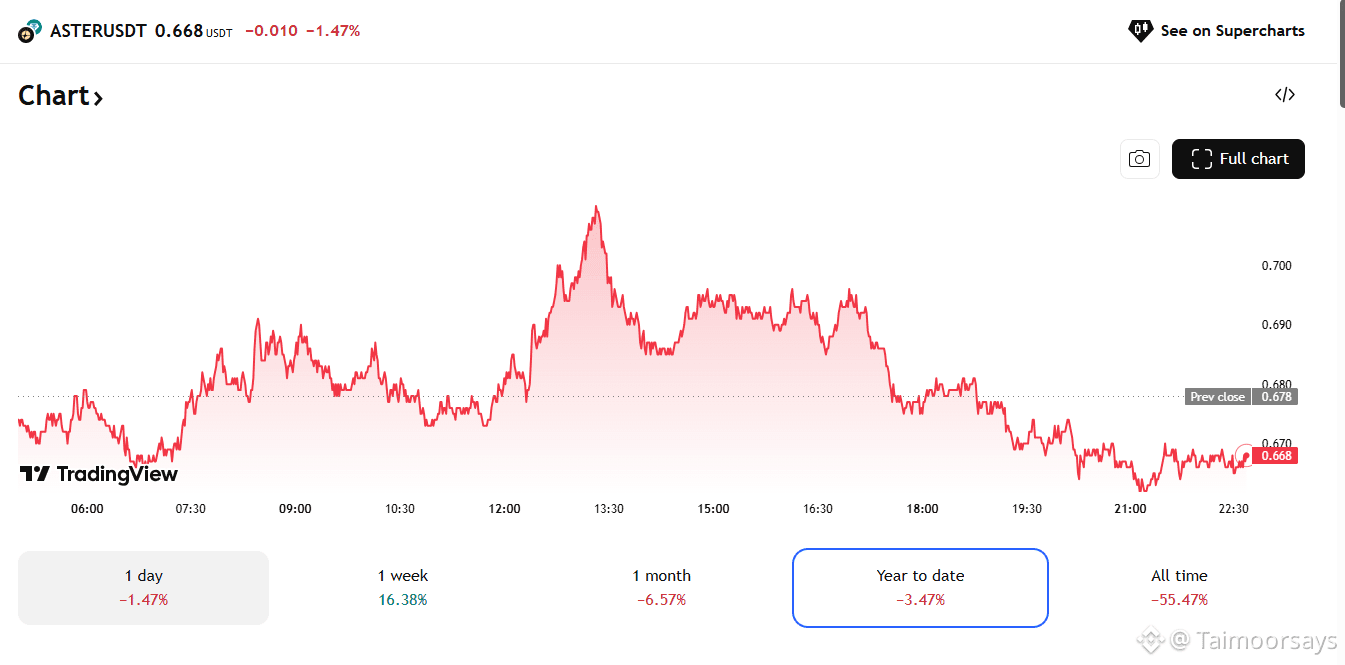

(As of late January 28, 2026 – current price ≈ $0.64 – $0.71 USD, varying slightly across exchanges like CoinMarketCap ~$0.64, TradingView ~$0.67, Coinbase ~$0.71)

$ASTER is the governance/utility token of Aster DEX (formerly Astherus/APX merger), a next-gen decentralized perpetual futures + spot exchange. It supports multi-chain trading (BNB Chain primary, plus Ethereum, Solana, Arbitrum), high-leverage perps (up to 100x+), MEV resistance, yield-bearing collateral (like asBNB/USDF), and even 24/7 stock perps. Backed by YZi Labs (CZ's family office), it launched/rebounded hard in late 2025 with massive hype around airdrops, volume, and positioning as a Hyperliquid competitor. Token supply: 8B max, ~2.5B circulating, with heavy community allocations (53.5% for rewards/airdrops) + buyback mechanics from protocol fees.

Current Price & Market Snapshot

Live Price: ~$0.64–$0.71 USD (slight +1–2% in last 24h on some trackers, but mixed with recent dips)

24h Volume: $140M–$240M+ (very healthy for a mid-cap DeFi token)

Market Cap: ~$1.65B–$1.78B (rank ~#45–#68)

ATH: Around $3.00 (early Oct 2025 post-launch pump)

Recent Low: ~$0.55 (mid-Jan 2026)

Key Candlestick Patterns (Daily / Weekly Timeframes)

Weekly Chart

→ Massive green impulse candles in Sep–Oct 2025 during the explosive launch/rebrand pump (from sub-$0.10 to $3+).

→ Late 2025/early 2026: Formed large upper-wick candles (shooting star / rejection patterns) at highs → classic profit-taking + hype fade.

→ Recent weeks: Smaller red/green bodies with long shadows → consolidation/accumulation after ~75–80% drawdown from ATH. Holding above $0.55–$0.60 support zone so far, no strong bearish engulfing breakdown.

Daily Chart

→ Post-ATH correction: Series of red candles dominating into Jan 2026 lows (~$0.55).

→ Last 1–2 weeks: Alternating small candles, recent minor green pushes → trying to form higher lows around $0.60–$0.65.

→ Current action: Tight range with dojis/spinning tops + short wicks → volatility compression. No decisive breakout green engulfing above $0.75–$0.80 resistance yet, but also no panic-volume red candles cracking lower supports.

→ Pattern vibe: Coiling sideways after big correction — typical for DeFi tokens post-hype, often preceding next leg if volume sustains.

Quick Technical Outlook

Bullish case (green candles dominate):

Strong close above $0.80–$0.90 with volume surge → could target $1.20–$1.50 fast (re-test of prior consolidation).

Catalysts: Upcoming Aster Chain L1 launch (Q1 2026), staking rollout (Q2), sustained high perp volume, more airdrop/points farming hype.

Bearish risks (red candles take over):

Break below $0.55–$0.60 support → risks re-test $0.40s or lower if broader altcoin weakness hits.

Macro/DeFi rotation away from perps could pressure it further.

Most likely right now: Neutral to mildly bullish in consolidation. High volume relative to cap + ecosystem utility (perps, yields, governance) keeps it interesting vs pure memes. Chart looks coiled rather than broken — watch for a strong green candle breakout to signal renewed momentum in this DeFi perp narrative.