We keep building blockchains for the people in the room, forgetting the next user will not be a person at all. It will be an AI agent, a piece of software acting autonomously on a budget, with goals, and a need to interact with the world. This is not a distant sci fi trope, it is the logical next step in adoption, and it demands a completely different infrastructure mindset. Most chains today are like designing a car for a horse, optimizing for transaction speed, TPS, when the new driver does not have hands or eyes in the traditional sense. What I see in Vanar Chain is a deliberate, perhaps necessary, pivot. It is not about making another fast L1, it is about building the first environment where autonomous AI can natively live, reason, and transact. This shifts the entire value proposition from speculative asset to essential utility, you see.

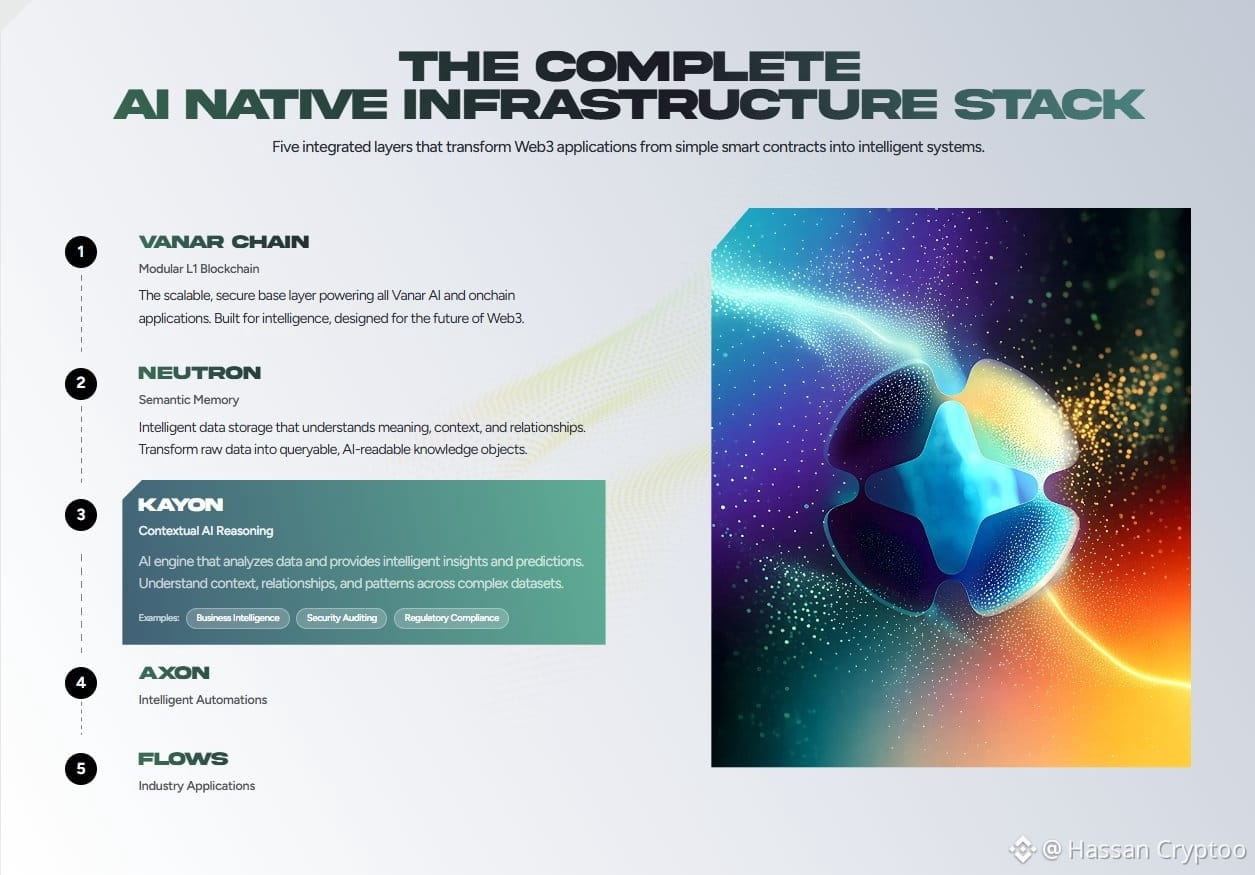

The core break from tradition is the user model. Human users navigate interfaces, manage private keys, and tolerate delays. AI agents operate programmatically, require deterministic outcomes, and need to verify their own actions. A chain built for humans might celebrate a slick wallet, a chain for AI requires native memory and explainability as base layer features. Vanar’s architecture, as detailed in its technical documentation, seems engineered around this. Take myNeutron, presented as an "on chain memory" system. For an AI, memory is not a nice to have feature, it is the core of persistent identity and learning. It allows an agent to recall past interactions, reference executed tasks, and build a continuous existence across sessions. Without this, every agent interaction is a blank slate, which is useless for complex, multi step goals. This is what "AI first" actually means, not adding an AI chatbot to a website, but baking the AI's operational needs into the chain's state model itself, which is quite important.

Then comes reasoning. An AI agent does not just execute a swap, it must decide why to swap, verify the outcome was correct, and adjust its strategy. This requires on chain logic and verifiable explainability, which is where a product like Kayon fits. If myNeutron is the chain's hippocampus, Kayon aims to be its prefrontal cortex, a layer for auditable decision making. For enterprise or regulated environments, this is non negotiable. You cannot deploy autonomous capital managed by AI if you cannot audit its decision trail. Vanar’s approach treats this explainability as a primitive, not an afterthought. The value for the VANRY token here is subtle but direct, it becomes the fuel for verifiable computation and state access within this reasoning layer, aligning its utility with the quality of agent intelligence, not just network spam.

