The 2025-2026 bull run might’ve reached its limit.

🤔Fear is spiking again, showing market exhaustion

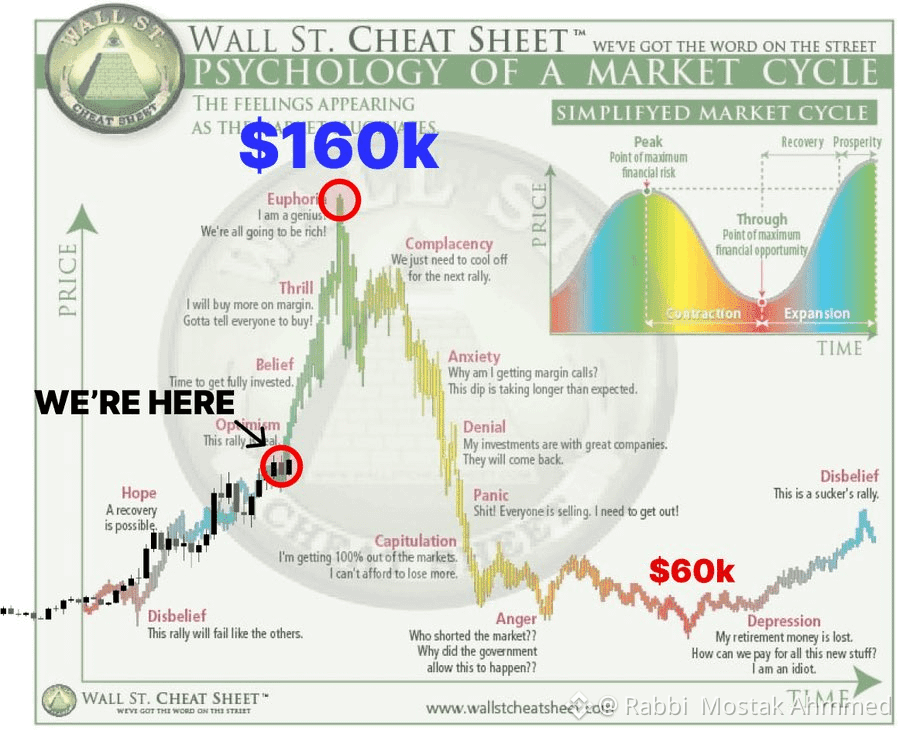

I checked cycle trends and investor psychology

⌛

Here’s my outlook for what’s ahead 👇

1.Retail panic is back in the market

Fear & Greed Index dropped to 29, and social sentiment crashed

Yet the actual catalysts aren’t bearish - they’re neutral or leaning bullish

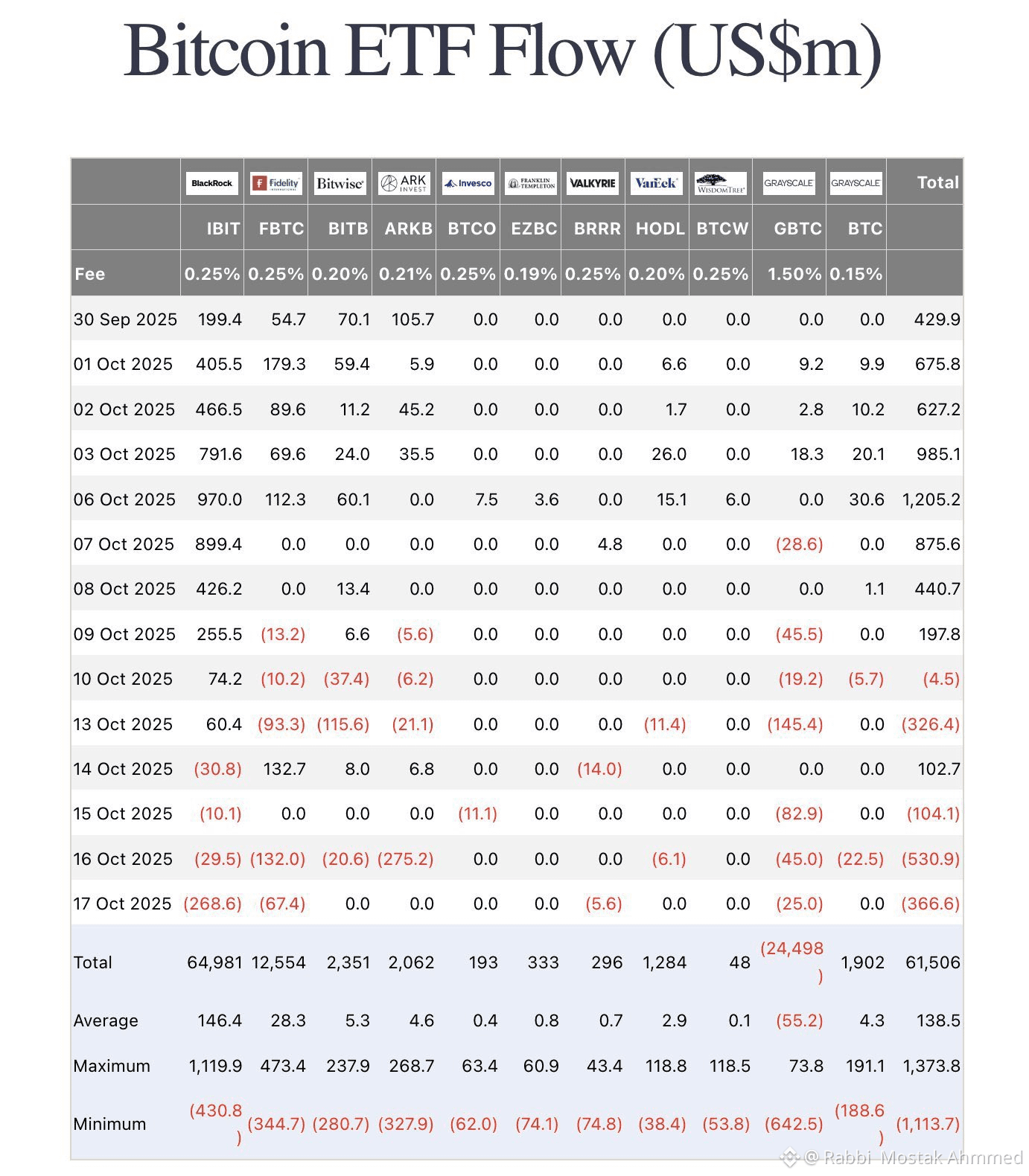

Rate cuts are already priced in, ETF flows remain steady, and miners aren’t selling

