The promise of stablecoins was simple: move dollars at internet speed. But the infrastructure they run on wasn’t built for that job. Ethereum was designed for smart contracts. Bitcoin for immutability. Solana for throughput. None were purpose-built as settlement rails for dollar-pegged assets moving constantly between wallets, exchanges, and payment processors.

That mismatch shows up in daily friction. Users paying gas in ETH to move USDT. Treasury systems holding volatile tokens just to settle payments. Transfers waiting for block confirmations because consensus optimized for other priorities. The infrastructure wasn’t broken, it was solving a different problem.

Plasma starts from the opposite premise: what if stablecoin settlement was the core function of the chain? Not a side use case. The foundation.

The design reflects that. PlasmaBFT delivers sub-second finality because payment systems can’t operate on probabilistic timelines. When a merchant gets paid, payroll executes, or collateral moves, confirmation must be fast enough to disappear operationally. Deterministic finality matters more here than maximum theoretical throughput.

The gas model also changes. On most chains, you pay gas in the native token whether you’re doing complex DeFi or sending money home. Plasma separates those roles. USDT transfers can be gasless, while heavier computation pays in XPL. That difference is structural. A payment rail that forces users to source a volatile gas asset adds friction exactly where stablecoins are meant to remove it. No finance team wants to explain why moving dollars required buying another token first.

Full EVM compatibility through Reth ensures developers don’t abandon tooling or codebases to use specialized settlement rails. Adoption rarely happens in greenfield conditions. Accounting software, treasury platforms, and payment processors integrate through existing Web3 standards. Compatibility here reduces integration from a migration project to a configuration step.

Specialization raises a neutrality question. Infrastructure supporting dollar settlement cannot rely on the shifting priorities of a single validator group. Plasma anchors its state to Bitcoin, inheriting Bitcoin’s security and censorship resistance without pushing stablecoin logic onto Bitcoin itself. Bitcoin acts as a security base layer, a role it has proven for over a decade.

Traditional payment rails highlight the contrast. SWIFT takes days. Card networks settle fast but allow chargebacks weeks later. Even fintech rails operate within banking boundaries that define who can participate. Stablecoin settlement on specialized infrastructure removes those limits: near-instant finality, 24/7 availability, transparent costs, and global accessibility. But delivering that consistently requires infrastructure where settlement is the main workload.

The demand already exists. Remittances, merchant payments in volatile-currency regions, trading collateral flows, and treasury automation all depend on fast, predictable stablecoin movement. When settlement speed, cost, or reliability become variables, they enter operational risk calculations. Purpose-built Layer 1 settlement aims to remove that variable entirely.

