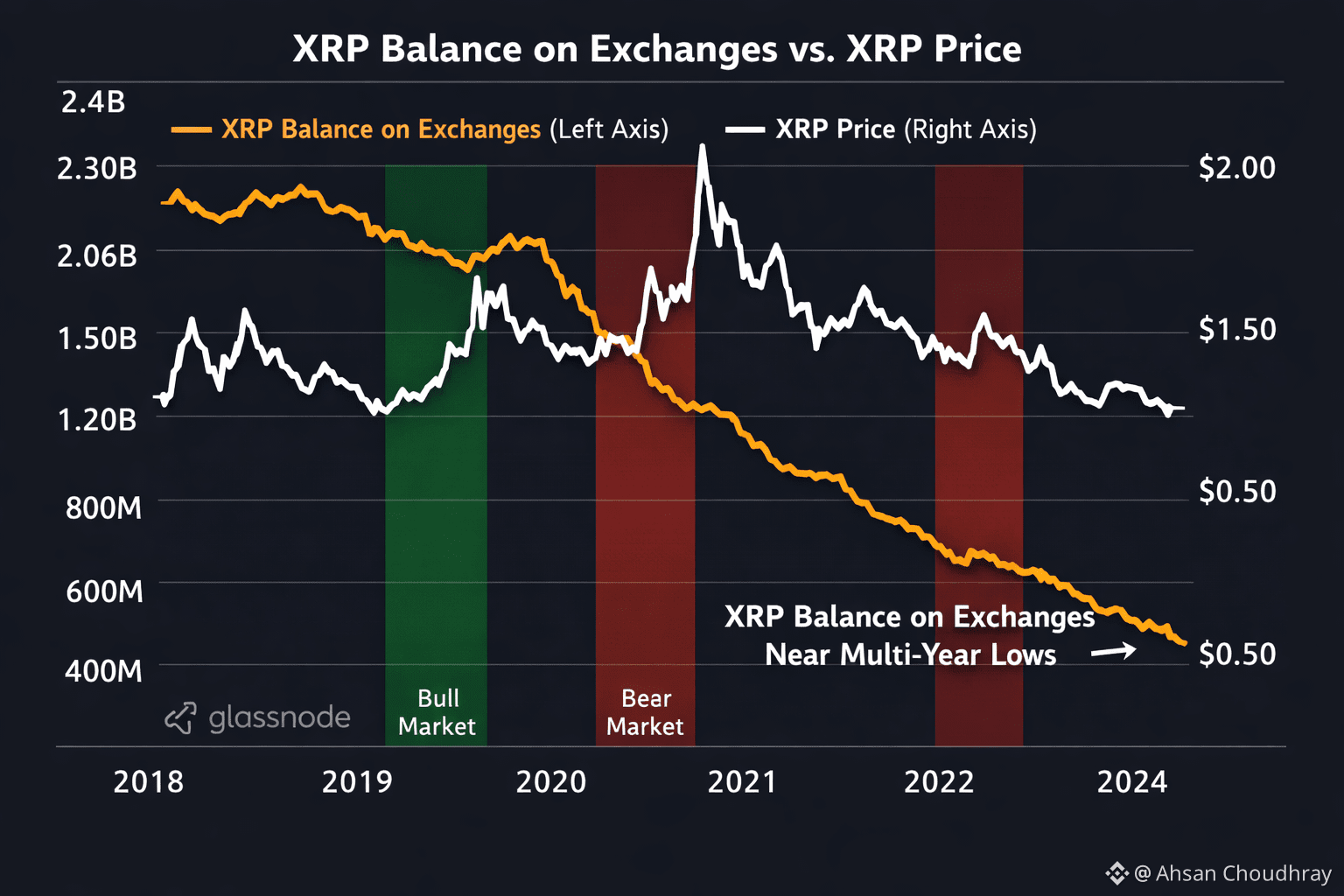

A crypto analyst known as Diana (@InvestWithD on X) has highlighted new on-chain data suggesting a notable drop in the amount of XRP held on centralized exchanges. According to her analysis, exchange-held XRP balances have fallen to levels not seen in several years, signaling a possible change in how investors are managing their holdings.

Diana points to data from Glassnode showing a consistent decline in XRP reserves on exchanges over multiple market cycles. Despite periods of price volatility, the overall trend indicates that more holders are transferring their XRP away from trading platforms and into private wallets. This behavior is often associated with lower short-term selling pressure, as assets kept in self-custody are generally less liquid.

She argues that shrinking exchange balances can reduce the immediately available supply, which may become important if demand increases. Rather than a temporary fluctuation, Diana views this as a longer-term structural shift, suggesting that investors may be positioning themselves with greater confidence by choosing self-custody over exchange storage.

However, her interpretation has sparked debate within the XRP community. Some critics have pointed out that Ripple’s monthly escrow releases—around one billion XRP—continue to add supply to the market. From this perspective, claims of tightening supply may be premature as long as these regular unlocks remain in place.

Others have questioned the bullish implications altogether, noting that XRP’s price has faced downward pressure even as exchange balances declined. They argue that on-chain data alone does not guarantee positive price movement, especially when broader market sentiment remains weak.

Overall, the discussion reflects a familiar tension in crypto analysis: balancing on-chain indicators with real-world supply mechanisms and price action. While falling exchange balances provide insight into holder behavior, factors such as escrow releases and market demand still play a critical role in shaping XRP’s price outlook.