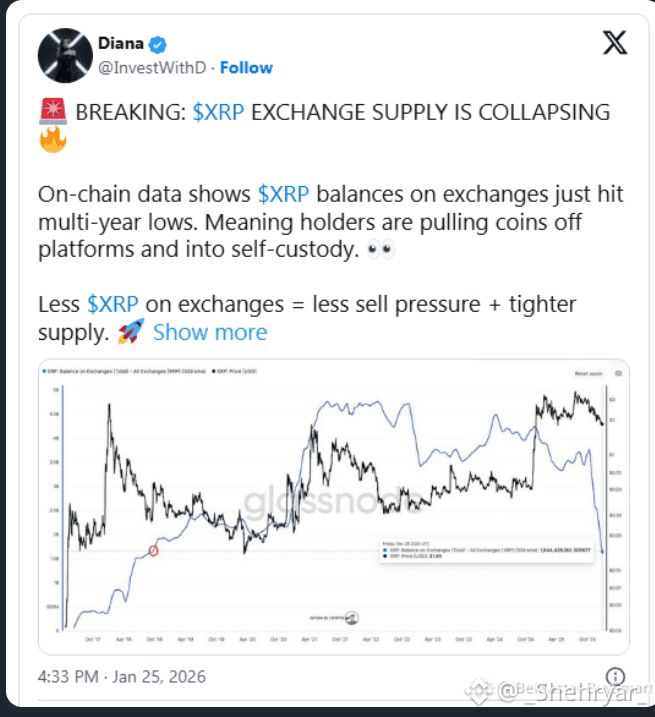

$XRP exchange balances have dropped to multi-year lows, according to on-chain data highlighted by crypto analyst Diana (@InvestWithD) — and it’s catching the market’s attention.

Using Glassnode data, Diana pointed out that XRP held on centralized exchanges has been steadily declining across multiple market cycles. This suggests a clear behavioral shift: holders are moving XRP off exchanges and into self-custody.

📉 What the Data Shows

Exchange-held XRP is near levels not seen in years

The decline has persisted despite price fluctuations

This trend signals reduced short-term selling intent

Historically, falling exchange balances indicate tightening liquid supply, since assets held in private wallets are less likely to be sold immediately. If demand rises while supply on exchanges remains limited, price reactions can become more aggressive.

🔐 Self-Custody = Conviction?

Diana framed this move as a structural change, not a temporary anomaly. Long-term holders often shift to self-custody when conviction increases or when they’re positioning for future developments.

In simple terms:

➡️ Fewer coins on exchanges = less instant sell pressure

➡️ Less sell pressure + rising demand = potential volatility upside

⚠️ Community Pushback: Escrow & Price Reality

Not everyone agrees with the bullish interpretation.

• Critics pointed to monthly escrow unlocks (~1B XRP ), arguing that true supply scarcity won’t exist until escrow is fully exhausted.

• Others noted that price has still struggled, questioning how bullish the exchange data really is in the short term.

These responses highlight an important reality: on-chain signals don’t work in isolation.

📊 The Bigger Picture

Exchange supply metrics don’t capture all circulating dynamics — but they do reveal how holders are behaving. Right now, XRP investors appear to be prioritizing control and long-term positioning over liquidity.

As $XRP trades through shifting market conditions, the interaction between:

Escrow releases

Exchange liquidity

Holder behavior

will remain a key factor in shaping future price action.

📌 Bottom line:

Exchange supply is tightening — but whether that translates into price strength depends on demand, sentiment, and macro conditions.