There are blockchains that are seeking attention by introducing new functions than anyone would remember. The plasma moves in the opposite direction. The project is the process of reading a network whose only goal is to do something at scale that can be best had in terms of stability and whose user experience is immediate and pristine. The importance of such design selection is clear because the next chapter of adoption is not so novel as that of habits. The technology is not very tolerant in the event of the people moving the value across applications by paying or settling or in any other fashion transferring the value. It has to disappear. This is the emotional part of Plasma. It is trying to be the series which would not be anything at all, but a smooth result.

On product level, Plasma may be presented as a high performance Layer 1, but tailored to the stable coins with a specific emphasis put on the near instant transfer, low fees, and support of EVM. Positioning is not conspicuous. Stablecoin movement is not perceived as a periphery feature. The documentation refers to stablecoin native contracts, which enables transfer of supported by a stable value assets that are fee-free and do not require optional gas tokens and secret payment tooling. This is the kind of feature set that will most probably be of relevance in the real world usage as it meets three pain points that silently kill the adoption: friction during the checkout, unreliable cost, and inability to accommodate different user paths across different regions and merchandize.

The liquidity story is also decent. In the documentation about Plasma, its network is intended to ensure that on the first day, the network has very deep liquidity of stablecoins, claiming that it will have more than one billion dollars to move. Whether any network can relatively match its marketing at any given moment is always a good question but the intent is not insignificant. It means that it tries to avert the standard cold start in the situation when there is a chain which is technically alive but practically empty. Liquidity is not only money. Liquidity is the permission slip of a more permissive type which not only informs builders that an app can be started but it also allows it to be launched even when it does not cause users to jump through hoops.

Practically the chain has already been defined with concrete network parameters that can be tested and integrated at will with ease. Plasma mainnet Beta is a public chain, its chain id is 9745, it has a public RPC endpoint, and a block explorer. Even such details as the fact that the public endpoints are rate limited are eloquent. The use of such a note is prevalent when actual traffic and actually real cases are expected. The fact is that it is closer or furthermore, it is as follows: experimenting is not forbidden, serious production needs serious infrastructure.

The developer path will be significant because infrastructure will win when developers no longer consider it. Plasma leans towards familiarity as regards to compatibility of the EVM i.e. the pre-existing tooling and contract patterns can be transferred with a lot less reinvention. This is not all about convenience. It is about time. A builder would choose the use of ecosystems in which launches are significantly quicker and less time intensive, and the number of failure modes is reduced. In terms of payments, all other failure modes will be reflected in the form of support tickets, refund request, and a blemished brand experience. The nature of the statements expressed by plasma suggests that the layer of payments could be composed in the manner that the number of issues arising daily could be reduced rather than increasing.

The other less noticeable yet influential dimension is confidentiality. The native feature set contains confidential payment capabilities, which is stated to be confidential, and they are stated to be a feature that the apps may call when the right moment occurs, rather than a default to render the privacy of the apps would make the auditability impossible. The disparity in the actual world is significant. The obvious motives of why a lot of users should receive privacy include the desire not to share balance or salary streams. The accounting and compliance also demand selective disclosure by most of the businesses. Radical designs that make all transactions opaque are also less realistic than systems capable of operating both without being separated into tokens and 2-domain mental models.

