As stablecoins move deeper into financial operations, a quiet shift is happening. Payments are no longer only triggered by people. Increasingly, they are triggered by systems.

Treasury tools rebalance positions automatically. Market-making bots move liquidity without manual approval. Internal accounting systems execute scheduled transfers. In these environments, infrastructure is not responding to human judgment in real time. It is responding to code.

This changes the requirements placed on settlement networks.

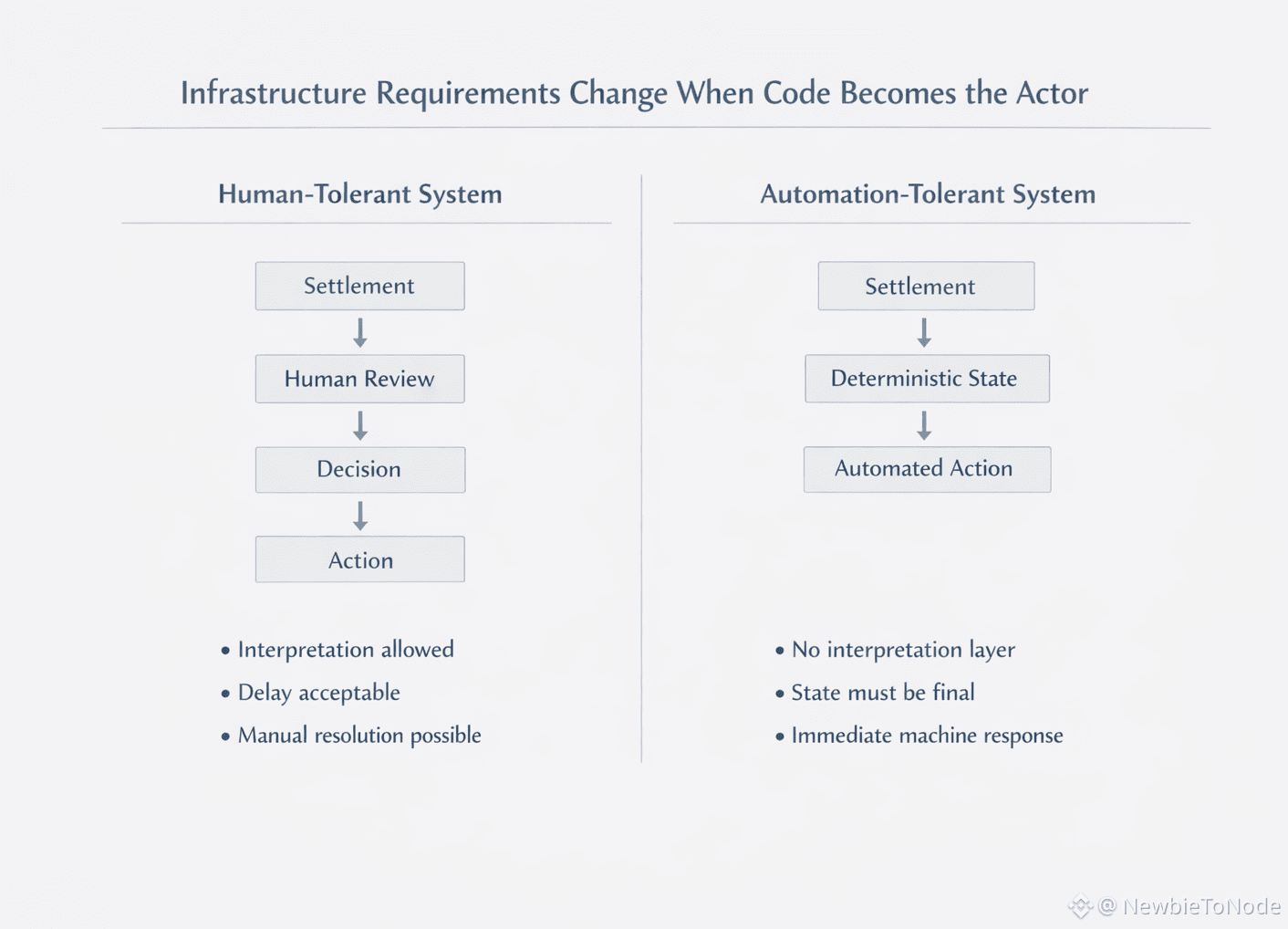

Humans can tolerate ambiguity for a short time. A person can pause, refresh, or wait for clarification. Automated systems cannot operate that way. They depend on states that are unambiguous, repeatable, and safe to act upon without interpretation. When a transfer is considered complete, downstream logic proceeds immediately. If the underlying settlement behavior varies, automation becomes risky.

