In financial infrastructure, failure is not the only source of cost. Systems can work exactly as designed and still create friction. The real expense often comes from variance — small differences in how outcomes behave across conditions, times, or volumes. Variance forces organizations to compensate, and those compensations accumulate quietly over time.

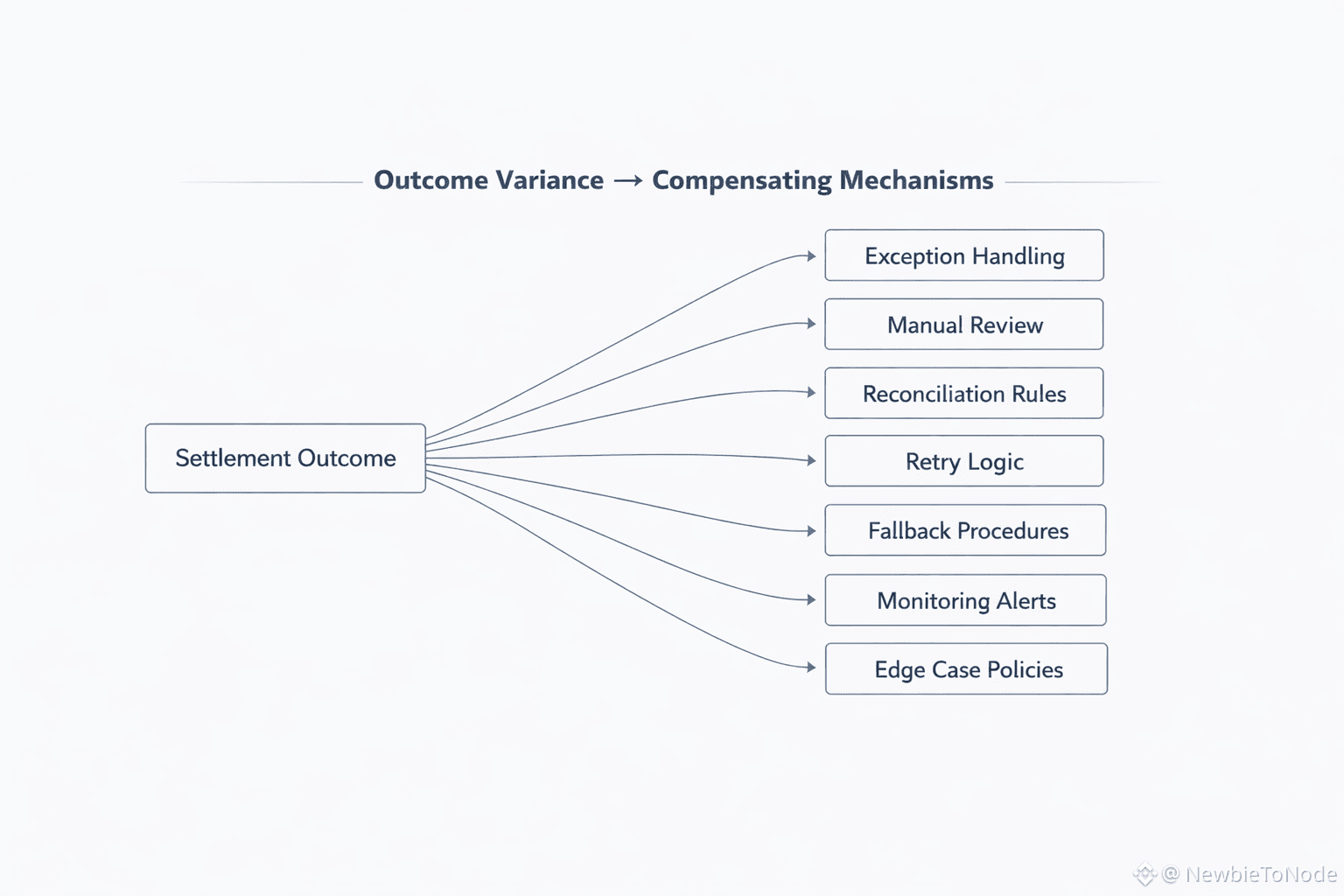

Stablecoins are increasingly used in operational workflows where repetition is the norm. Treasury sweeps, internal transfers, merchant settlements, and automated accounting runs all depend on predictable outcomes. When settlement behavior varies — even subtly — downstream systems must account for that uncertainty. Extra checks, fallback logic, manual review, and reconciliation rules begin to layer on top of the core payment flow.

None of this indicates a broken system. It indicates a system whose outputs cannot be treated as identical under repetition.

This is where deterministic settlement becomes more than a technical detail. On Plasma, finality through PlasmaBFT is designed to ensure that once a stablecoin transfer is finalized, its state is clear and consistent regardless of context. The same inputs lead to the same type of terminal outcome. That consistency reduces the need for compensating mechanisms in the layers above.

Variance creates operational surface area. Every exception path, retry rule, or manual checkpoint represents additional logic that teams must maintain and monitor. Over time, these layers become more complex than the original payment flow they were meant to safeguard. The system may still “work,” but the cost of supervising it grows.