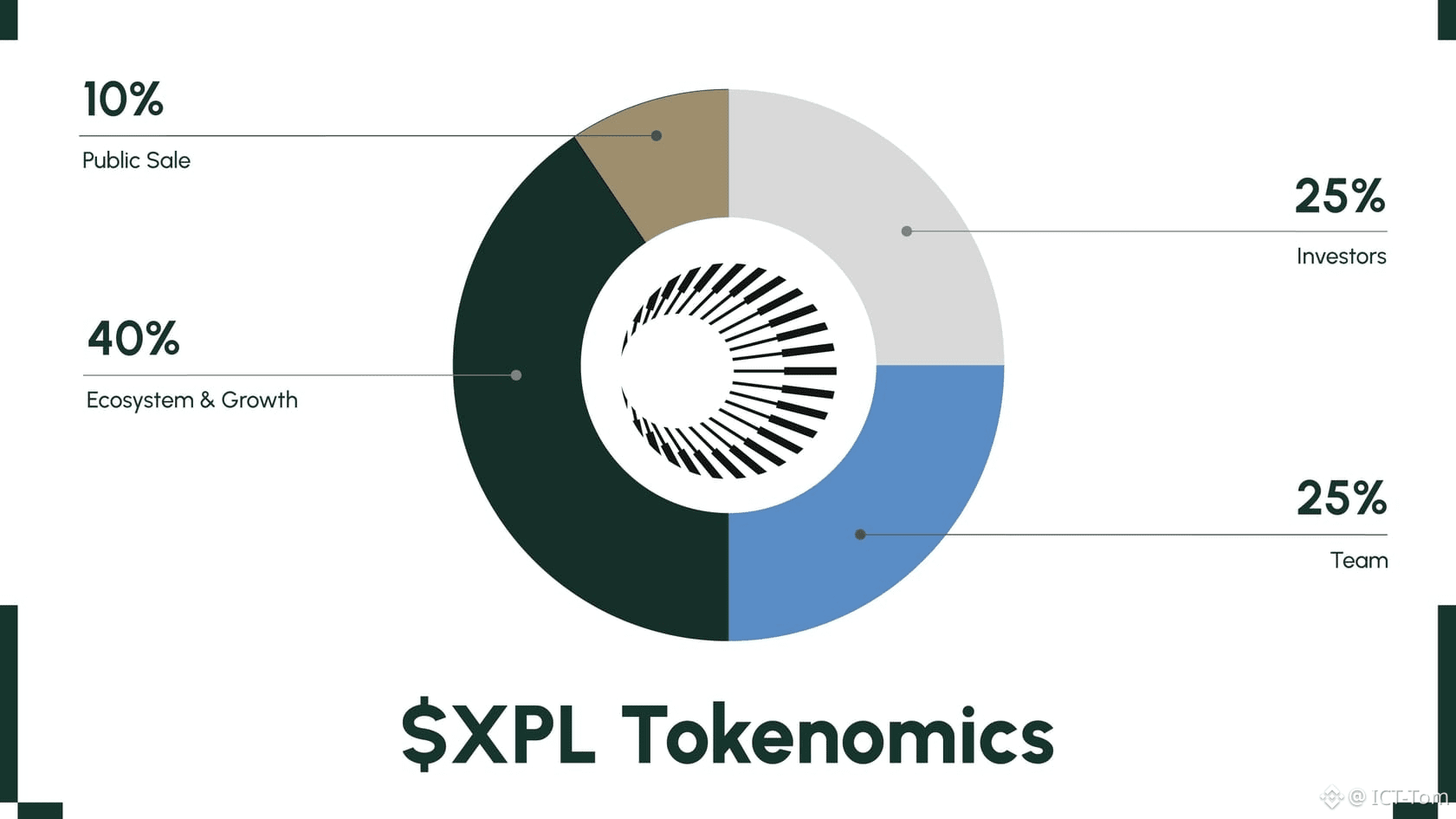

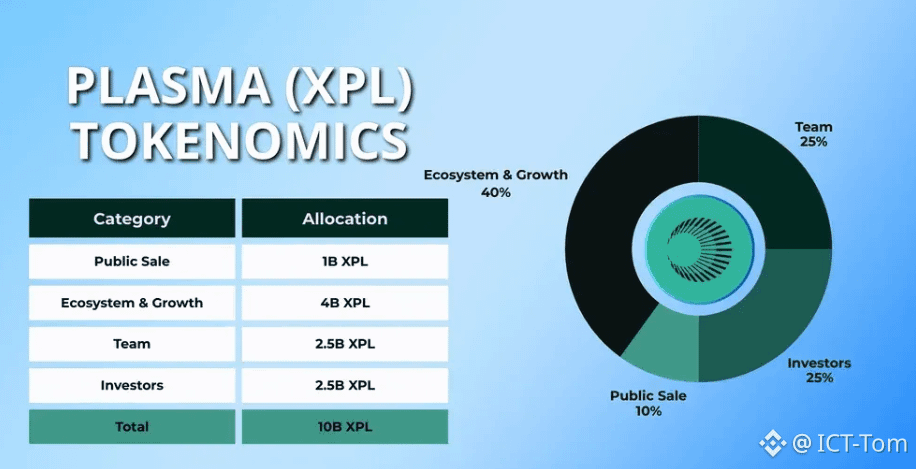

On the token side, the intersection of belief and structure occurs. It is reported that XPL is the cash of the network level functions and the documentation includes a huge lockout description concerning the jurisdiction specific participation in the sale of a product. The tokens received by certain buyers will be locked away in a timeframe of twelve months and completely unlock in July 28, 2026, though tokens received by other participants will be said to be fully unlocked when the mainnet beta is launched. This information affects supply stream, mood and volatility expectations. It also asks a more grown-up style of thinking about holding: not as a day to day emotional game, but as a schedule with recurrent events.

