers utilize this duality will be the real test. The design is there offering a bridge between two worlds. Its utility will be decided by those who attempt to cross it.