Plasma is built around a simple promise that feels surprisingly rare in crypto payments, make stable value move like the internet without asking people to learn the internet first. The focus is stablecoin first design where everyday transfers are treated as the main workload, not a secondary feature that competes with everything else. That is why the communication from plasma keeps returning to the same themes, speed that feels instant, fees that stay predictable, and an experience that does not punish users for wanting to send money rather than trade. The network token XPL sits inside this design as the coordination layer that helps the chain run while the payment experience stays stablecoin native. #Plasma  The deeper idea is not just higher throughput, it is removing the small frictions that quietly kill adoption. A normal person does not want to manage multiple assets just to pay a fee, does not want to watch a transaction hang while a timer spins, and does not want a payment to become expensive because the network got busy. Plasma aims to make the default path smooth, so the stablecoin someone already holds can be used as the natural unit of movement while the chain handles execution efficiently in the background. When this works, payments stop feeling like a technical action and start feeling like a basic function, send, receive, settle, done.

The deeper idea is not just higher throughput, it is removing the small frictions that quietly kill adoption. A normal person does not want to manage multiple assets just to pay a fee, does not want to watch a transaction hang while a timer spins, and does not want a payment to become expensive because the network got busy. Plasma aims to make the default path smooth, so the stablecoin someone already holds can be used as the natural unit of movement while the chain handles execution efficiently in the background. When this works, payments stop feeling like a technical action and start feeling like a basic function, send, receive, settle, done.

A practical part of Plasma’s approach is compatibility with common smart contract development patterns so builders can ship without reinventing their stack. This matters because payment networks win through applications, not slogans. If developers can deploy familiar contract logic, integrate familiar wallet flows, and reuse familiar tools, then attention shifts from learning a new environment to improving user experience. Plasma’s goal is to make stablecoin applications feel native from day one, merchant checkout, subscription billing, payroll style payouts, marketplace revenue splits, and settlement logic that can run automatically without turning each transaction into a complex ceremony.

Plasma also leans into the reality that payment systems must feel dependable before they feel exciting. That means a design that can handle bursts of activity without turning small transfers into expensive transfers, and a design where the confirmation experience feels predictable enough for commerce. People do not measure a payment rail by how clever the architecture is, they measure it by whether it works the same way every time. The ambition here is to make stablecoin movement routine at scale, not just possible, and that requires both performance and discipline in how the network prioritizes the payment workload.

A more advanced layer of the story is how Plasma thinks about settlement confidence and cross network movement. Any chain that wants to be a serious payment rail must address how value comes in and how value exits, especially when users want to move funds across ecosystems or anchor their trust in something they already view as durable. Plasma’s approach emphasizes a bridge model that aims to reduce trust assumptions, so that moving value is not just fast, but also structured in a way that feels credible to cautious users and builders. The exact mechanics matter less than the principle, payments infrastructure has to be safe in design, not only convenient in marketing.

Privacy is another area where payment networks separate themselves from general purpose chains. Many users do not want their spending to be public by default, and many businesses cannot treat supplier payments, payroll flows, or customer invoices as openly visible data. Plasma’s direction includes privacy aware payment options so builders can design experiences that protect normal commercial confidentiality. The best payment privacy is not secrecy for drama, it is privacy that feels like everyday dignity, the kind that lets people transact without broadcasting their entire financial life.

