This is exploding right now and it changes everything about privacy in crypto payments. Everyone talks about blockchain transparency like it's purely a feature, but let's get real—businesses and individuals need financial privacy. Plasma just launched opt-in confidential transfers that let you choose when transactions are public and when they're private. This isn't some regulatory gray area. It's compliant, optional privacy that finally makes blockchain viable for real-world financial use cases.

Let's break down why this matters.

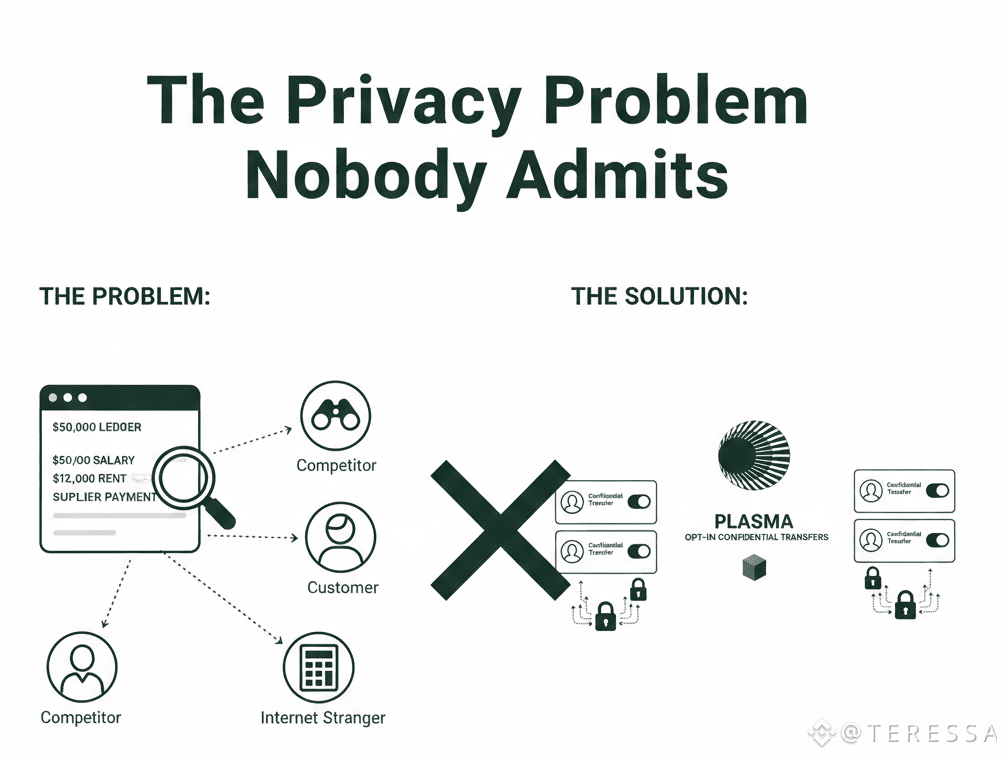

The Privacy Problem Nobody Admits

Here's what's broken about current blockchain payments: every transaction is permanently public. Your salary, your spending habits, your business deals—all visible to anyone who knows your wallet address. Competitors can track your supplier payments. Customers can see your margins. Random internet strangers can analyze your financial life.

This transparency is a dealbreaker for most real-world financial activity. Businesses can't operate with suppliers seeing every transaction. Individuals deserve basic financial privacy. The idea that "blockchain means public forever" has been holding back adoption for years.

Plasma's confidential transfers finally solve this without sacrificing the compliance that makes institutional adoption possible.

What Opt-In Actually Means

You control when privacy matters. Regular transfers remain public and transparent by default—perfect for situations where transparency adds value. But when you need privacy, you can opt into confidential transfers where transaction amounts and participants are shielded.

This isn't forced privacy that creates regulatory concerns. It's optional privacy that users activate when appropriate. Paying employees? Confidential. Donating publicly? Transparent. Business-to-business settlement? Confidential. The flexibility matches how people actually need to use money.