2. Wondering why the market dumped?

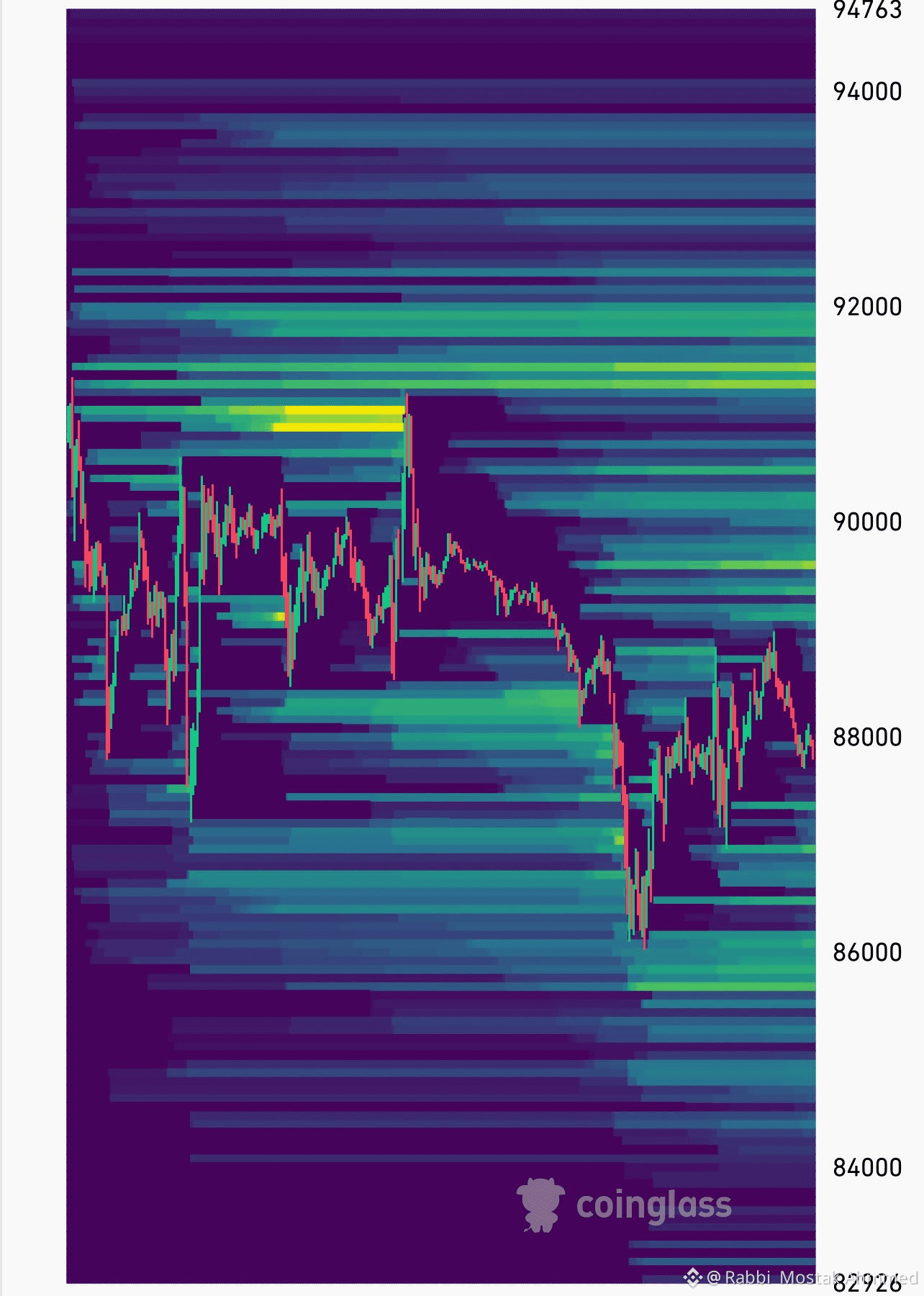

Binance and Trump together wiped out $1B worth of longs

It was one of the quick liquidation acorss the market.

