Most traders think trading is only about entry. In reality, entry is just the beginning. What really decides whether a trade becomes profitable or turns into a mess is management, patience, and decision-making after entry.

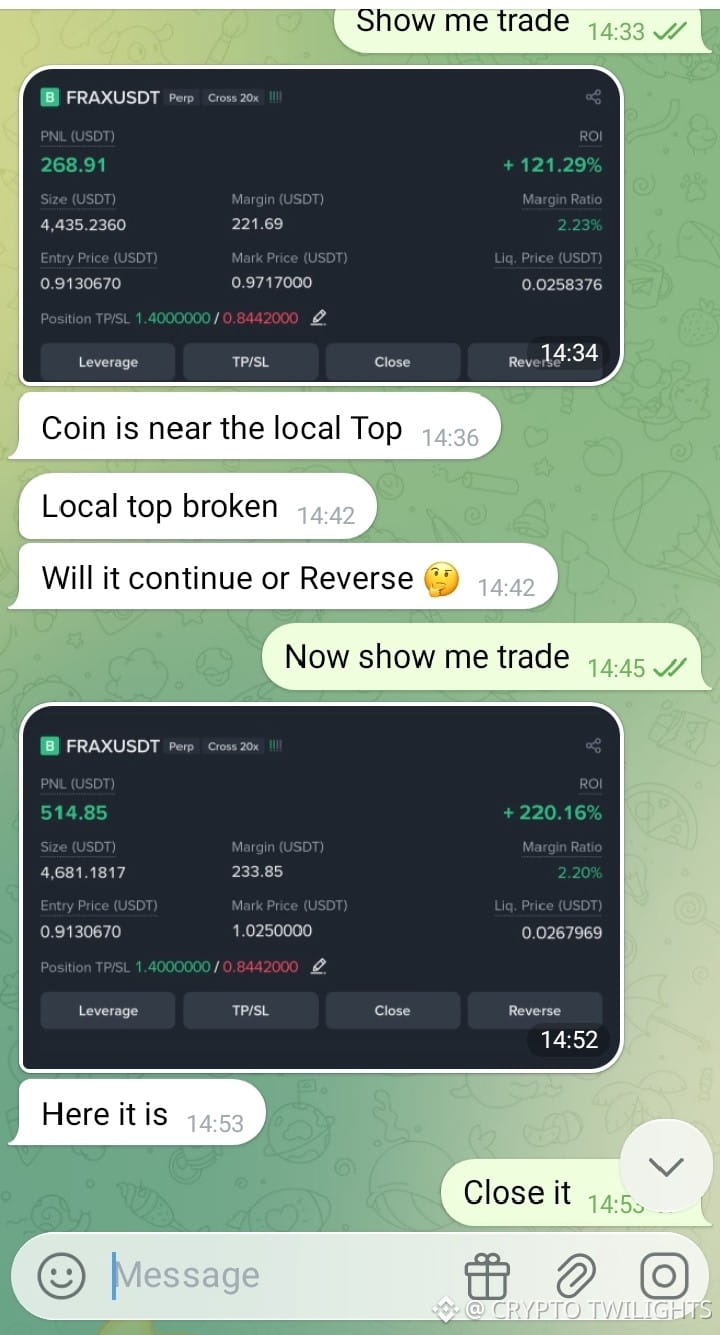

In this trade, price was moving near a local top. That is always a critical area. When price approaches a local top, there are only two possible outcomes:

either the level holds and price reverses, or the level breaks and continuation starts. The mistake most traders make is predicting instead of reacting.

Instead of guessing, the correct approach is to observe the behavior of price at that level. Once the local top was broken and price held above it, that level flipped from resistance into support. That was the confirmation, not the entry candle itself.

After confirmation, the long position was allowed to run. There was no panic, no emotional closing, no overthinking every small candle. This is important because strong moves never go straight. They always retrace, shake weak hands, and then continue.