How the Technology Works

Let's get into the mechanics without drowning in cryptography. Plasma uses zero-knowledge proofs to verify transactions are valid without revealing amounts or parties involved. The network confirms you have sufficient balance and the transaction is legitimate, but observers can't see the details.

This cryptographic approach means privacy without trust assumptions. You're not relying on a trusted third party to keep secrets—the mathematics ensures privacy while maintaining network security. It's privacy with the same cryptographic guarantees that secure regular blockchain transactions.

Business Use Cases Transform

Everyone keeps asking what this enables. Here are concrete examples: companies can pay suppliers without revealing pricing to competitors. Payroll processes without broadcasting employee salaries on a public ledger. Treasury operations without exposing corporate cash management strategies. M&A negotiations where confidential payments don't leak deal terms.

These use cases are impossible with fully transparent blockchains. They're the reason businesses haven't adopted crypto payments at scale despite obvious advantages in speed and cost. Confidential transfers remove the blocker.

Individual Privacy Protection

Here's what matters for regular users: your salary doesn't appear on a public blockchain. Your rent payments don't expose your housing situation. Your purchases don't create a permanent record of your spending habits. Your donations remain private if you choose.

This privacy isn't about hiding illegal activity—it's about basic financial dignity. The same privacy you expect from your bank account, now available in stablecoin payments on Plasma.

Compliance Without Compromise

Confidential doesn't mean unregulated. Plasma's implementation includes features that let authorized parties—think regulators or auditors—verify compliance when needed. This isn't backdoor access anyone can use. It's structured transparency for legitimate regulatory purposes.

Businesses can operate with transaction privacy while still meeting audit requirements. Individuals get privacy while the network prevents money laundering and terrorism financing. The balance enables both privacy and compliance—not one at the expense of the other.

The Technical Security

Let's talk about what protects confidential transactions from attack. Zero-knowledge proofs are mathematically sound—they've been scrutinized by cryptographers for years. The implementation on Plasma has been audited by security firms. The privacy guarantees are as strong as the cryptographic security protecting regular transactions.

Users aren't trading security for privacy. They're getting both through properly implemented cryptography.

Comparing to Other Privacy Solutions

Everyone wants to know how this compares to privacy coins or mixing services. Here's the key difference: those approaches create regulatory friction and often attract illicit use. Plasma's opt-in model gives you privacy when needed while maintaining transparent transactions as the default.

This approach is viable for institutional adoption in ways that fully private networks aren't. Banks can use confidential transfers for legitimate business while regulators understand the system isn't designed primarily for opacity.

Network Performance Impact

Here's a practical concern: do confidential transfers slow everything down or cost more? The answer is surprisingly good—slight overhead compared to regular transfers, but still dramatically faster and cheaper than traditional banking. You're not sacrificing Plasma's performance advantages to gain privacy.

The technology is efficient enough for production use at scale, not just theoretical demonstrations.

What This Means for Adoption

Confidential transfers remove one of the biggest objections to blockchain payments. Businesses that couldn't consider public blockchain transactions can now use Plasma confidentially. Individuals who value privacy can adopt stablecoin payments without broadcasting their financial lives.

This expands the addressable market for Plasma dramatically. Every business that needs payment privacy—which is basically every business—can now use blockchain settlement without compromising competitive information.

The Privacy Rights Angle

Let's get philosophical for a moment. Financial privacy is a human right in most developed democracies. Your bank doesn't publish your transactions. Why should blockchain? Plasma's approach respects privacy rights while maintaining the transparency needed for network security and regulatory compliance.

This balance is how blockchain becomes infrastructure for mainstream finance rather than remaining a niche for people willing to sacrifice privacy.

