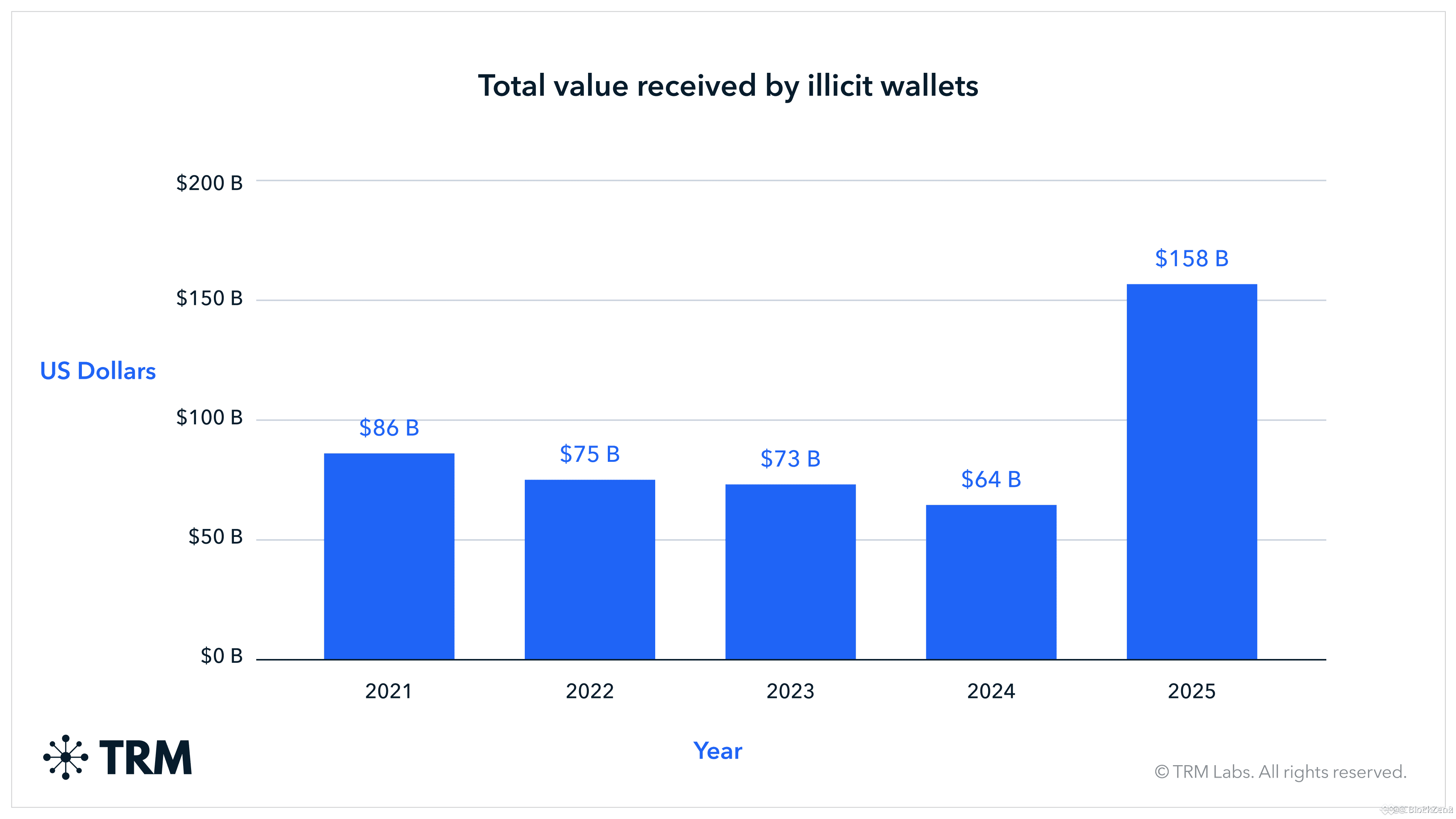

💥 A new TRM Labs report reveals that criminal groups generated an estimated $158 BILLION in illicit digital asset activity in 2025 — marking a sharp reversal after several years of declining illegal volumes.

