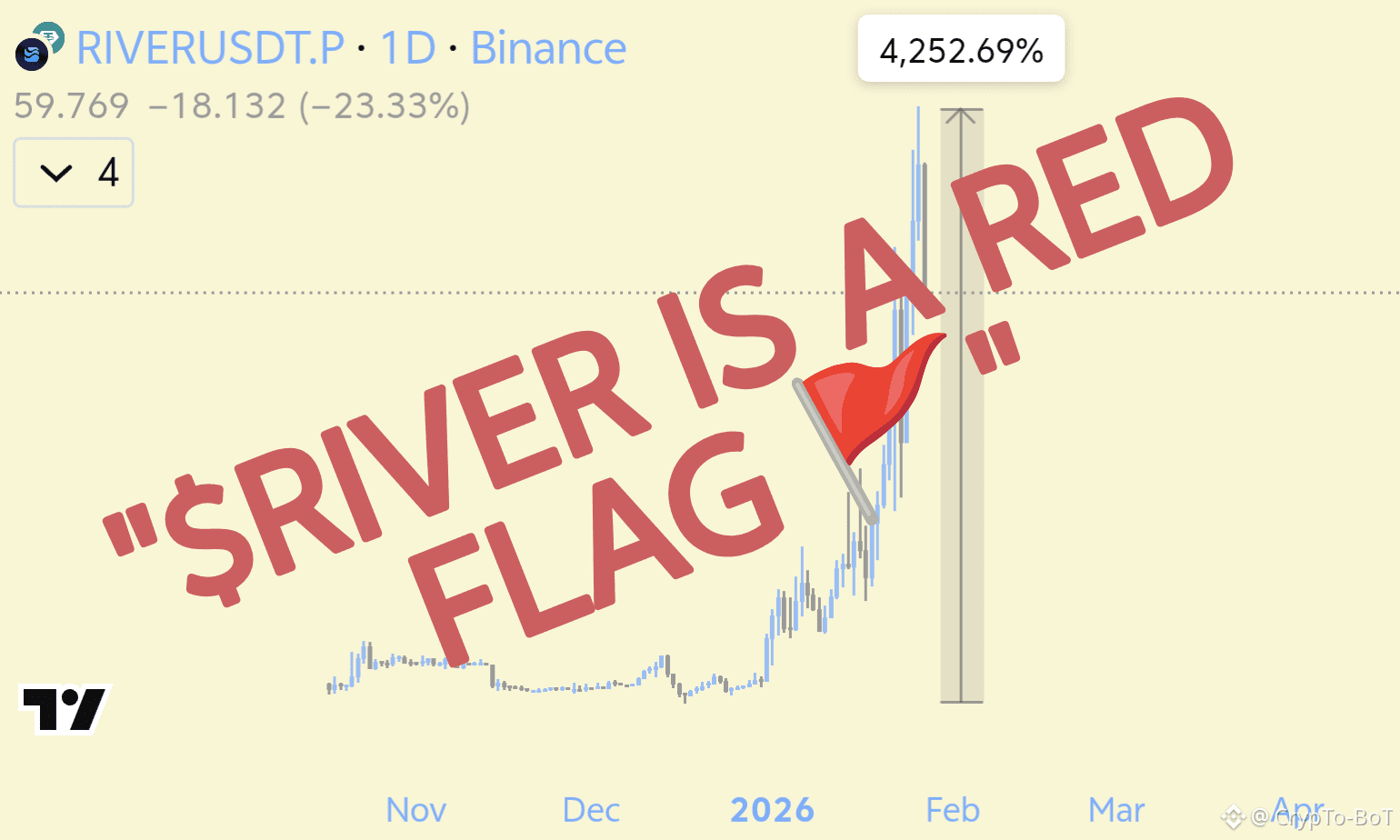

Investigation: The $RIVER Supply Cornering Operation

An analysis of the $RIVER token reveals a highly sophisticated, industrial-scale supply cornering scheme. Currently, a single entity controls 50.1% of the circulating supply (approx. 9.82M tokens) through a sprawling, obfuscated network of 2,418 sharded wallets.

The cluster’s activity traces back to late 2025. The operation was seeded by a wallet funded with 8 BNB from OKX, which utilized the Multicall3 distribution contract to bypass standard blockchain explorer alerts. This initial capital was dispersed into 362 addresses, eventually forming a nine-hop chain to finalize the 2,418-wallet web.

These wallets were used to aggressively sweep millions of $RIVER from Bitget at an average entry of ~$4.12. By removing half of the tradable float, the entity created a severe supply vacuum. This allowed for an engineered pump to a recent $87 ATH, representing a 1,600% increase since the start of 2026.

On-chain forensics show thousand-fold interactions occurring within the same block—a definitive "Sybil" fingerprint. While the project recently announced an $8M investment from Justin Sun to integrate satUSD into TRON, data suggests this institutional news is being used as a narrative "smokescreen" for the whale's activity.

The market structure is extremely predatory. CoinGlass data shows derivatives volume exceeding spot by 80x, with deeply negative funding rates (up to -16%). This indicates the rally was largely fueled by forced short liquidations rather than organic buying, leaving the price purely dependent on the whale’s leverage.

Warning: This is a textbook liquidity trap. The entity currently holds over $300M in unrealized paper profits, which far exceeds the available liquidity in exchange order books. Retail participants are currently being positioned as exit liquidity; if the entity initiates a synchronized unwind through its sharded network, the resulting price collapse will be instantaneous.

Investors should be aware that trading $RIVER currently means playing against a house that owns half the deck. Any movement of funds from the "Scout" wallets—such as 0x50b309...94cac9f20—back to CEX deposit addresses should be viewed as a final sell signal.

Stay safe ✅