Many new traders want to make quick profits with futures trading, but most of them do not understand the basic concepts and risks.

This usually leads to unnecessary liquidations, blown accounts, and emotional stress.

In this post, we will cover what futures trading is, how it works, and which key rules every beginner should follow before opening a single position.

1️⃣ What Is Futures Trading?

In futures trading, you do not directly own the asset (like $BTC or $ETH ).

Instead, you trade contracts that track the price movement of the asset.

You can potentially profit in both directions:

Go Long if you expect the price to move up.

Go Short if you expect the price to move down.

If your analysis is correct, you make a profit; if it is wrong, you take a loss, often faster than in spot trading.

2️⃣ How Leverage Works

Leverage means the exchange gives you additional buying power on top of your own capital.

Example: If you have 10 USDT and use 10x leverage, you can open a position worth 100 USDT.

Leverage multiplies both profit and loss.

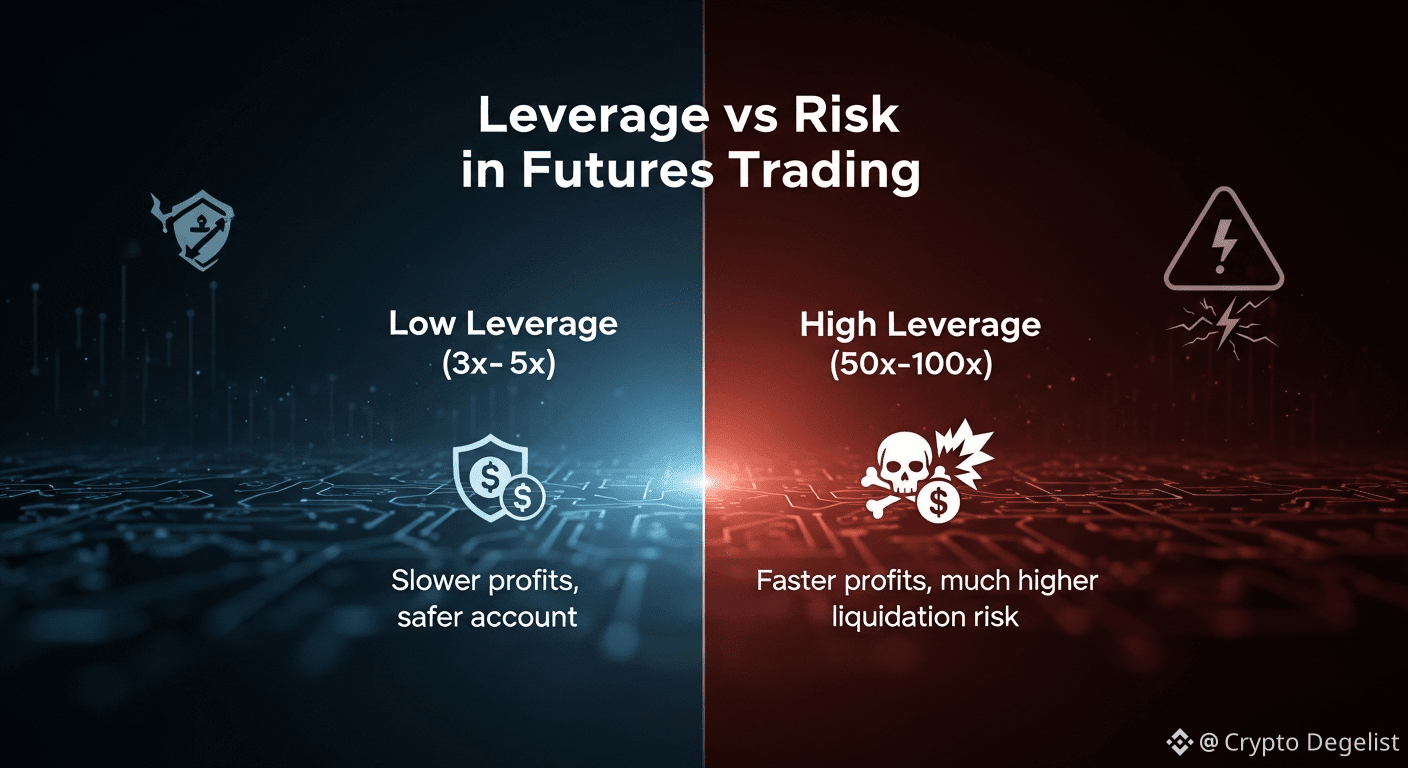

For beginners, high leverage (20x, 50x, 100x) is extremely dangerous.

It is much safer to start with low leverage (3x–5x) only after you properly understand risk management.

3️⃣ Key Futures Terms You Must Know

Margin:

The amount of your own capital that you put into a futures position. This is the real money you are risking.Liquidation:

When your losses reach a certain level, the exchange will automatically close your position to protect the remaining margin. This is called liquidation.Stop Loss (SL):

A pre‑defined price level where your position will be closed automatically to limit your loss.Take Profit (TP):

A pre‑defined level where your trade will close in profit so you don’t give everything back due to greed or sudden reversals.

4️⃣ Five Golden Rules Before You Trade Futures

Only risk money you can afford to lose

Futures is a high‑risk product, not a get‑rich‑quick shortcut.Never enter a trade without a plan

Always define your entry, stop loss, take profit, and risk per trade before you open a position.Use small, controlled risk per trade

A common rule is to risk only 1–2% of your total capital on a single trade.

If you have 100 USDT, your maximum acceptable loss per trade should be around 1–2 USDT.Avoid high leverage, especially as a beginner

Do not copy screenshots or random traders using 50x or 100x leverage.

Even a small move against you can wipe out your entire position.Control your emotions

Avoid FOMO entries (chasing a coin after a big pump).

Avoid revenge trading (increasing position size just to recover a previous loss).

5️⃣ How Should a Beginner Start?

First, learn basic chart concepts on spot trading: candlesticks, trends, support and resistance, and volume.

Then move to futures with small capital (for example, 10–20 USDT) and low leverage.

Always set both SL and TP, and keep a simple trading journal where you record:

Why you took the trade

Your entry, SL, TP

The result and what you learned

6️⃣ Quick Takeaways

Futures trading lets you trade price movement with leverage instead of owning the asset directly.

Leverage is a powerful tool but can destroy your account if used without risk management.

Consistency, discipline, and emotional control are more important than one lucky high‑leverage win.

⚠️ Disclaimer

This content is for educational purposes only and should not be considered financial or investment advice.

Futures and crypto trading are highly risky, and you can lose part or all of your capital.

Always do your own research (DYOR) and make decisions according to your own financial situation and risk tolerance.