But here’s the twist 👇

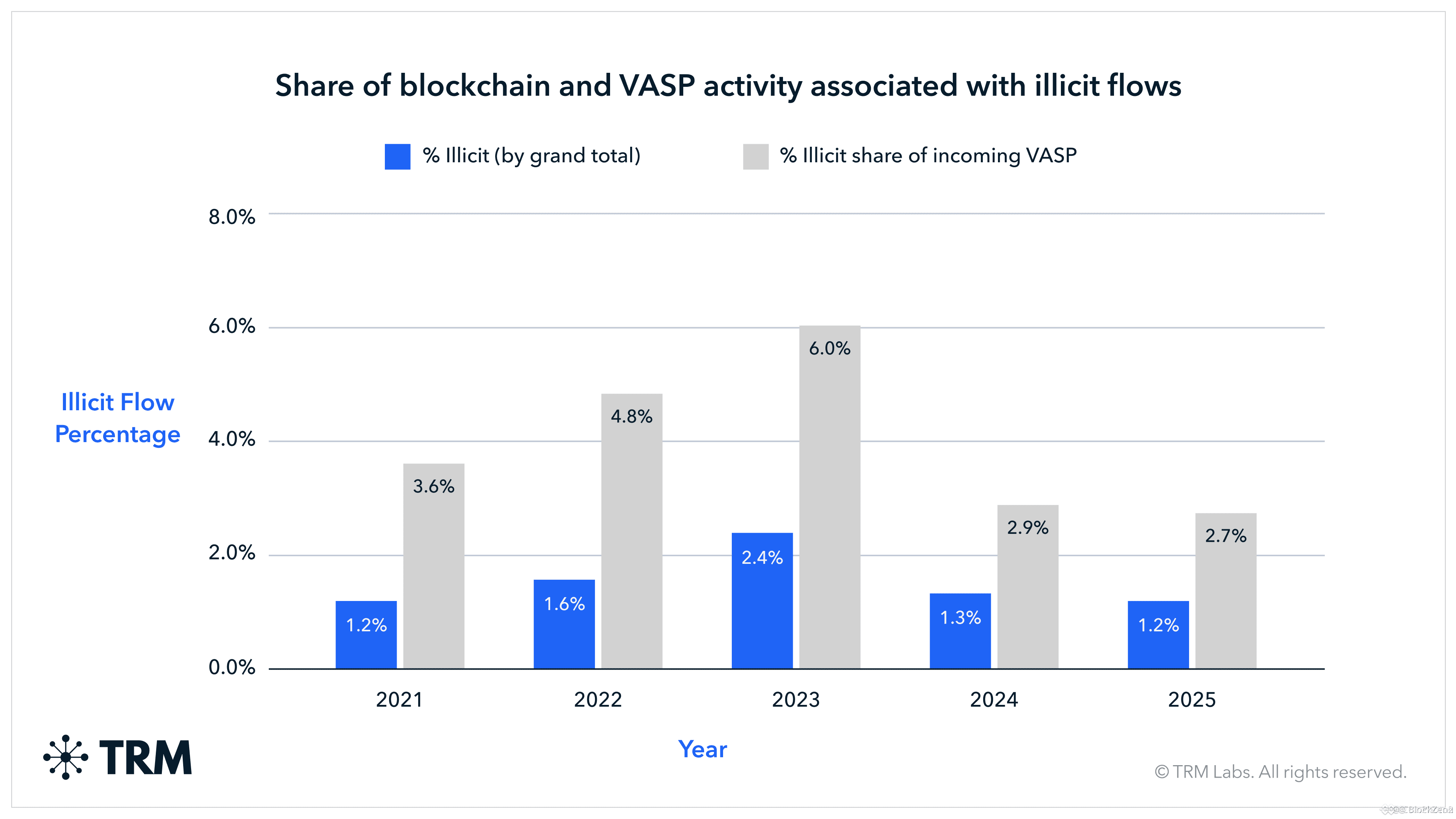

Despite the massive dollar figure, illicit activity represented only ~1.2% of total crypto volume, as overall market growth — especially in stablecoins — exploded.

📊 Bigger market. Bigger numbers. Smaller percentage.

🕵️♂️ WHO’S DRIVING THE SPIKE?

⚠️ State-Linked Operations Are Taking Over Criminal activity is becoming more organized, professional, and geopolitically driven.

