A Global Market Reset Is Quietly Taking Shape. 😲

What Is Happening Right Now Is Not Random, And It Is Not Isolated.

Most Investors Are Focused On Daily Price Action.

They Are Missing The Bigger Strategic Shift Playing Out In Real Time.

This Is Not About Headlines Or Emotions.

This Is About Energy, Power, And Capital Control.

VENEZUELA IS THE CENTERPIECE

Venezuela Holds The Largest Proven Crude Oil Reserves On Earth.

Roughly 303 Billion Barrels, A Strategic Asset Of Global Importance.

China Is Venezuela’s Primary Buyer.

Around 80–85% Of Venezuelan Crude Flows Directly To China.

That Oil Is Not Just Fuel.

It Is Leverage Over Manufacturing, Growth, And Inflation.

CUTTING ENERGY IS CUTTING POWER

When Access To Venezuelan Oil Is Restricted,

China Loses Its Cheapest And Most Reliable Energy Source.

This Is Not About Regime Change Or Politics.

It Is About Denying Strategic Inputs To A Global Competitor.

This Strategy Did Not Start In Venezuela.

It Has Been Repeated Across Multiple Energy Corridors.

IRAN FOLLOWS THE SAME PLAYBOOK

China Is Also The Largest Buyer Of Iranian Oil.

Pressure On Iran In 2025 Targeted The Same Objective.

Same Mechanism.

Different Geography.

ENERGY DENIAL IS ECONOMIC WARFARE

This Is Not “Taking Oil.”

This Is Restricting Access To Supply, Pricing Power, And Stability.

Denying China:

Cheap Energy

Reliable Supply Chains

Strategic Influence In The Western Hemisphere

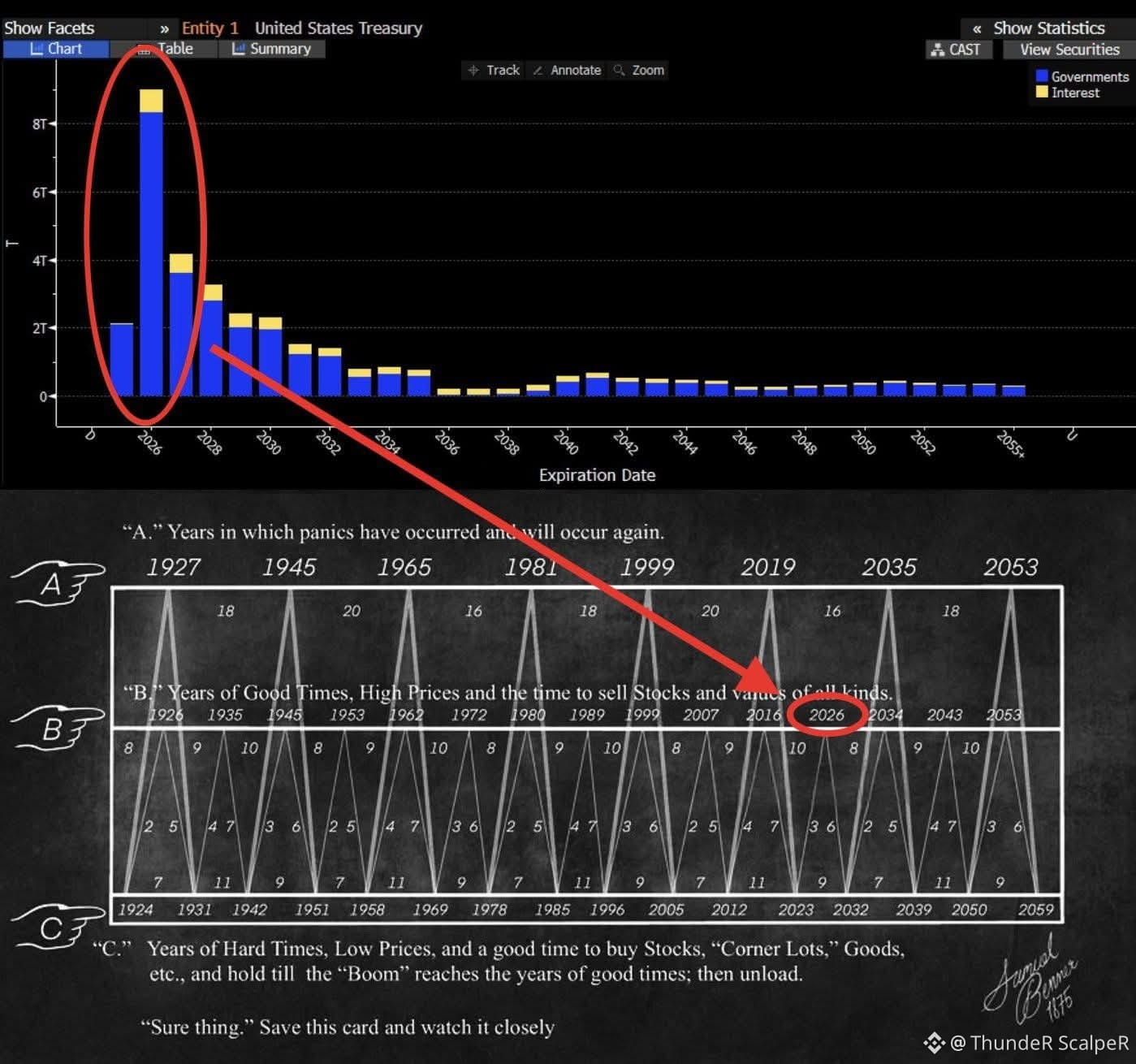

TIMING MATTERS 🌟

Political Transitions In Venezuela Were Not Sudden.

They Were Negotiated Under Heavy External Pressure.

The Timing Of Recent Events Coincided With Chinese Diplomatic Talks.

That Is Not An Accident.

That Is A Message.

THE RESPONSE PHASE BEGINS ☢️

China Has Already Started Responding Through Resources.

From January 2026, Restrictions On Silver Exports Are In Place.

Silver Is Not Just A Metal.

It Is A Critical Industrial And Monetary Input.

This Signals A Shift Toward Resource-Based Negotiation.

Energy For Metals.

Supply For Leverage.

MARKET IMPACT PATHWAY

If Negotiations Escalate Or Break Down, Markets React Fast.

Oil Prices Rise As Supply Risk Is Repriced.

Inflation Expectations Rebound.

Emerging Markets Feel Stress First.

Developed Markets Follow With A Lag.

The Dollar Strengthens Short-Term.

Liquidity Tightens Across Risk Assets.

Crypto And High-Beta Assets Flush First.

Long-Term Hedging Demand Appears Later.

THIS IS NOT A NORMAL CYCLE 📉

This Is Not A Simple Bull Or Bear Market.

This Is Great-Power Competition Entering The Energy Layer.

Energy Controls Growth.

Growth Controls Currency.

Currency Controls Markets.

By The Time This Becomes Obvious In Headlines,

Most Positioning Will Already Be Wrong.

SURVIVING 2026 REQUIRES A DIFFERENT MINDSET💪💵.

This Is A Period Of Strategic Realignment, Not Short-Term Noise.

Risk Management And Macro Awareness Matter More Than Ever.

Those Who Understand Capital Flows Early Stay Ahead.

Those Who React Late Become Liquidity For Others.

Position Accordingly⚠️🙏.

Follow for more and like it.

#FedHoldsRates #GoldOnTheRise #WhoIsNextFedChair #VIRBNB #TokenizedSilverSurge