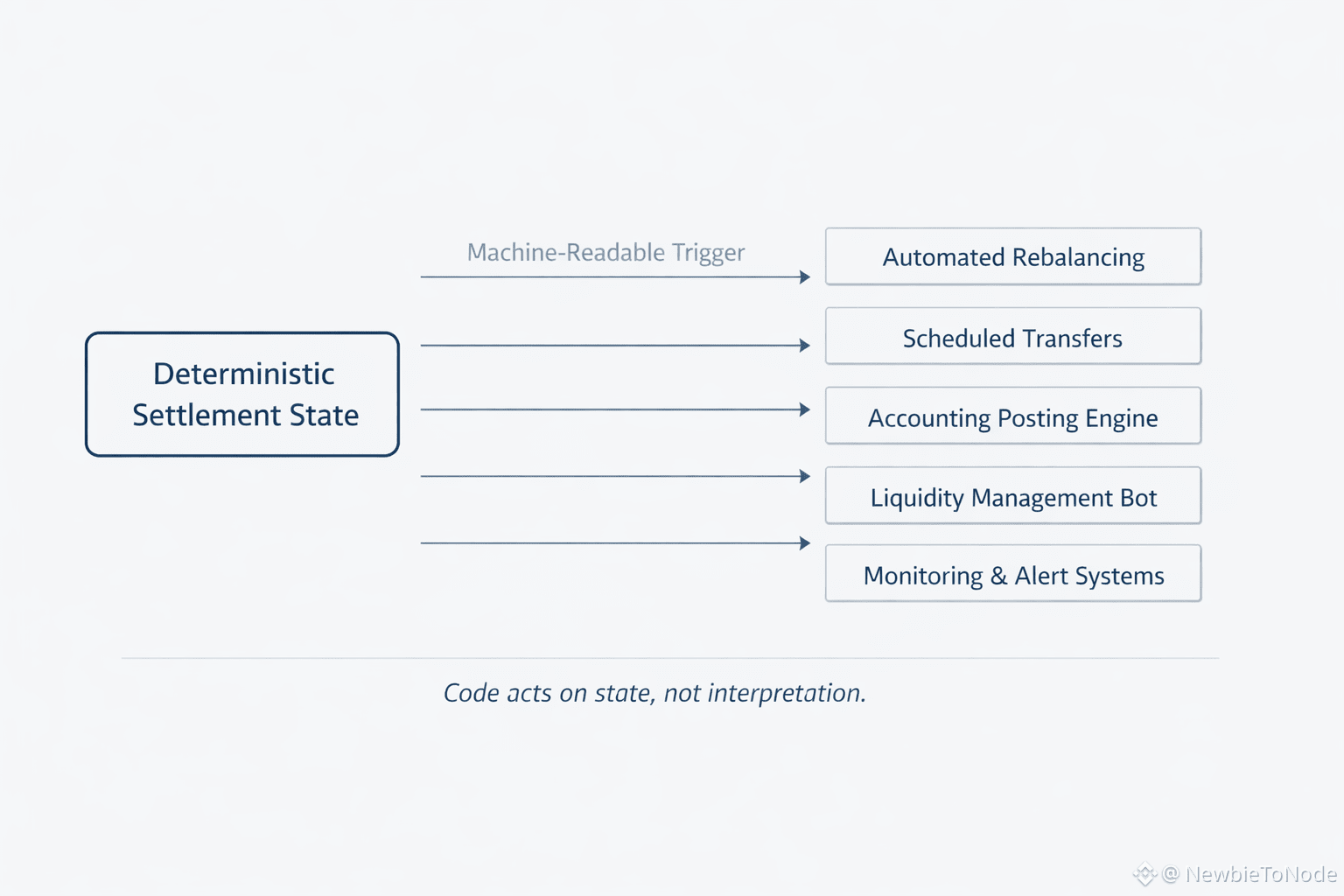

Plasma’s deterministic settlement model addresses this need directly. Through PlasmaBFT finality, a stablecoin transfer reaches a terminal state that is intended to be definitive. Once finality is achieved, the outcome is not provisional or dependent on additional context. This allows automated systems to treat settlement as a reliable signal rather than a suggestion.

The importance of this grows with scale. A single uncertain transaction can be reviewed manually. Thousands triggered by automation cannot. If settlement states require interpretation, systems must add defensive logic. Extra validation steps, timeout rules, reconciliation checks, and exception handling accumulate. These safeguards slow automation and increase operational complexity.

By contrast, when settlement behavior is consistent, automation becomes simpler and safer. Downstream processes can rely on invariants instead of heuristics. Accounting software can post entries automatically. Liquidity management tools can rebalance without human confirmation. Monitoring systems can alert on true anomalies rather than normal variance.

This does not remove the need for governance or risk controls. Those layers remain essential. What changes is the burden placed on settlement itself. Infrastructure that supports automation must provide outcomes stable enough that code can trust them without continuous oversight.

Stablecoins, by design, function as operational money. They are used for movement, settlement, and balance management rather than speculation alone. As their use becomes more system-driven, infrastructure must support machine-to-machine coordination as reliably as human-to-human payments.

Plasma’s focus on deterministic settlement positions it within this shift. It provides a layer where automated processes can anchor decisions without needing to reinterpret each transaction. The value lies not only in speed, but in the predictability of terminal states.

In the long run, financial infrastructure will be judged by how well it supports automation at scale. Systems that behave consistently under repetition allow organizations to replace supervision with design. Plasma’s settlement model reflects this direction, aligning stablecoin infrastructure with the realities of increasingly automated financial operations.