The drop was planned, not natural - and now traders are too afraid to re-enter

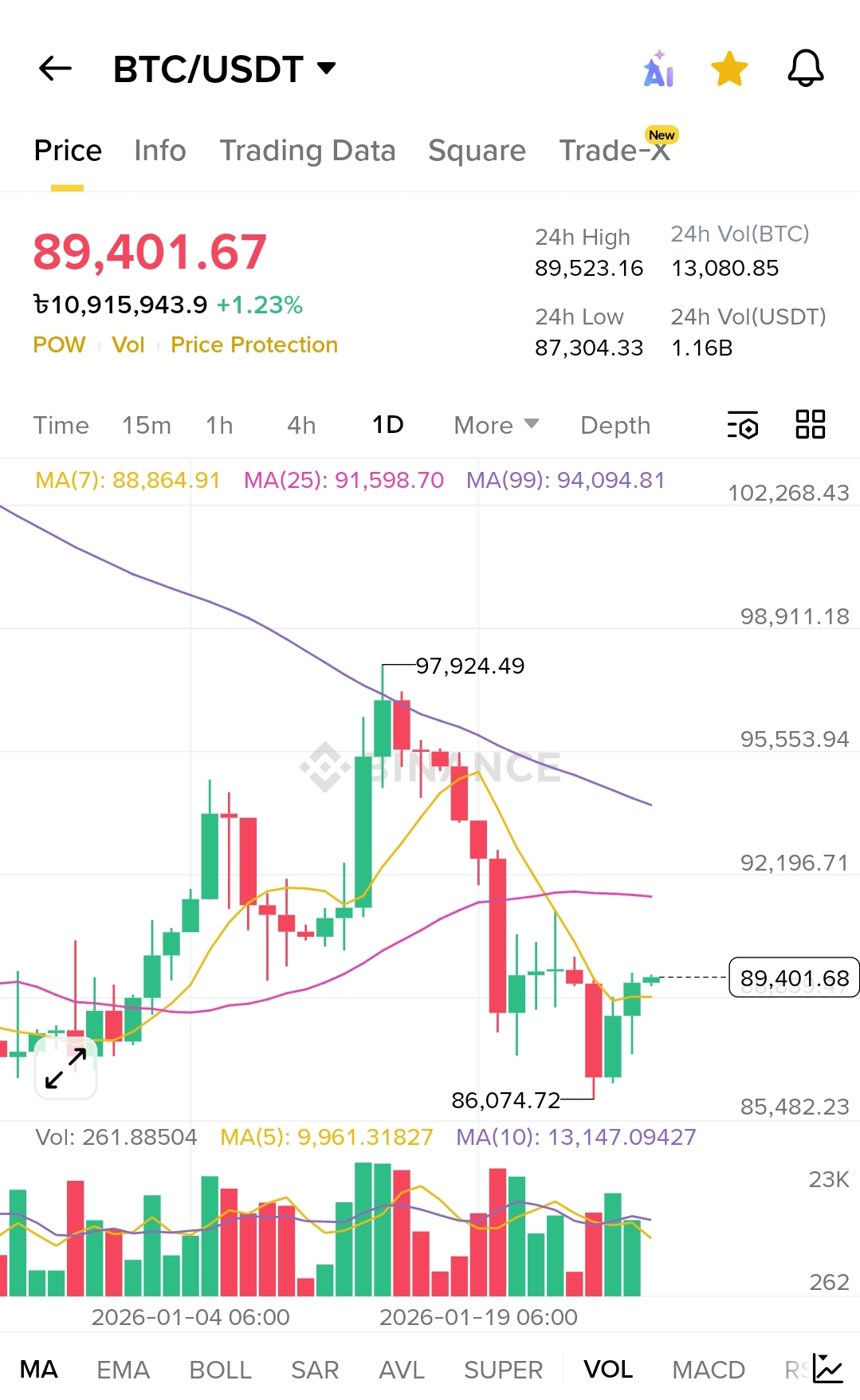

3.BTC is holding around $87000

It broke below the 200d BPRO .