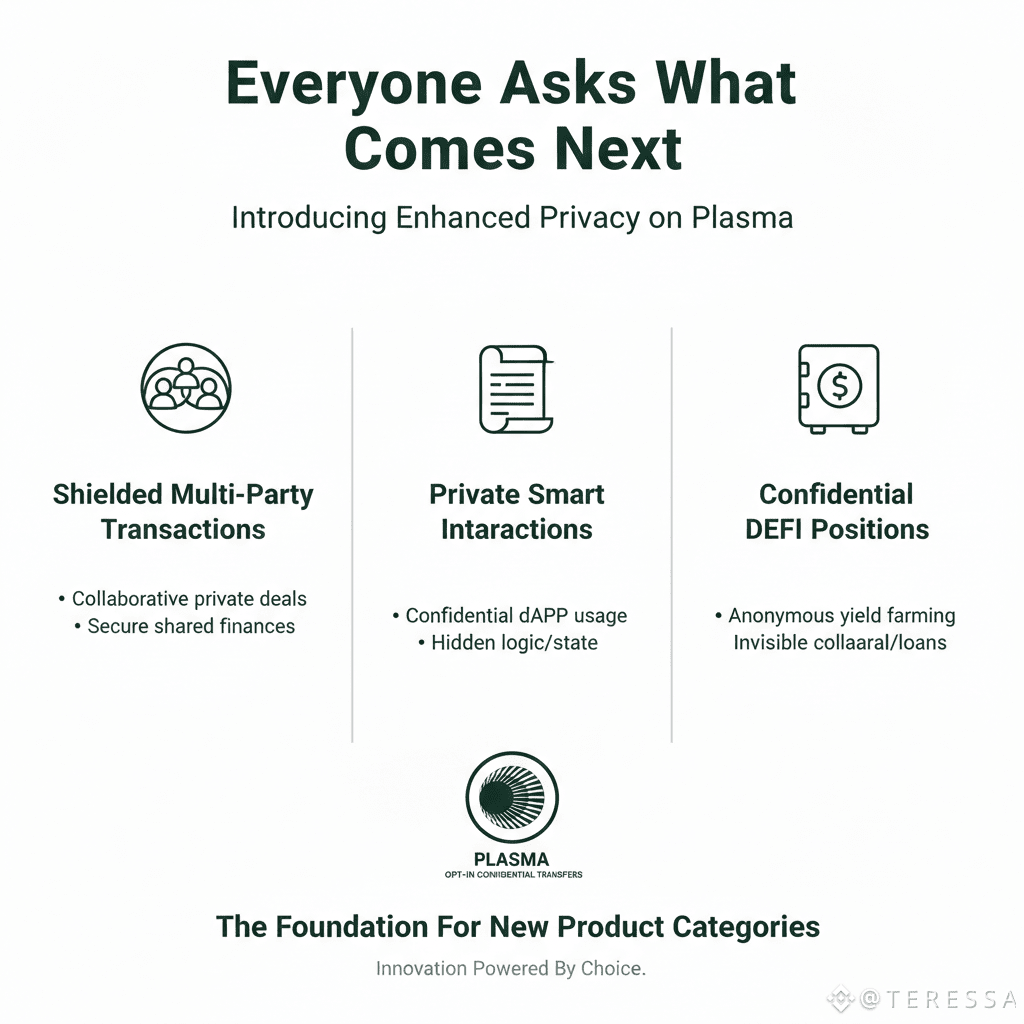

Future Development Roadmap

Everyone keeps asking what comes next. Plasma is exploring enhanced privacy features—shielded multi-party transactions, private smart contract interactions, confidential DeFi positions. The foundation of opt-in privacy opens up entire product categories that weren't previously viable.

The roadmap suggests privacy becomes a core competitive advantage for Plasma in attracting both institutional and individual users who need financial confidentiality.

Opt-in confidential transfers aren't just a feature—they're a fundamental shift in making blockchain payments viable for real-world use. Businesses get the privacy they need to operate competitively. Individuals get financial dignity. Regulators get the compliance hooks they require. And everyone gets the speed and cost advantages of Plasma settlement.

This is what blockchain payments needed to cross from crypto-native use cases to mainstream financial infrastructure. Privacy when you need it, transparency when you want it, and compliance throughout. That's not a compromise—that's the complete package that actually works for how people and businesses use money.