Bias

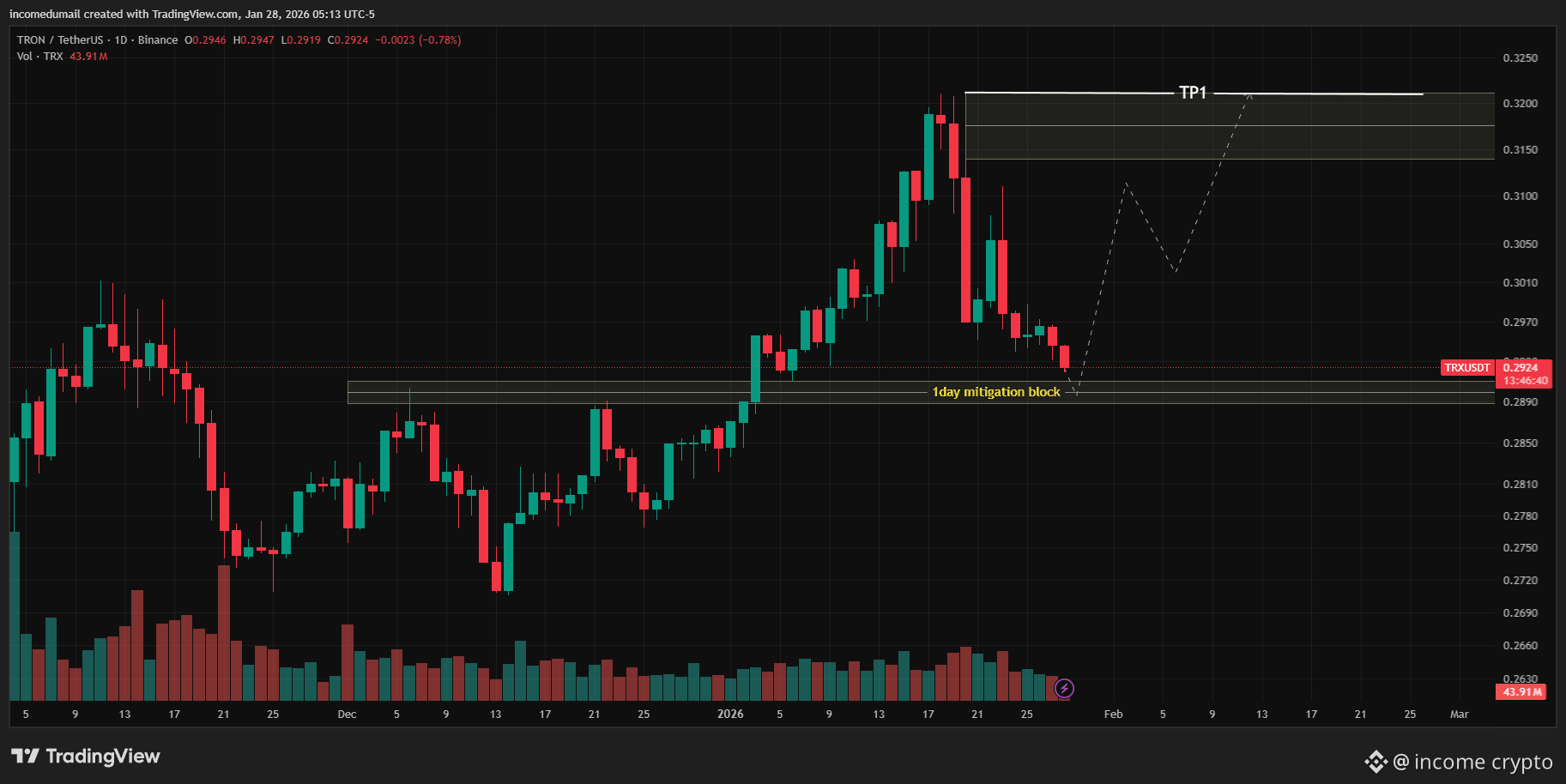

Bullish — mean-reversion into a daily mitigation block, targeting the recent supply zone. Trade idea conditional on block holding.

Entry

Primary (scale): 0.289 – 0.294 (buy into the 1-day mitigation block)

Aggressive (breakout): 0.298 – 0.300 (retest/hold after initial bounce)

Stop

0.278 — below the mitigation block and nearby structure low. If this truthfully breaks, the setup is invalid.

Targets

T1 (partial): 0.310 — first resistance / logical profit-taking zone.

T2 (full): 0.322 — mapped supply / TP1 on your chart.

T3 (stretch): 0.335 — extended continuation if momentum and BTC cooperate.

Why

• Price is in a higher-timeframe uptrend and currently retracing into a clearly defined daily mitigation block.

• Block sits on prior support/resolved liquidity — appealing place for buyers to re-enter.

• Pullback shows orderly selling (no violent distribution wick), increasing odds of a clean mitigation test then continuation.

• Reward profile is skewed: tight stop under the block, multiple nearby targets above.

Risk

• Daily break below the block = bull trap; the stop is intended to cut that quickly.

• False bounces possible — scale in and size position so one failed test doesn’t ruin the account.

• Keep position risk to a preset % (1–2% per trade) and take partials at T1; move stop to BE after first partial.

TO TRADE CLICK BELOW