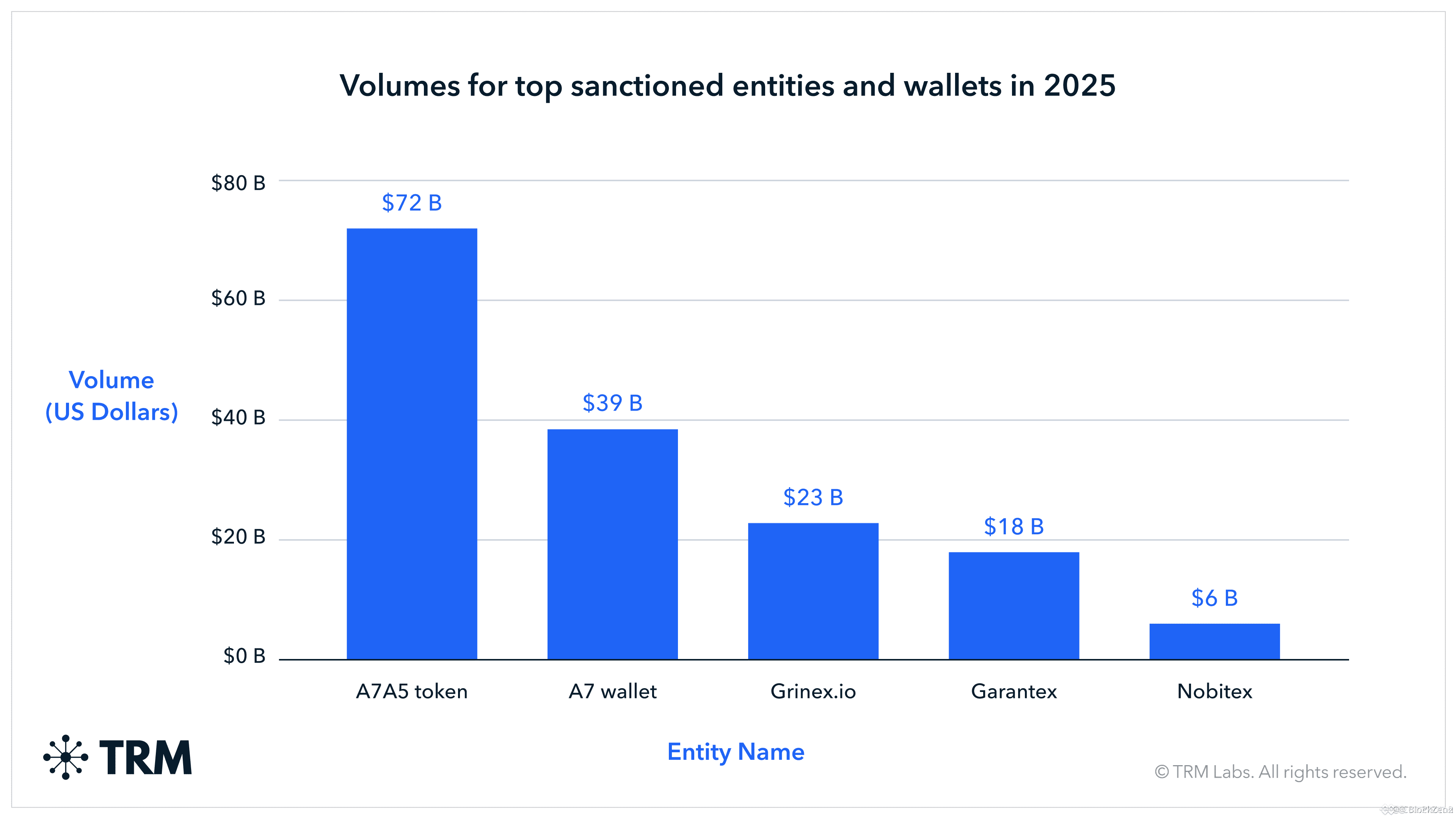

🇷🇺 Russia-linked networks

• Major surge in sanctions-evasion crypto flows

• Sophisticated infrastructure and layered laundering systems

• Cross-border payment routing using digital assets

🇰🇵 North Korea-linked groups

• Still dominant in exchange hacks and cyber theft

• Responsible for large-scale laundering operations

• Funds often recycled into weapons and state programs

This is no longer small-time cybercrime — it’s nation-scale financial warfare.

💣 HACKING DAMAGE IN 2025

💥 Nearly $3 BILLION stolen in crypto hacks

• A large portion tied to one major exchange breach

• Attackers now targeting core infrastructure & operational systems

• Not just smart contract bugs anymore

• Sophisticated intrusion techniques rising fast

Security risk has shifted from code flaws to system-level vulnerabilities.

