Nobody likes to talk about this.

Because once you understand it, you can’t unsee it.

The United States is sitting on a debt structure so fragile that it’s set to drain liquidity from the global financial system — not emotionally, not politically, but mechanically.

If you hold Bitcoin, stocks, crypto, gold, or any risk asset, this matters more than any headline or hype cycle.

The Number That Changes Everything

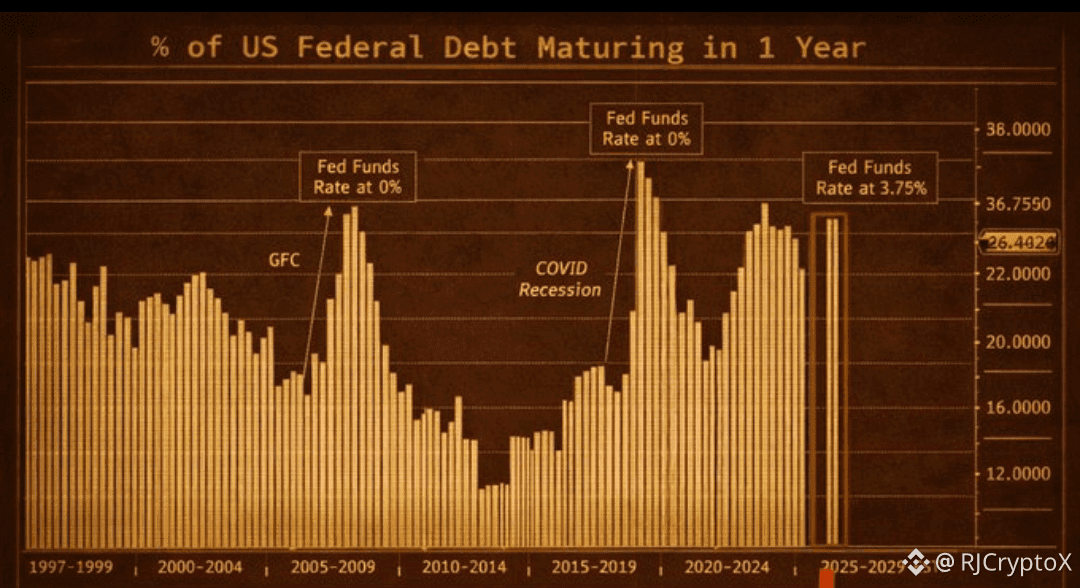

More than 25% of total U.S. debt matures within the next 12 months.

That’s over $10 TRILLION that must be refinanced — no delays, no loopholes, no creative accounting.

This is the largest refinancing wall in modern U.S. history.

Why This Was Fine in 2020 — and Dangerous Now

Back in 2020: • Interest rates were near zero

• Liquidity was overflowing

• The Fed backstopped everything

• Refinancing costs were negligible

At one point, nearly 29% of U.S. debt was short-term — and nobody cared.

Fast forward to today: • Policy rates around 3.75%

• Bond buyers demand real yield

• Liquidity is already tight

• Debt levels are far larger

The same debt structure has gone from harmless to toxic.

What Actually Happens Next (No Theories Here)

The U.S. Treasury has no choice.

To refinance maturing debt, it must: • Issue massive amounts of new Treasuries

• Flood bond markets with supply

• Compete with every other asset for capital

This isn’t speculation — this is how bond markets work.

Every dollar buying Treasuries is a dollar not going into: • Stocks

• Crypto

• Gold

• Emerging markets

• Private credit

• Risk assets

Liquidity doesn’t disappear — it gets redirected.

“Rate Cuts Will Save Us” — Not Really

Markets are pricing in 2–3 rate cuts.

That doesn’t fix the problem.

Even with cuts: • Refinancing costs stay far above 2020 levels

• The debt volume is enormous

• Bond issuance is unavoidable

Cuts may slow the bleeding.

They do not stop the drain.

This Isn’t a Recession Call — It’s Worse

This isn’t about an instant crash.

It’s about a slow liquidity vacuum.

When liquidity drains: • Valuations compress

• Volatility spikes

• Correlations go to 1

• Speculative assets crack first

This is how bull markets die quietly, not loudly.

Why Crypto Is Especially Exposed

Crypto thrives on excess liquidity.

When money is cheap: • Bitcoin rallies

• Altcoins explode

• Leverage expands

• Speculation runs wild

When liquidity tightens: • Leverage unwinds

• Weak hands are forced out

• Volatility spikes

• Only the strongest assets survive

This isn’t bearish propaganda.

It’s macro mechanics.

The 12–24 Month Window That Matters

This refinancing wall doesn’t hit once — it persists.

Over the next 1–2 years, the U.S. must: • Continuously roll debt

• Continuously issue bonds

• Continuously absorb liquidity

That creates sustained pressure across all global markets.

Not a crash.

A grind.

The Uncomfortable Truth

There’s no painless exit: • More debt issuance → liquidity drain

• Monetization → weaker dollar

• Financial repression → distorted markets

Every path involves pain — somewhere.

What This Means for Investors

This isn’t a call to panic.

It’s a call to stop ignoring liquidity.

We’re entering a phase where: • Liquidity > narratives

• Macro > micro

• Risk management > hopium

The next winners won’t be the loudest voices.

They’ll be the ones who understand when liquidity leaves — and when it comes back.

📉 Markets don’t forgive ignorance.

📊 They reward preparation.

#GlobalLiquidity #USDebtCrisis #MacroReality #RiskManagement #MarketCycles

Follow RJCryptoX for real-time alerts.