Crypto doesn’t trade in a vacuum.

It reacts to liquidity, policy signals, confidence, and narrative and right now, all four are converging inside a 72-hour macro pressure window that traders can’t afford to ignore.

This week isn’t about hype coins or random pumps.

It’s about macro alignment and whether risk assets get breathing room, or get squeezed again.

Over the next three days, six major events collide.

Any one of them can move markets. Together, they create one of the most fragile setups in months.

Let’s break it down clearly and without noise

1️⃣ Trump’s Speech Energy, Inflation & Narrative Control

Today | 4:00 PM ET

Trump will speak on the U.S. economy and energy prices.

Why this matters for crypto:

• Energy prices drive inflation expectations

• Inflation expectations drive Fed policy assumptions

If Trump emphasizes lower energy prices, markets may interpret political pressure to cool inflation mildly supportive for risk assets in the short term.

But there’s a second layer:

Trump has already hinted at new tariffs.

Tariffs are inflationary. Inflationary policy forces the Fed to stay restrictive longer.

Markets don’t react to speeches they react to what those speeches imply for future liquidity.

This sets the narrative tone for everything that follows.

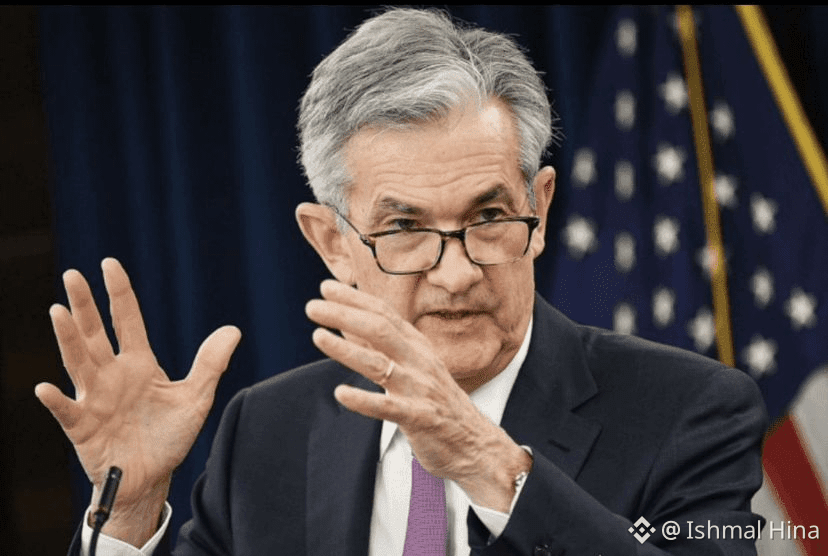

2️⃣ The Fed Decision It’s Not the Rates, It’s Powell

FOMC | Tomorrow

No hike. No cut.

That’s consensus.

Which means real volatility starts when Powell speaks.

Key context:

• Inflation is not convincingly slowing

• Powell has recently pushed back against political pressure

If Powell leans even slightly hawkish, markets will hear:

• “No urgency to cut”

• “No rush to ease financial conditions”

Crypto is extremely sensitive to rate-cut expectations.

A hawkish tone doesn’t mean an instant crash —

It means:

• Choppy ranges

• Fake breakouts

• Aggressive stop hunts

Classic liquidity-driven price action.

3️⃣ Mega-Cap Earnings — Tesla, Meta, Microsoft

These companies don’t just report earnings

They define equity sentiment.

• Strong results → relief rally

• Weak results → risk-off cascade

The risk here is timing:

These earnings drop the same day as the FOMC.

That’s macro + micro volatility stacked together.

If even one of these names disappoints while Powell stays firm, equities can wobble and crypto rarely ignores that signal.

4️⃣ PPI Inflation Data The Fed’s Reality Check

Thursday

PPI measures inflation at the production level, before it reaches consumers.

Why it matters:

• Hot PPI = sticky inflation

• Sticky inflation = delayed rate cuts

• Delayed rate cuts = tight liquidity

Tight liquidity is crypto’s biggest short-term enemy.

A single hot print can unwind days of bullish positioning.

5️⃣ Apple Earnings Quiet, Heavy Impact

Apple doesn’t need hype to move markets.

If Apple disappoints:

• Indexes feel it

• Funds rebalance

• Risk exposure gets reduced

Apple reports the same day as PPI, adding yet another volatility layer to an already overloaded week.

6️⃣ U.S. Government Shutdown Deadline Liquidity Risk

Friday

A government shutdown isn’t just political noise.

Shutdowns:

• Freeze parts of government spending

• Pull liquidity out of the system

• Hit speculative assets first

Last time this happened, crypto didn’t drift it sold off aggressively.

This time the backdrop is worse:

• Higher rates

• Slower growth

• Fragile risk sentiment

A shutdown here would be a real macro shock, not a footnote.

Why This 72-Hour Window Matters

Individually, these events are manageable.

Together, they force a market decision:

• Risk-on continuation

• Or risk-off defense

This doesn’t mean “everything crashes.”

It means volatility rises and weak positioning gets punished.

How Smart Traders Approach This Week

This is not the week for emotional leverage.

It’s the week for:

• Smaller position sizing

• Clear invalidation levels

• Patience over prediction

If markets hold through this window, confidence improves.

If they break, better entries come later.

Either way capital preservation comes first.

Final Thought

The next 72 hours won’t decide crypto forever.

But they will shape the next major move.

Stay flexible.

Respect liquidity.

Markets reward discipline, not excitement.

#FedWatch #MacroPressure #BinanceSquare #SquareCreator