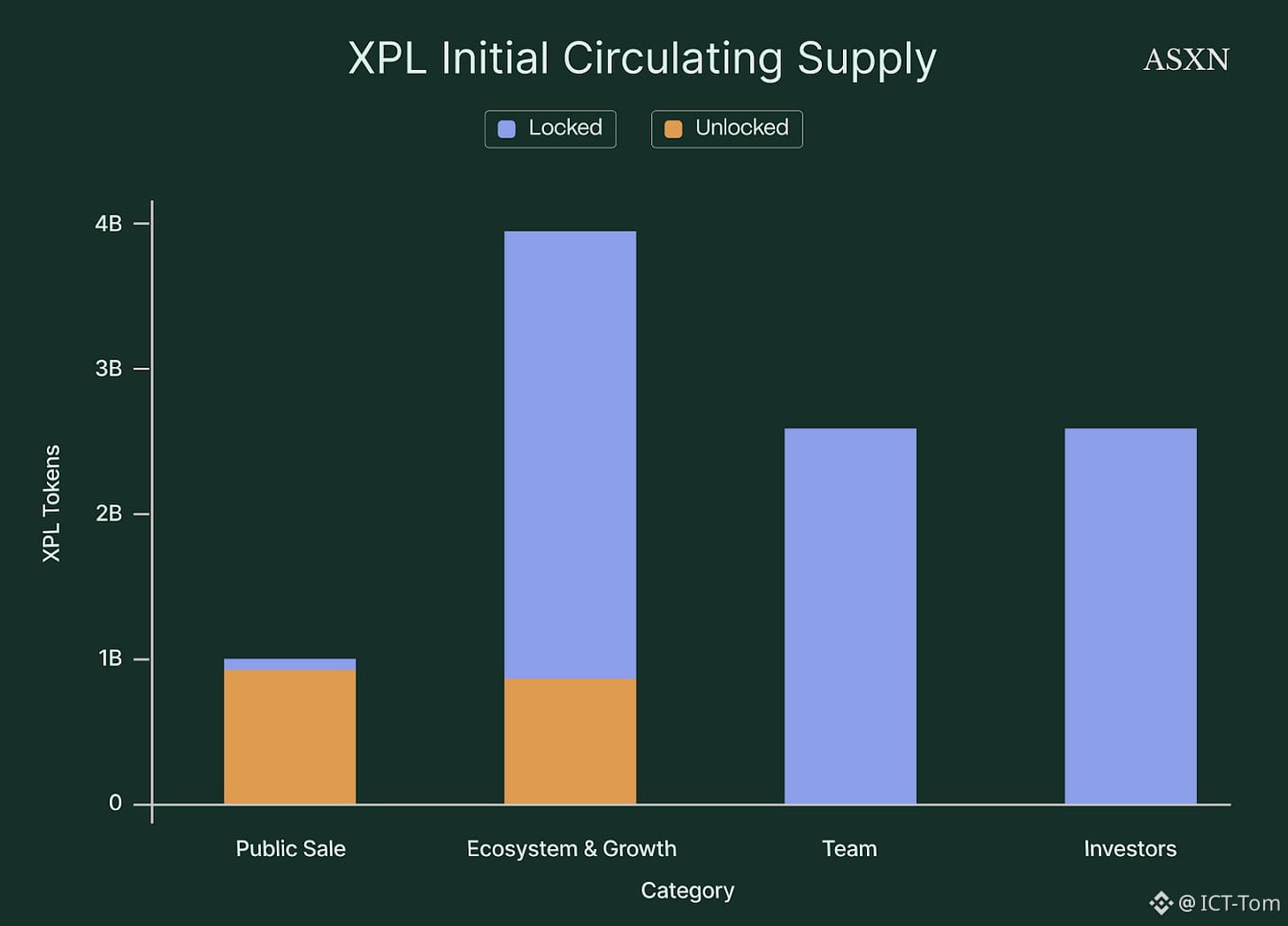

The role of $XPL becomes clearer when the chain is viewed as an operating system for payments rather than a speculative toy. A network needs validators or equivalent participants, incentives to keep them honest, and economics that make reliability sustainable over time. That is where $XPL typically fits, aligning network security and performance with long term participation so the system does not depend on temporary attention. If Plasma succeeds, the average user may rarely think about $XPL directly, while builders and infrastructure participants care about it deeply because it underwrites the chain’s consistency.

What makes Plasma feel different conceptually is the idea of stablecoin liquidity as a first class resource rather than something that arrives slowly after years of ecosystem building. A payment chain becomes useful when it is liquid, because liquidity is what makes settlement smooth and routing efficient. When liquidity is shallow, payments fragment and apps hesitate to rely on the network. Plasma’s vision is to start from a liquidity rich foundation so the network can behave like a real rail early, giving builders confidence to launch products that depend on stable value movement rather than treating stablecoins as a side feature.

From an application point of view, Plasma’s most exciting future is not one killer app, it is a new category of normal apps that finally work well with stable value. Think micro subscriptions that charge by usage instead of by month, creator payouts that settle continuously instead of weekly, contractor payments that arrive when milestones are met rather than when a bank window opens, and merchant checkout that feels like tapping a button rather than managing a portfolio. These are not fantasy use cases, they are basic business workflows that become more efficient when money moves fast, cheaply, and predictably.

The strongest signal of maturity will be the boring metrics that normal users feel without naming them. Do payments remain cheap when usage surges, do confirmations feel consistent, do wallets remove steps rather than add steps, do merchants trust it enough to route real sales through it, do developers build and keep building because the experience stays reliable. A payments chain is judged by the absence of drama. When people stop talking about the rail and start talking about what they built on it, that is when the infrastructure has crossed the line into real adoption.

There are also real risks to name honestly because humanized writing is not only hype. Any payments focused network must prove resilience under stress, must keep the user journey simple even as features expand, and must avoid complexity that leaks into the interface. Bridges must be engineered with care because cross network movement is often where trust is tested. Token economics must avoid turning the user journey into a tax. And the network must remain focused, because payment rails lose their edge when they chase every trend instead of perfecting the one job they set out to do.

Plasma’s story is compelling because it is grounded in a single human truth, people want money to move without thinking about it. The future that fits this truth is one where stablecoins feel like everyday cash, apps feel like everyday tools, and the chain stays quietly dependable while builders create the experiences users actually touch. If that future lands, plasma becomes less like a brand and more like a background utility, while $XPL continues its role as the internal alignment engine that helps the network stay secure and performant as it scales. #Plasma $XPL @Plasma