Let’s pause the noise and look at what markets have actually done, not what fear keeps screaming.

Every cycle, the same headlines dominate:

“Financial collapse incoming”

“Dollar is finished”

“Markets about to implode”

“War, debt, global instability”

The reaction is predictable: 👉 Investors panic

👉 Money rushes into gold

👉 Risk assets get dumped

Feels sensible — but history tells a very different story. 📊

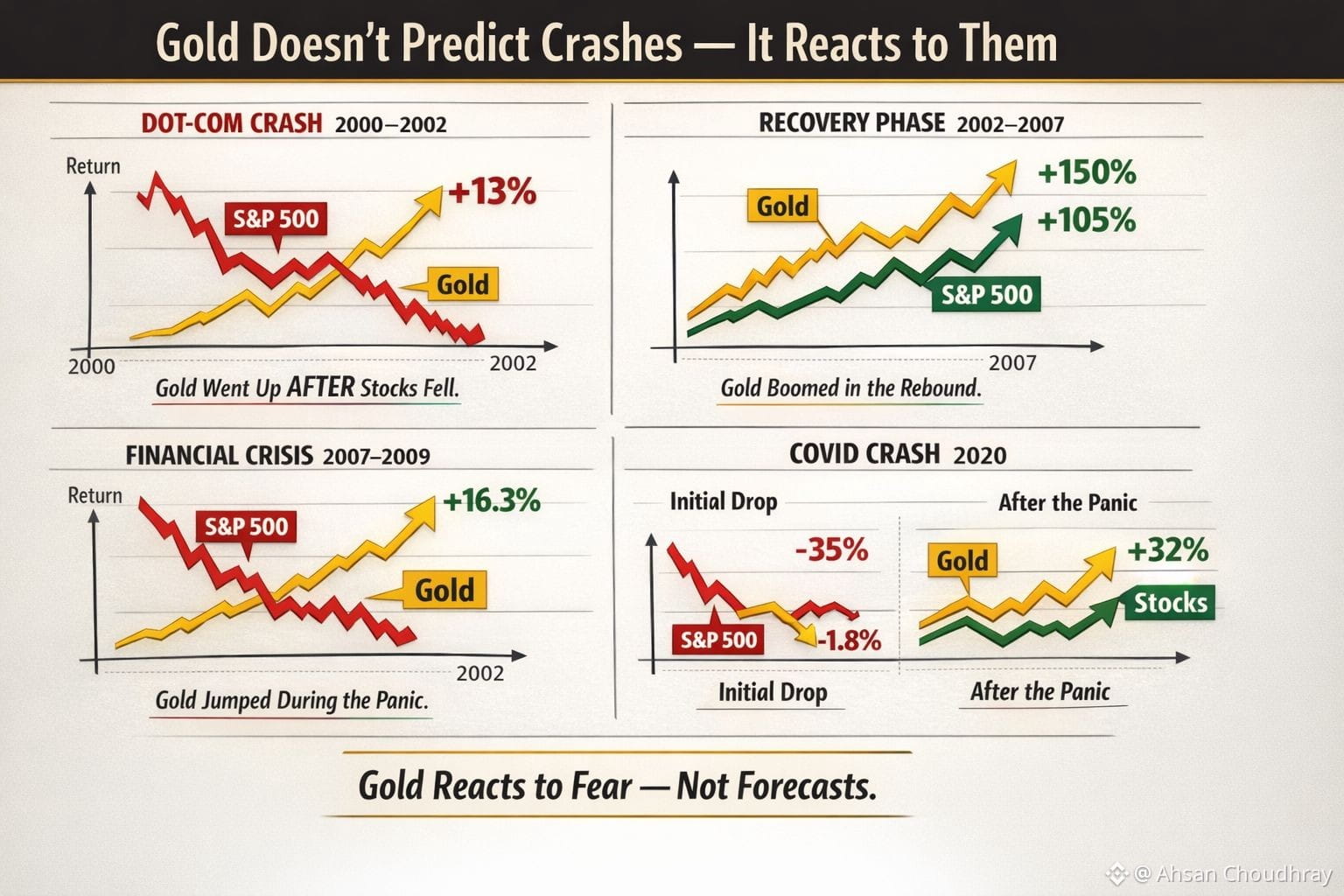

📉 How Gold Really Behaves in Crises

Dot-Com Bust (2000–2002)

S&P 500: -50%

Gold: +13%

➡️ Gold didn’t lead the move. It rose after stocks were already bleeding.

Post-Crash Recovery (2002–2007)

Gold: +150%

S&P 500: +105%

➡️ Fear lingered, and gold benefited during the healing phase.

Global Financial Crisis (2007–2009)

S&P 500: -57.6%

Gold: +16.3%

➡️ Gold worked — but as a panic hedge, not a warning signal.

🪤 The Part Most People Ignore

2009–2019 (No Crash, Just Expansion)

Gold: +41%

S&P 500: +305%

➡️ A full decade where gold holders paid the opportunity cost.

COVID Shock (2020)

S&P 500: -35%

Gold: -1.8% initially

After panic settled:

Gold: +32%

Stocks: +54%

➡️ Same pattern again — gold moved after fear peaked.

⚠️ What’s Driving Gold Now?

Markets are overloaded with worries:

US debt & deficits 💰

AI bubble fears 🤖

Wars & geopolitics 🌍

Trade tensions 🚢

Political instability 🗳️

And once again, investors are piling into metals before any real breakdown.

That’s the mistake.

🚫 The Hidden Risk No One Talks About

If a major crash doesn’t happen:

Capital stays trapped in gold

Stocks, crypto, and real estate keep compounding

Fear-driven buyers miss years of upside

🧠 The Takeaway

Gold isn’t a crystal ball.

It doesn’t predict crashes — it reacts to them.

Treat it as insurance, not a prophecy.

Gold = response asset, not timing tool.