Still, this area has sparked reversals in previous cycles

RSI sits at 36 with neutral momentum - shaken, not finished

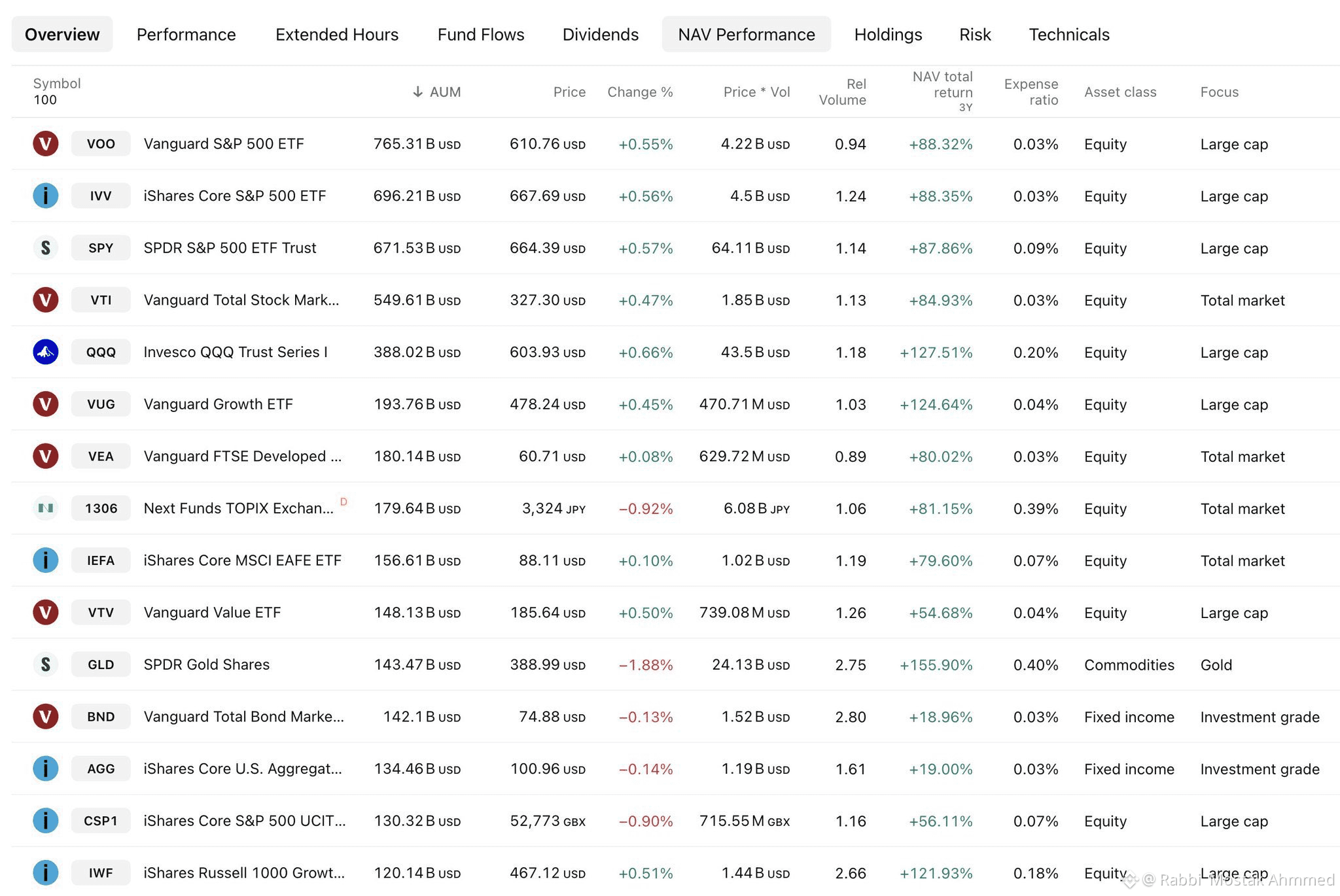

4.Retail expects $80k next

But big players see it differently

Spot ETF assets still hold above $143B

Outflows exist, but it’s rotation - not withdrawal

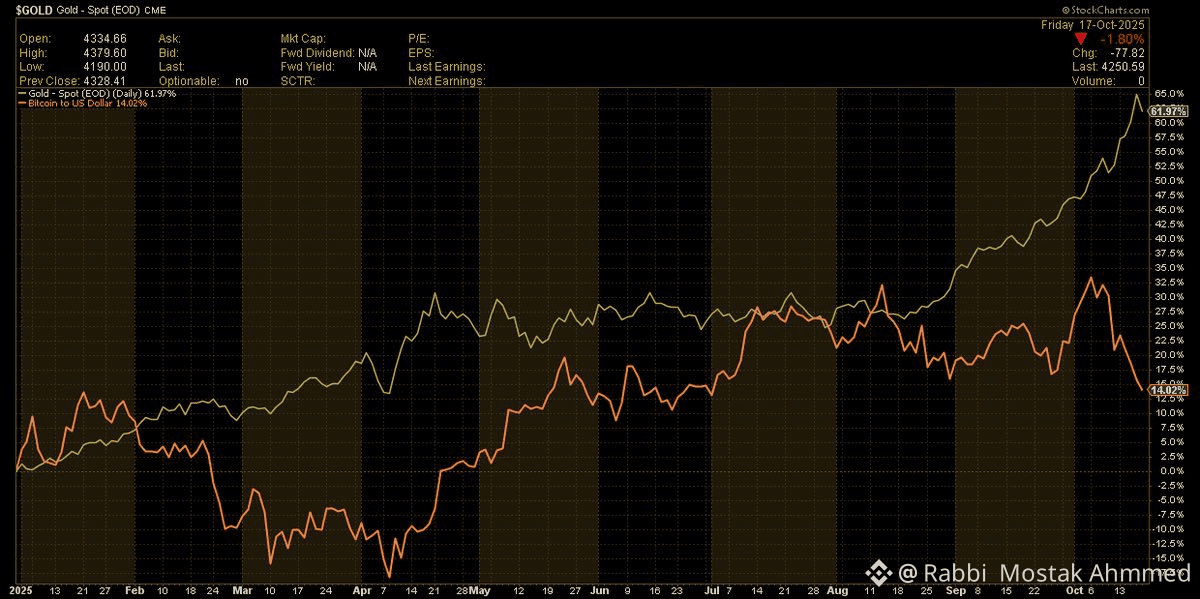

5. ETH is echoing BTC’s weakness

AUM remains stable at $23.88B

Funds aren’t exiting crypto — they’re waiting for confirmation

That confirmation might come from a short squeeze trigger

6. This is lining up for a brutal upside squeeze

Just like last week’s planned crash, only flipped

The market structure remains the same just reversed

Longs got wiped out, now shorts are next in line

7.Miners are around breakeven.

They’re not dumping — they’re holding steady

On-chain metrics show a slowdown, not a breakdown

This kind of late-cycle volatility is typical, not fatal

8.Q1 has always been Bitcoin’s launch phase

It’s delivered an average 51% gain over the past 15 years

And right now, we’re sitting right on that timing line

9.We’re now 1,080 days deep into this cycle

That marks about 99.5% of the usual duration

Historically, major tops tend to form in this phase

The next 5–10 days statistically matter the most

10. Retail believes the bull run has ended

Smart money views this as the perfect entry point

Fear is loud, but opportunity speaks quietly

When volatility hits extremes, trends flip quickly

11. True, this cycle feels different - more institutional and far trickier

But that doesn’t make it weaker

It just makes trading tougher and easy to misread

Don’t let fear blind you to a rare opportunity.