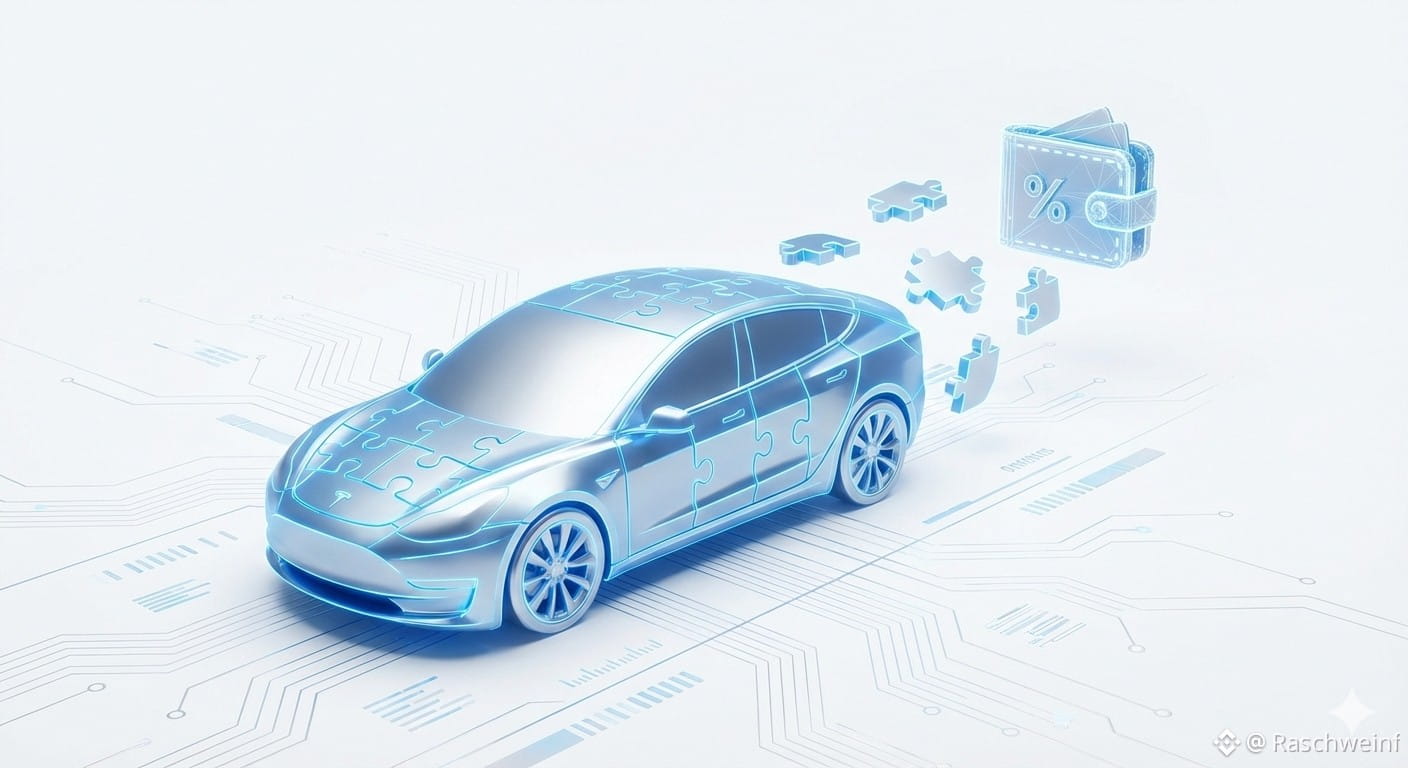

Ever imagined trading Tesla stock on a Sunday at 2 a.m.? The investment world is currently undergoing a major evolution, as the boundaries between the traditional stock market and the crypto ecosystem begin to blur. One of the most striking innovations is the emergence of the TSLA Token. This instrument was designed as a bridge for investors seeking exposure to Tesla, Inc.'s stock price without having to deal with the often rigid bureaucracy of conventional stock exchanges and time zone constraints.

In the Web3 world, this is no longer just a dream. The TSLA Token serves as a bridge for investors seeking high efficiency, allowing you to gain exposure to the stock price of Elon Musk's giant company directly from your digital wallet without having to leave the crypto ecosystem.

Interestingly, this innovation is completely redefining the way we interact with capital markets; from 24/7 access without traditional brokers to potential integration with DeFi protocols like staking and lending. However, it's important to remember that this market never sleeps. Be sure to remain vigilant about the potential volatility risks, especially with speculative token versions, because despite its convenience, the risks are commensurate with its potential.

What Are the Advantages?

The main advantage of tokenization is global accessibility. While previously purchasing US company shares required an international brokerage account with a complicated verification process, now anyone with an internet connection can purchase them in token form. Furthermore, the crypto market operates 24/7, meaning you can transact at any time, even when Wall Street is closed.

In terms of functionality, tokens like TSLAx or TSLAon allow for fractional ownership. You don't need to buy a full share if you have limited capital; you can buy fractions based on your budget. Furthermore, these assets can be integrated into DeFi protocols for staking or as collateral in lending, providing additional utility that wouldn't be possible if the shares were simply sitting in a traditional brokerage account.

Risks and Weaknesses to Watch Out For

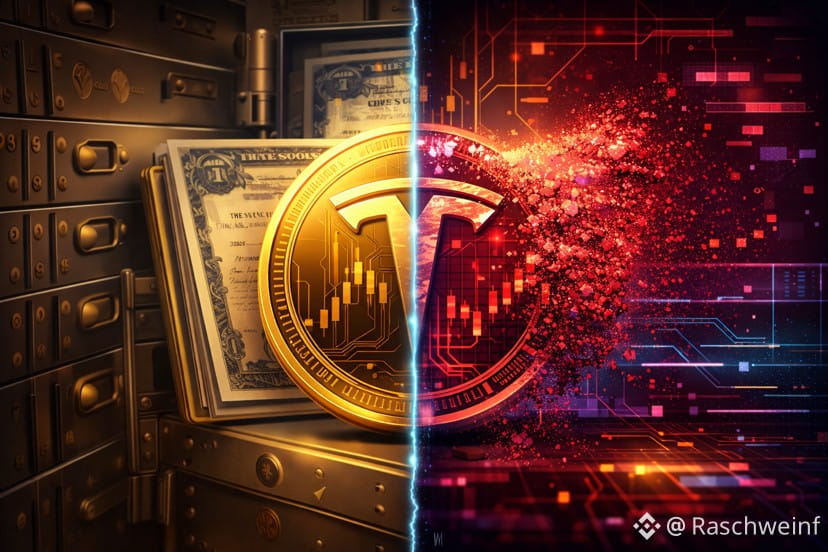

However, despite its convenience, this instrument has a critical gap. The main issue is regulation. Due to their gray area nature, investor protection for these types of tokens is not as strong as for real stocks regulated by regulatory bodies like the SEC. If the token platform experiences legal or technical issues, your assets could be at risk.

Furthermore, investors must carefully distinguish between Asset-Backed Tokens and Meme Versions. Tokens on networks like Solana are often purely speculative and not backed by real-world stocks. Their prices can fluctuate wildly based solely on social media trends, not the fundamental performance of Tesla. Furthermore, there are smart contract risks and reliance on a third party (the token issuer) to ensure the price remains in sync with the market price of the underlying stock.

Conclusion

The TSLA token is an innovation that offers new financial freedom, but it requires a higher level of vigilance. For those interested in trying it, be sure to always do your own research and understand whether the token you choose is backed by real assets or is merely a speculative asset.