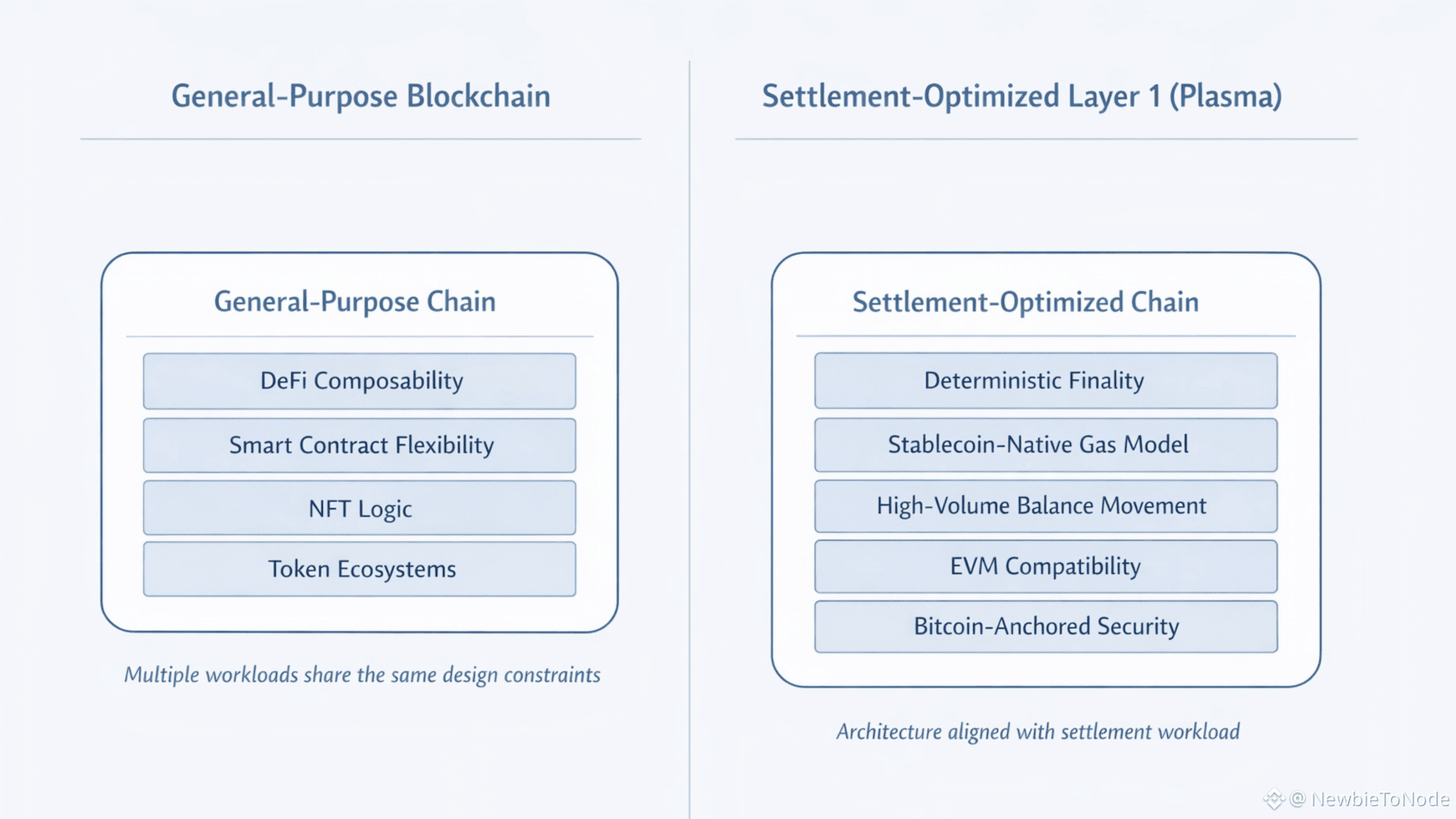

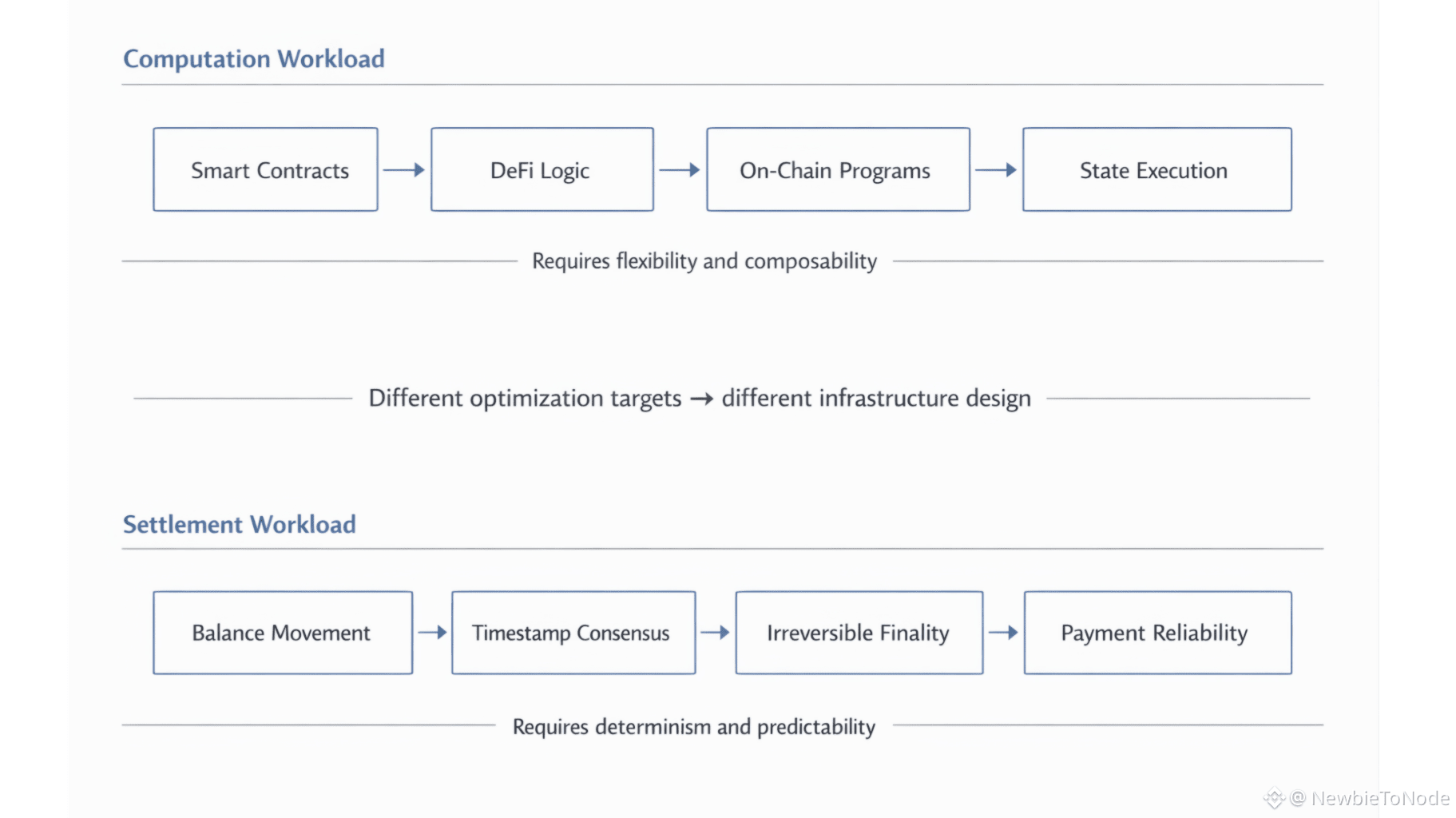

The deeper insight is that settlement and computation are different workloads. DeFi needs composability. Payment rails need irreversible confirmation. NFT platforms need expressive contracts. Stablecoin settlement needs reliable balance movement and timestamp consensus. Optimizing one chain for all of these leads to compromises. Running global payment settlement on general-purpose chains is like running airport traffic control on gaming servers — capable, but not designed for that responsibility.

This isn’t criticism of general-purpose blockchains. They were built for different priorities. But as stablecoins grow into global financial infrastructure, the question shifts from “can they run here?” to “should settlement have infrastructure designed specifically for it?”

Stablecoins moved money onto the internet. Plasma’s thesis is that the rails moving that money should treat settlement as the primary function — fast, predictable, compatible, and secure by design, not by adaptation.