🧼 HOW THE MONEY GETS CLEANED

🕸 Advanced laundering pipelines include:

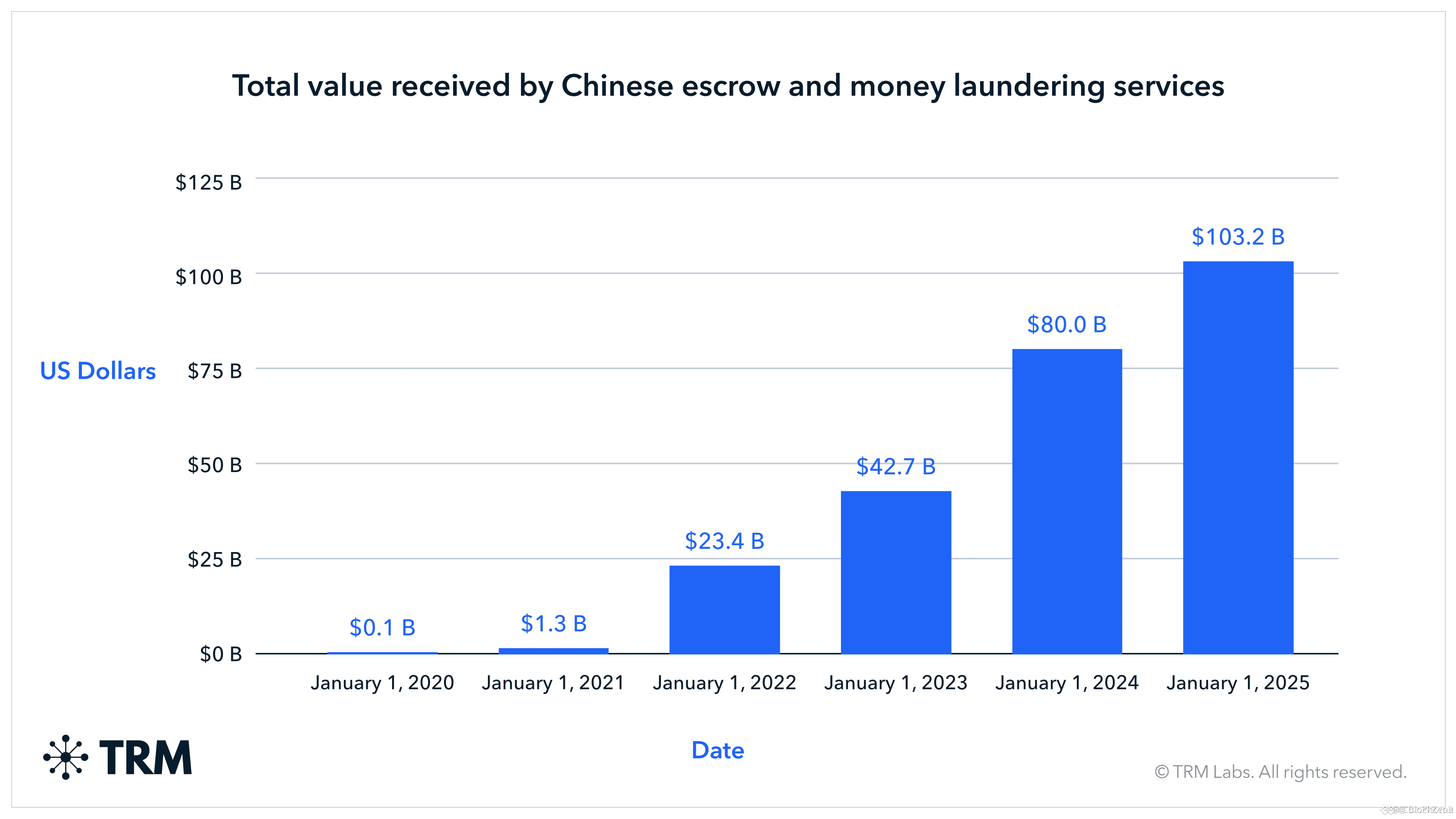

✔️ “Chinese laundromats” networks

✔️ Chain-hopping across multiple blockchains

✔️ Transaction fragmentation to avoid detection

✔️ Layered wallets and delayed settlement routes

TRM warns this professionalization makes asset recovery harder and drastically shrinks law enforcement response windows.

🏛 REGULATION PRESSURE HEATS UP

🇺🇸 These findings arrive as U.S. lawmakers debate crypto market structure legislation, with illicit finance remaining one of the biggest political pressure points.

Expect:

📌 Stronger compliance rules

📌 More exchange oversight

📌 Tighter stablecoin monitoring

📌 Increased blockchain surveillance

Regulation narratives could become a major market catalyst in 2026.

⚡ BOTTOM LINE

Crypto adoption is accelerating — but so is criminal sophistication.

Even though illicit flows are only 1.2% of total volume, the absolute dollar scale and geopolitical involvement raise serious regulatory and security implications for the entire industry.

👀 Traders and investors should monitor regulatory headlines closely — they may drive volatility across exchanges, stablecoins, and compliance-focused projects.

#CryptoNews #Blockchain #Regulation #CyberSecurity #Bitcoin #Stablecoins #TRMLabs #Web3 🚀