Automation is the next step. An agent that can remember and reason must also act without constant human signing. This introduces massive risk if not handled securely. The Flows product, described as a safe automation engine, attempts to solve this by providing a trusted environment for conditional logic and execution. It is the difference between an agent that can analyze data and one that can also execute the trade, deploy the contract, or mint the asset when its conditions are met. This creates a closed loop of perception, decision, and action. When reviewing the project's materials, this focus on completing the loop stood out to me. It is a recognition that partial solutions do not work for autonomous users, an agent with memory but no ability to act is crippled, to be perfectly honest.

All of this leads to the most critical, and most misunderstood, primitive, payments. An AI agent does not use a MetaMask pop up. It requires programmatic, non interactive settlement that can be woven directly into its logic flow. This is where Vanar’s positioning around "payments as infrastructure" makes strategic sense. It is not about competing with Venmo, it is about being the rails that an AI agent uses to pay for an API call, settle a micro task on a marketplace, or distribute funds to a subnet of other agents. The VANRY token’s role crystallizes here as the settlement medium within this native economic layer. Its demand becomes a function of autonomous economic activity, a potentially more sustainable model than narrative driven speculation, when you think about it.

Looking at the current market data, with VANRY trading around $0.0085 and holding a market cap rank just outside the top 200, the market is still pricing it as another alt L1. The Binance Spot chart shows a phase of sideways movement, succeeding a stretch of notable price swings. Such a phase is a frequent characteristic of cryptocurrencies in intervals separating distinct narrative-driven hype cycles. The volume, while present, does not yet reflect the specialized utility being built. This gap between current valuation and potential utility as AI agent infrastructure is the entire thesis.

Ultimately, Vanar Chain’s bet is that the next explosive wave of blockchain usage will not be driven by millions of new humans downloading wallets, but by billions of AI agents needing a home. These agents need a world that speaks their language, one of verifiable memory, explainable reasoning, trusted automation, and seamless settlement. By constructing its stack around these pillars, from myNeutron to its payment rails, Vanar is building for that world. The VANRY token, therefore, is not a ticket to a hype cycle, it is designed to be the currency of that new, post human economy. Its success hinges not on winning the L1 beauty contest for developers today, but on becoming the obvious, perhaps only, choice for the developers of autonomous agents tomorrow.

by Hassan Cryptoo

@Vanarchain | #vanar | $VANRY