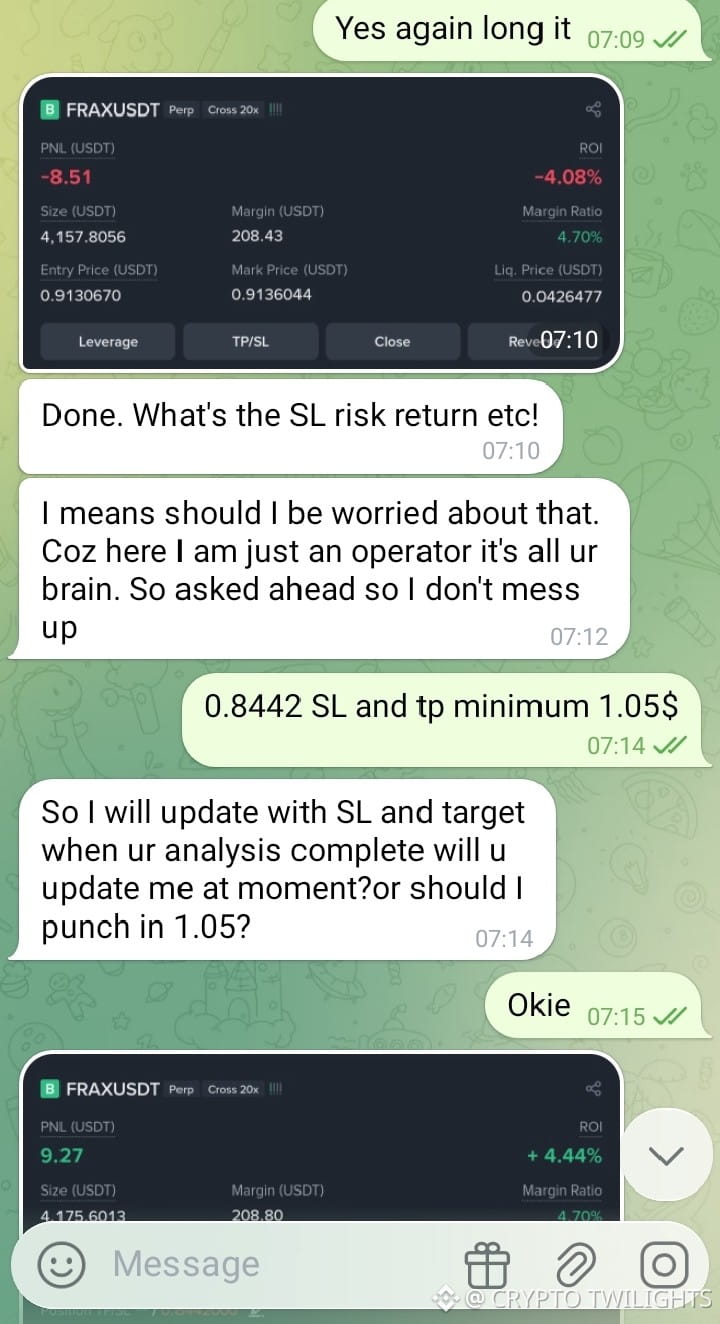

One thing many people ignore is that drawdown does not mean the trade is wrong. Even a perfect setup can go slightly negative before moving in your favor. That’s why stop loss placement matters more than being right.

In this trade, the stop loss was already defined clearly. Once SL is placed logically, there is no reason to be stressed. Either the market respects the level or it doesn’t. Your job ends after execution.

Another important point is role clarity. If one person is analyzing and another is executing, communication must be very clear. Targets, stop loss, and expectations should be written in advance. That avoids confusion and emotional decisions during live price movement.

Risk-to-reward was favorable here. The downside was limited, while the upside allowed price to expand freely. This is how professional traders think. They don’t focus on win rate, they focus on how much they make when right vs how much they lose when wrong.

Also notice something very important:

profits were not forced. The trade was allowed to breathe. Closing too early is one of the biggest reasons traders stay small forever. You don’t need many trades, you need one good trade managed properly.

Another lesson from this setup is confirmation over prediction. The market doesn’t reward opinions. It rewards patience. When structure breaks and holds, probabilities shift. Trade the shift, not your bias.

Lastly, remember this:

trading is not about excitement.

trading is not about revenge.

trading is not about proving anything.

Trading is about following your plan even when emotions try to interfere.

Define your levels.

Respect your stop loss.

Let your winners run.

Accept small losses without ego.

If you can do this consistently, results will follow naturally.

Stay disciplined. Stay focused. Let the chart speak.