The market information is dynamic and is changing fast, but it can give an indication of the awareness and liquidity. The price monitors currently show that Plasma is currently being traded in the twelve to thirteen cent price range with a big daily turnover on the basis of the location and time of the day. The exact number is not the one that is of higher importance. The fact is in the active exchange and popularity of the asset, which is likely to bring more eyes on which the development of networks is followed.

And this to that which is human. A very large proportion of the holders do not just possess a token. They have a vision of the future. It is the same emotional question all the time, is this going to be real infrastructure or will it be a narrative? The first architecture of the stablecoin of Plasma is a design geared towards a slower and more sustainable path, as payment rails grow by duplication, and not spectacle. A network which becomes the default of some sort of transfer is compensated better than the hype. It earns habit.

It is possible to project the future in three layers in a realistic way. The former is basic payments. Small transfers are again possible when the friction in fees is abolished and when in effect set off is immediate. That is daily app to app traffic, seller disbursement, creator disbursement and payroll type traffic. The second level of consumer experience is stable value. The most heavily branded chains do not emerge as winners in that layer. The chains are the ones that place stable value movement in the background. The third layer is institutional style routing whereby reliability and predictable execution is more valued than experimentation. The native architecture of the institutions grade security and stablecoin of the essence of the messaging of the plasma address that direction.

The idealistic one will not be hard to imagine. The reduced fee chain, user friendly gas logic, and inability to lose privacy at the necessary moments can be an attractive one as soon as the product teams are concerned with the conversion rates. Each extra clicking or any extra charge notice reduces the conversion within a payments setting. The properties of plasma appear to be geared towards reducing such drop offs. In the case the ecosystem is attractive to builders that have a motivation in regular users, the result can be the onslaught of products where the blockchain layer is not sold in any form, since it does not need to be.

The conservatory case is also worth admiring. The nature of payment infrastructure is directly associated with the regulation, liquidity conditions, and operations of the stable value instruments. Even perfect-looking engineering cannot embrace the alterations in the external world in its entirety. The other risk is that stablecoin oriented chains can be tested brutally in case of any downturn or congestion, as the demands on payments are not softened. The trust is soon exhausted when the former can no longer pay it. That is why even the path to supremacy is mostly adorned by months of uninspired steadiness rather than glimpses of interest.

The most advanced technique that will be employed by coin holders is the constant prediction. It is better observation. The strongest indicators are often those that are visible on the surface: steady growth of transaction, habits of frequent usage and those applications that do not steal users. Network configuration details and explorers can be used to measure those signals. Another advanced movement is time understanding. The unlock date of July 28, 2026 is not a date in itself. It is a structural fact, which is able to affect supply movements and mood. The difference between rational conviction and decision making is often the organising on the basis of what is known.

The nontrading participation also has innovative ways of participation. Regarding the ecosystem as craft is one of the ideas. Craft products and help to transfer value easily to real people through support builders. The other idea is to take care about the education that appears to be realistic, including the ability to develop user flows that would not lead to the failure of transactions and the ability to avoid the frustration of gas warnings. The third principle is to encourage experiences of stable-state payment rather than a speculative setting, such as subscriptions, micro-payments or loyalty streams by merchants, by the circulation of stable values. Provided that Plasma is attempting to be payments infrastructure, then items that appear to be daily tools, and not experiments, will benefit the ecosystem.

The spirit of Plasma is characterised by two phrases. Hush, hush money and bang, bang infrastructure. Quiet money is the need of the user to have the value that does not vary when the value is to be applied in life. Loud infrastructure means that the rails underneath must be strong enough to carry the real volume without doing anything. The thesis one of plasma stablecoin is essentially a speculation that the new wave will be a wave that welcomes usefulness over noise, and that the chains that emerge the victors will, in fact, behave like utilities.

plasma does not demand attention through being complicated. It would like to be judged on the merits of having removed friction and bringing about reliability in the applications that people already use. #plasma will feel comfortable in its fullest strength when the chain becomes the fallback mechanism of translocation of values of stability within apps which people already use. And such the kind of future that may compensate long-suffering possessors, especially those who determine progress by indications of adoption, and not by daily feeling.

plasma can be the network that is no longer discussed by the network people because of its sheer functionality. $XPL can be the exposure of the rails that shift stable value in the background where the silence is the loudest thing to hear. @Plasma #Plasma $XPL