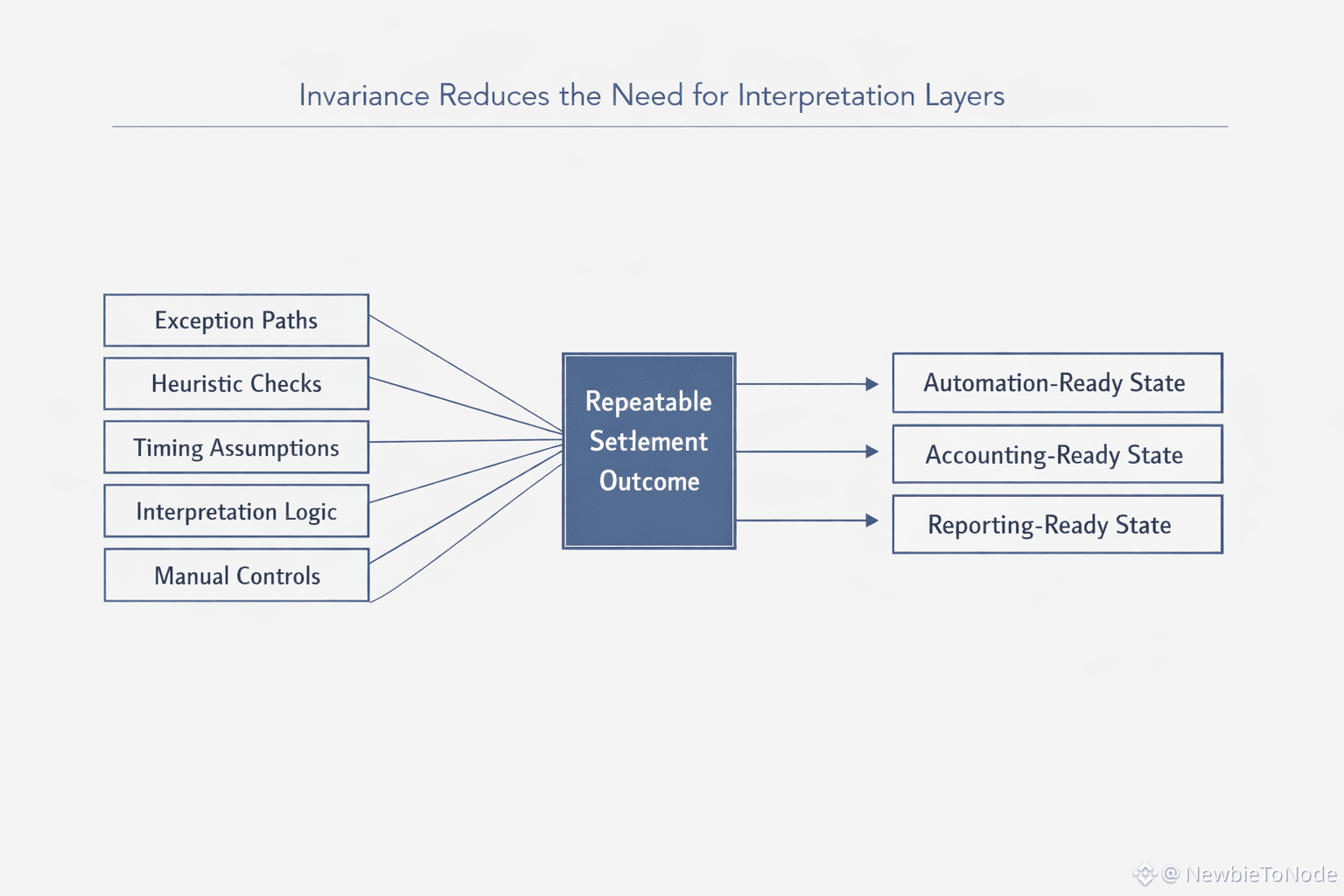

By contrast, systems built around repeatable outcomes allow complexity to contract. When settlement behavior is consistent, workflows can rely on invariants rather than heuristics. Automation pipelines do not need to guess whether a state is safe to use. Reporting systems do not need to interpret subtle differences between transactions that should be equivalent. Teams spend less time managing edge cases and more time operating on known ground.

This does not eliminate responsibility from downstream systems. Businesses still apply policy, risk checks, and internal controls. What changes is the burden of interpretation. Deterministic settlement localizes uncertainty to the moment of finality rather than allowing it to leak into every subsequent step.

As financial systems scale, variance becomes more expensive than delay. A slightly slower but consistent process is often easier to automate than a fast one with irregular behavior. Plasma’s approach to stablecoin settlement reflects this reality. By emphasizing deterministic finality and stablecoin-first design, it aims to provide a settlement layer whose outputs are stable enough to be reused without reinterpretation.

The long-term effect of reduced variance is not dramatic on a single transaction. It shows up in the disappearance of extra rules, fewer manual interventions, and simpler operational playbooks. Infrastructure becomes less about watching for anomalies and more about trusting repeatable outcomes.

Plasma’s settlement model highlights an important shift in how performance is measured. Reliability is not only about uptime or speed. It is about how little the system forces surrounding processes to compensate for inconsistency. When outcomes behave the same way every time, financial infrastructure becomes easier to reason about, easier to automate, and less expensive to operate.

In that sense, reducing variance is not just a technical achievement. It is an economic one. Systems that minimize behavioral differences across transactions enable organizations to scale without scaling complexity. Plasma’s focus on deterministic settlement positions it as infrastructure designed not just to move value, but to reduce the hidden cost of keeping financial systems predictable.